Filing GSTR-1 in GST Govt. Portal

(How can I create, submit and file details for the outward supplies in the Form GSTR-1 ?)2 |

To create, submit and file details for inward supplies in the GSTR-1, perform the following steps:

1. Login and Navigate to GSTR-1 page

2. Opt for Quarterly or Monthly Returns

3. Generate GSTR-1 Summary

4. Enter GSTR-1 Invoice Details for Current Tax Period including Amendments of Previous Tax Periods in various Tiles

GSTR-1 – Invoice Details

(1) 4A, 4B, 4C, 6B, 6C - B2B Invoices: To add an invoice for taxable outwards supplies to a registered person

(2) 5A, 5B - B2C (Large) Invoices: To add an invoice for taxable outwards supplies to a consumer, where place of supply is other than the State where supplier is located (Inter-state supplies) and invoice value is more than Rs. 2.5 lakh

(3) 9B - Credit / Debit Notes (Registered): To add details of credit or debit notes issued to the registered recipients

(4) 9B - Credit / Debit Notes (Unregistered): To add details of credit, debit notes or refund voucher issued to the unregistered recipients

(5) 6A - Exports Invoices: To add an invoice for supplies exported

(6) 9A - Amended B2B Invoice: To make amendments to details of outward supplies to a registered person of earlier tax periods

(7) 9A - Amended B2C (Large) Invoice: To make amendments to taxable outward supplies to an unregistered person of earlier tax periods

(8) 9A - Amended Exports Invoices: To make amendments to supplies exported

(9) 9C - Amended Credit/ Debit Notes (Registered): To make amendments to details of credit or debit notes issued to the registered recipients of earlier tax periods

(10) 9C - Amended Credit/ Debit Notes (Unregistered): To make amendments to details of credit or debit notes issued to the unregistered recipients of earlier tax periods

GSTR-1 – Other Details

(11) 7- B2C Others: To add consolidated details of taxable outwards supplies to a customer where invoice value is less than Rs. 2.5 lakh and all intra state supplies to unregistered customers

(12) 8A, 8B, 8C, 8D - Nil Rated Supplies: Nil Rated Supplies: To add consolidated details of nil rated, exempted and Non-GST Outward supplies

(13) 11A(1), 11A(2) - Tax Liability (Advances Received): Tax Liability (Advances Received): To add details of transactions attracting tax liability arising on account of Time of Supply (like receipt of advances)

(14) 11B(1), 11B(2) - Adjustment of Advances: To add the advance amount received in earlier tax period and adjusted against the supplies being shown in this tax period

(15) 12 - HSN-wise-summary of outward supplies: To furnish the summarized details of all outward supplies HSN and rate wise along with quantitative details.

(16) 13 - Documents Issued: To add the details of documents issued during the tax period

(17) 11A - Amended Tax Liability (Advance Received): Consolidated statement for amendments of information furnished in earlier tax period

(18) 11B - Amended of Adjustment of Advances: Consolidated statement for amendments of information furnished in earlier tax period

(19) 10 - Amended B2C (Others): To make amendments to details of B2C of earlier tax periods

5. Preview GSTR-1

6. Acknowledge and Submit GSTR-1 to freeze data

7. File GSTR-1 with DSC/ EVC

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials i.e. your user id and password

3. Click the Services > Returns > Returns Dashboard command. |

|

4. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the return from the drop-down list.

5. Click the SEARCH button. |

|

|

The "Option Form for Quarterly Return filing by Normal Taxpayer" page is displayed.

1. Select Yes or No for "Whether your aggregate turnover during FY 2016-2017 was upto Rs. 1.5 Crores?: If you have registered after 1st July 2017, do you expect your aggregate turnover during FY 2017-2018 to be upto Rs. 1.5 Crores?".

Note:

- In case you are an existing taxpayer and has been enrolled with GST Portal and your aggregate turnover during FY 2016-2017 was upto Rs. 1.5 Croress, select Yes or else select No.

- In case you have registered on the GST Portal after 1st July 2017 and expect your aggregate turnover during FY 2017-2018 to be upto Rs. 1.5 Crores, select Yes or else select No.

In case of Yes:

a. Select Yes or No for Would you like to opt for quarterly filing of tax return:.

In case of Yes:

a. Click the SUBMIT button. |

|

b. Click the PROCEED button.

Once you click the PROCEED button, all your previous filed GSTR-1 returns except for the month of July will be ignored. You will be required to file returns for the quarters ending September, December and March. Payments of all your taxes will be monthly through form GSTR-3B. |

|

A success message is displayed for selection of quarterly filing of returns. |

|

In case of No:

a. Click the SUBMIT button. |

|

b. Click the PROCEED button.

Once you click the PROCEED button, you can file your GSTR-1 monthly. |

|

A success message is displayed for selection of monthly filing of returns. |

|

|

In case of No:

a. Click the SUBMIT button. |

b. Click the PROCEED button. A success message is displayed for selection of monthly filing of returns. |

|

2. In the GSTR-1 tile, click the PREPARE ONLINE button if you want to prepare the return by making entries on the GST Portal.

Note:

• GSTR-1 has to be filed for July month by all taxpayers. Thus a taxpayer who opts for quarterly return filing will have to file GSTR-1 in the following manner:

For July: Monthly (by choosing July from drop down menu)

For 2nd Quarter (August and September): Quarterly by choosing September

For 3rd Quarter (Oct-Dec): Quarterly by choosing December

• You can click the PREPARE OFFLINE button to upload the JSON (Java Script Object Notation) file containing invoice details and other GSTR-1 details in the GSTN specified format prepared through the GSTN provided offline tools or any other software. |

|

3. The GSTR-1 – Details of outward supplies of goods or services page is displayed. In first month, Turnover of ‘Aggregate Turnover - April to June, 2017’ will be there for Taxpayer to fill along with ‘Aggregate Turnover in the preceding financial year’ and then click on the SAVE button. This field is mandatory. You can proceed to furnish other details only after furnishing this information.

From the next month, ‘Aggregate Turnover in the preceding financial year’ will be auto-populated based on previous tax period return |

|

|

1. Scroll down to the bottom of the GSTR-1 – Details of outward supplies of goods or services page and click the GENERATE GSTR1 SUMMARY button to include the auto drafted details pending for action from recipients.

The invoices that were missed to be included by you, may have been added in the Uploaded by Receiver while filing his GSTR-2. |

|

After the summary generation is initiated, you will notice the message to check after one minute. |

|

After the summary is generated, you will notice a success message on top of the page. |

|

The summary is generated by the GST Portal automatically at an interval of every <30 minutes>.

In case you want to see the summary instantly, after you have added the invoices, you can also generate the summary by clicking the GENERATE GSTR1 SUMMARY button. However, summary can be generated only at interval of 10 minutes. In case you attempt to generate summary, earlier than 10 minutes, you will notice an error message on top of the page. |

|

|

4. Enter details for Current Tax Period including Amendments of Previous Tax Periods in various Tiles

There are number of tiles representing Tables to enter relevant details. Click on the tile names to know and enter related details:

GSTR-1 – Invoice Details

(1) 4A, 4B, 4C, 6B, 6C - B2B Invoices: To add an invoice for taxable outwards supplies to a registered person

(2) 5A, 5B - B2C (Large) Invoices: To add an invoice for taxable outwards supplies to a consumer, where place of supply is other than the State where supplier is located (Inter-state supplies) and invoice value is more than Rs. 2.5 lakh

(3) 9B - Credit / Debit Notes (Registered): To add details of credit or debit notes issued to the registered recipients

(4) 9B - Credit / Debit Notes (Unregistered): To add details of credit, debit notes or refund voucher issued to the unregistered recipients

(5) 6A - Exports Invoices: To add an invoice for supplies exported

(6) 9A - Amended B2B Invoice: To make amendments to details of outward supplies to a registered person of earlier tax periods

(7) 9A - Amended B2C (Large) Invoice: To make amendments to taxable outward supplies to an unregistered person of earlier tax periods

(8) 9A - Amended Exports Invoices: To make amendments to supplies exported

(9) 9C - Amended Credit/ Debit Notes (Registered): To make amendments to details of credit or debit notes issued to the registered recipients of earlier tax periods

(10) 9C - Amended Credit/ Debit Notes (Unregistered): To make amendments to details of credit or debit notes issued to the unregistered recipients of earlier tax periods

GSTR-1 – Other Details

(11) 7- B2C Others: To add consolidated details of taxable outwards supplies to a customer where invoice value is less than Rs. 2.5 lakh and all intra state supplies to unregistered customers

(12) 8A, 8B, 8C, 8D - Nil Rated Supplies: Nil Rated Supplies: To add consolidated details of nil rated, exempted and Non-GST Outward supplies

(13) 11A(1), 11A(2) - Tax Liability (Advances Received): Tax Liability (Advances Received): To add details of transactions attracting tax liability arising on account of Time of Supply (like receipt of advances)

(14) 11B(1), 11B(2) - Adjustment of Advances: To add the advance amount received in earlier tax period and adjusted against the supplies being shown in this tax period

(15) 12 - HSN-wise-summary of outward supplies: To furnish the summarized details of all outward supplies HSN and rate wise along with quantitative details.

(16) 13 - Documents Issued: To add the details of documents issued during the tax period

(17) 11A - Amended Tax Liability (Advance Received): Consolidated statement for amendments of information furnished in earlier tax period

(18) 11B - Amended of Adjustment of Advances: Consolidated statement for amendments of information furnished in earlier tax period

(19) 10 - Amended B2C (Others): To make amendments to details of B2C of earlier tax periods

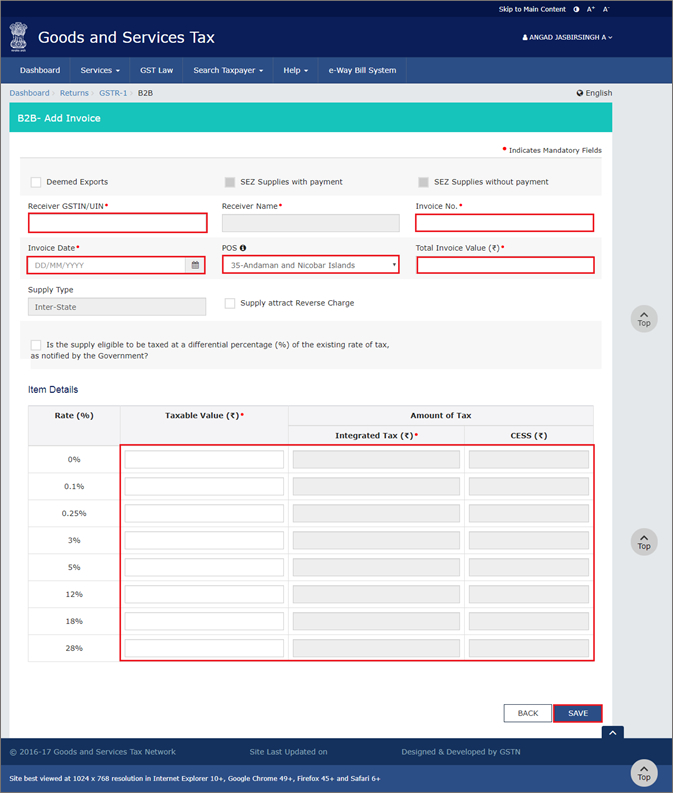

To add an invoice for taxable outwards supplies to a registered person, perform the following steps:

1. Click the 4A, 4B, 4C, 6B, 6C - B2B Invoices tile to enter the invoice details for B2B transactions (goods/ services sold to a registered taxpayer). |

| |

|

2. The B2B Invoices – Receiver-Wise-Summary page is displayed. Click the ADD INVOICE button to add a new invoice for any receiver. |

|

3. The B2B – Add Invoice page is displayed. In the Receiver GSTIN/UIN field, enter the GSTIN or UIN of the receiver.

4. Select the checkbox for Deemed Exports or SEZ Supplies with payment or SEZ supplies without payment as applicable.

Note: Deemed export details can be provided for payment of IGST, CGST and SGST payments.

5. In the Invoice No., Invoice Date and Total Invoice Value fields, enter the Invoice number, date of the invoice and value of the total invoice.

Note:

• The GSTIN should be registered on the date of invoice.

• Once the GSTIN of the receiver is entered, Receiver Name, POS and Supply Type fields are auto-populated based on the GSTIN of the receiver.

• The auto-populated POS is editable. Depending on selected POS, the supply type gets auto-populated.

• The screen will expand downwards and more fields will appear to enter line item details of the invoice.

• In case of UN Bodies, Embassies, Government Offices or Other Notified persons, you need to provide Unique Identification Number (UIN) of the receiver.

• An invoice number should be alphanumeric with allowable special characters and unique for a given Financial Year (FY).

• Invoice date cannot be a future date or a date prior to the date of registering with GST.

6. Select the Supply attract Reverse Charge checkbox, in case supply made to the taxpayer is covered under the reverse charge mechanism.

7. Select the Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax, as notified by the Government? checkbox, in case supply is eligible to be taxed at a differential percentage of the existing rate of tax.

In case of Intra-State transaction:

In case the POS (place of supply) of the goods/ services is the same state as that of the supplier, the transaction is an Intra-State transaction.

Notice, fields for Central Tax and State/UT Tax will appear.

a) In the Taxable Value field against the rates, enter the taxable value of the goods or services.

b) In the Cess field, enter the cess amount.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount.

In case of Inter-State transaction:

In case the Place of Supply (POS) is different from the state of the supplier, transaction becomes an Inter-State transaction.

Notice, fields for Integrated Tax will appear.

a) In the Taxable Value field against the rates, enter the taxable value of the goods or services.

b) In the Cess field, enter the cess amount.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount. The CESS field is not auto populated and has to be entered by the taxpayer.

8. Click the SAVE button to save the invoice details. |

|

|

9. You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the added invoices (under Actions).

Note: B2B invoices uploaded in GSTR-1 as a supplier will reflect in the B2B Invoices of the receiver in GSTR-2A/GSTR-2 in near real time. However, no action can be taken by receiver unless the Supplier files GSTR-1.

Uploaded by Taxpayer: The "Uploaded by Taxpayer" tab shows all the invoices that you have uploaded for a given tax period.

Uploaded by Receiver: The "Uploaded by Receiver" tab displays the invoices that you missed from your GSTR-1, but were uploaded by the Receiver Taxpayer for taking appropriate actions.

Modified by Receiver: If the receiver Taxpayer has modified any invoice that you uploaded in your GSTR-1, it will show-up under the "Modified by Receiver" tab for taking appropriate actions.

Rejected by Receiver: The "Rejected by Receiver" tab displays invoices from your GSTR-1 that were rejected by the receiver Taxpayer for taking appropriate actions.

10. Click the BACK button to go back to the Invoices - Receiver-Wise-Summary page. |

|

11. Here, you can view receiver wise summary of invoices. A tax payer can add invoice of the particular receiver by clicking on the particular receiver and then clicking on the ADD INVOICE button at the bottom of the page. Click the BACK button to go back to the GSTR-1 page. |

|

You will be directed to the GSTR-1 landing page and the B2B Invoices tile in GSTR-1 will reflect the number of invoices added along with Total Invoice value, Total taxable value and total tax liability. |

|

|

To add an invoice for taxable outwards supplies to a consumer, where place of supply is other than the State where supplier is located (Inter-state supplies) and invoice value is more than Rs. 2.5 lakh, perform the following steps:

1. Click the 5A, 5B - B2C (Large) Invoices tile to enter the invoice details for inter-state taxable outward supplies made to a consumer of value greater than 2.5 lacs. |

|

2. The B2C (Large) Invoices – Summary page is displayed. Click the ADD INVOICE button to add a new invoice. |

|

3. The B2C (Large) Invoices – Details page is displayed. In the POS field, select the place of supply (state code) where the supplies were delivered.

4. In the Invoice No. field, enter the Invoice number issued to the consumer of that POS.

Note: An invoice number should be alphanumeric with allowable special characters and unique for a given Financial Year (FY).

5. In the Invoice Date field, enter the date on which the invoice was generated.

6. In the Total Invoice Value field, enter the total amount for which the goods or services are supplied.

7. If the supply is made through an e-commerce company, select the checkbox for Supplies through E-Commerce and in the GSTIN of the e-commerce operator field, enter the GSTIN of the e-commerce company.

Note: Fill this field only when the supply is made through an e-commerce company.

8. In the Taxable Value field against the rates, enter the taxable value of the goods or services.

9. In the Cess field, enter the cess amount.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount. The CESS field is not auto populated and has to be entered by the taxpayer.

10. Click the SAVE button to save the invoice details. |

|

|

11. You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is processed.

Here, you can also edit/delete the added invoices (under Actions).

12. Click the BACK button to go back to the GSTR-1 page. |

|

You will be directed to the GSTR-1 landing page and the B2C (large) Invoices tile in GSTR-1 will reflect the number of invoices added along with Total tax liability. |

|

|

To add details of credit or debit notes for the registered user, perform the following steps:

1. Click the 9B - Credit / Debit Notes (Registered)/refund voucher tile to enter the details of credit or debit notes issued to the registered recipients or details of refund voucher against advance received. |

|

2. The Credit/Debit Notes (Registered) - Summary page is displayed. Click the ADD DETAILS button to add credit or debit note details. |

|

3. The Credit / Debit Notes (Registered) – Add Note page is displayed. In the Receiver GSTIN/UIN field, enter the GSTIN of the receiver (registered taxpayer) to whom supply is made.

Note: The Receiver Name field is auto-populated, when the user enters the GSTIN of the Receiver.

4. In the Debit/Credit Note No. field, enter the debit or credit note number or refund voucher number

Note: A Debit or Credit Note number should be unique for a given Financial Year (FY).

5. In the Debit/Credit Note Date field, enter the date on which the debit or credit Note was issued.

Note: The date should be before the end date of the tax period. Debit / credit note date cannot be earlier than original invoice date.

6. In the Original Invoice Number field, enter the invoice number of the earlier filed invoice (original invoice) on which the Debit or Credit Note is being issued or the number of advance receipt against which the refund voucher is issued.

7. In the Original Invoice Date field, enter the original invoice date.

8. From the Note Type drop-down list, select whether the details added are for a Debit or Credit Note or refund voucher.

9. In the Note Value field, enter the value of the note or refund voucher.

10. From the Supply Type drop-down list, select whether the note or voucher is added for an invoice of Inter-state or Intra-state transaction.

11. Select the Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax, as notified by the Government? checkbox, in case supply is eligible to be taxed at a differential percentage of the existing rate of tax.

In case of Intra-State transaction:

In case the POS (place of supply) of the goods/ services is the same state as that of the supplier, the transaction is an Intra-State transaction.

Notice, fields for Central Tax and State/UT Tax appear.

a) In the Taxable Value field against the rates, enter the taxable value of the goods or services.

b) In the Cess field, enter the cess amount.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount. The CESS field is not auto populated and has to be entered by the taxpayer.

In case of Inter-State transaction:

In case Place of Supply (POS) is different from the state of the supplier, transaction becomes an Inter-State transaction.

Notice, fields for Integrated Tax appear.

a) In the Taxable Value field against the rates, enter the taxable value of the goods or services.

b) In the Cess field, enter the cess amount.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount. The CESS field is not auto populated and has to be entered by the taxpayer.

12 Click the SAVE button to save the details. |

|

13. You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the added invoices (under Actions).

Uploaded by Taxpayer: The "Uploaded by Taxpayer" tab shows all the debit/credit note/refund vouchers that you have uploaded for a given tax period.

Uploaded by Receiver: The "Uploaded by Receiver" tab displays the debit/credit note/refund vouchers that you missed from your GSTR-1, but were detected and uploaded by the Receiver Taxpayer for taking action.

Modified by Receiver: If the receiver Taxpayer has modified any debit/credit note/refund vouchers that you uploaded in your GSTR-1, it will show-up under the "Modified by Receiver" tab for taking action.

Rejected by Receiver: The "Rejected by Receiver" tab displays debit/credit note/refund vouchers from your GSTR-1 that were rejected by the receiver Taxpayer. |

|

14. You will be directed to the GSTR-1 landing page and the 9B- Credit/ Debit Notes (Registered) tile in GSTR-1 will reflect the number of credit/debit notes/refund vouchers added. |

|

|

|

To add details of credit or debit notes or refund vouchers issued to unregistered persons, perform the following steps:

1. Click the 9B - Credit / Debit Notes (Unregistered) tile to enter the details of credit or debit notes issued to the unregistered recipients. |

|

2. The Credit/Debit Notes (Unregistered) - Summary page is displayed. Click the ADD DETAILS button to add credit or debit note or refund voucher details. |

|

3. The Credit / Debit Notes (Unregistered) – Add Note page is displayed. From the Type drop-down list, select the appropriate choice like B2CL, export without payment etc.

4. In the Debit/Credit Note No. field, enter the debit or credit note number.

Note: A Debit or Credit Note number should be unique for a given Financial Year (FY).

5. In the Debit/Credit Note Date field, enter the date on which the debit or credit Note was issued.

Note: The date should be before the end date of the tax period. Debit / credit note date cannot be earlier than original invoice date.

6. In the Original Invoice Number field, enter the invoice number of the earlier filed invoice (original invoice) on which the Debit or Credit Note is being issued.

7. In the Original Invoice Date field, enter the original invoice date.

8. From the Note Type drop-down list, select whether the details are added for a Debit or Credit Note or refund voucher.

9. In the Note Value field, enter the value of the note or refund voucher

10. Select the Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax, as notified by the Government? checkbox, in case supply is eligible to be taxed at a differential percentage of the existing rate of tax.

In case of Inter-State transaction:

In case the POS (place of supply) is in a different state as that of the supplier, transaction becomes an Inter-State transaction.

Notice, fields for Integrated Tax appear.

a) In the Taxable Value field against the rates, enter the taxable value of the goods or services.

b) In the Cess field, enter the cess amount.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount. The CESS field is not auto populated and has to be entered.

11. Click the SAVE button to save the details. |

|

12. Click the BACK button to go back to the GSTR-1 page.

13. You will be directed to the GSTR-1 landing page and the 9B- Credit/ Debit Notes (Unregistered) tile in GSTR-1 will reflect the number of credit/debit notes/ refund vouchers added. |

|

| |

|

To add an invoice for supplies exported, perform the following steps:

1. Click the 6A- Export Invoices tile to enter the invoice details for supplies exported. |

|

2. The Exports – Invoices Summary page is displayed. Click the ADD INVOICE to add a new invoice. |

|

3. The Exports – Add Details page is displayed. In the Invoice No. field, enter the Invoice number issued against exports sales.

4. In the Invoice Date field, enter the date on which the invoice was generated.

5. In the Port Code field, enter the port code.

6. In the Shipping Bill No./Bill of Export No. field, enter the unique number of the shipping bill with location code generated while shipping.

Note: Shipping Bill No./Bill of Export No. should be minimum 3 and maximum 15 digit numeric.

7. In the Shipping Bill Date/ Bill of Export Date field, enter the date on which the shipping bill was issued.

8. In the Total Invoice Value field, enter the total amount of all the goods or services supplied.

9. From the GST Payment drop-down list, select whether the GST is paid against the invoice or not.

10. Select the Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax, as notified by the Government? checkbox, in case supply is eligible to be taxed at a differential percentage of the existing rate of tax.

11. In the Taxable Value field against the rates, enter the taxable value of the goods or services.

Note: The Amount of Tax fields are auto-populated based on the values entered in Taxable Value fields respectively. However, the taxpayer can edit the tax amount.

12. Click the SAVE button to save the details. |

|

13. You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the added invoices (under Actions).

14. Click the BACK button. |

|

15. You will be directed to the GSTR-1 landing page and the Export Invoices tile in GSTR-1 will reflect the number of such invoices added along with Total tax liability. |

|

|

|

To make amendments to details of outward supplies to a registered person furnished in returns of earlier tax periods, perform the following steps:

1. Click the 9A - Amended B2B Invoice tile. |

|

2. Select the Financial Year from the drop-down list.

3. In the Invoice No. field, enter the invoice number which you want to amend from earlier tax period.

4. Click the AMEND INVOICE button. |

|

5. In the Revised Invoice No. field, enter the revised invoice number for the previous invoice.

6. Select the Revised Date using the calendar. Make amendments to the details as required.

7. Click the SAVE button. |

|

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the amended invoices (under Actions).

Similarly, you can amend the invoices uploaded by receiver, modified by receiver or rejected by receiver.

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 9A - Amended B2B Invoice tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

|

To make amendments to taxable outward supplies to an unregistered person of earlier tax periods, perform the following steps:

1. Click the 9A - Amended B2C (Large) Invoice tile. |

|

2. Select the Financial Year from the drop-down list.

3. In the Invoice No. field, enter the invoice number which you want to amend from earlier tax period.

4. Click the AMEND INVOICE button. |

|

5. In the Revised/ Original Invoice No. field, enter the revised or original invoice number for the previous invoice.

6. Select the Revised/ Original Invoice Date using the calendar. Make amendments to the details as required. You cannot amend the POS of the invoice furnished earlier.

7. Click the SAVE button. |

|

| |

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the amended invoices (under Actions) if GSTR-1 has not been submitted yet. Place of Supply (POS) cannot be changed.

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 9A - Amended B2C (Large) Invoice tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

|

|

To make amendments to supplies exported, perform the following steps:

1. Click the 9A - Amended Exports Invoices tile. |

|

2. Select the Financial Year from the drop-down list.

3. In the Invoice No. field, enter the invoice number which you want to amend from earlier tax period.

4. Click the AMEND INVOICE button. |

|

5. In the Revised/ Original Invoice No. field, enter the revised or original invoice number for the previous invoice.

6. Select the Revised/ Original Invoice Date using the calendar. Make amendments to the details as required. You cannot amend the type of export (WPAY) /WOPAY mentioned in the invoice furnished earlier.

7. Click the SAVE button. |

|

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the amended invoices (under Actions).

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 9A - Amended Exports Invoices tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

|

To make amendments to details of credit or debit notes issued to the registered recipients of earlier tax periods, perform the following steps:

1. Click the 9C - Amended Credit/ Debit Notes (Registered) tile. |

|

2. Select the Financial Year from the drop-down list.

3. In the Credit/Debit Note No. field, enter the credit or debit number which you want to amend from earlier tax period.

4. Click the AMEND NOTE button. |

|

5. In the Revised Credit/ Debit Note No. field, enter the revised credit or debit Note number.

6. Select the Revised Credit/ Debit Note Date using the calendar. Make amendments to the details as required. You cannot amend the Unregistered nature of original supply (Export/B2CL) of the credit/debit note furnished earlier.

7. Click the SAVE button. |

|

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added note is Processed.

Here, you can also edit/delete the amended notes (under Actions).

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 9C - Amended Credit/ Debit Notes (Registered) tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

|

|

To make amendments to details of credit or debit notes issued to the unregistered recipients of earlier tax periods, perform the following steps:

1. Click the 9C - Amended Credit/ Debit Notes (Unregistered) tile. |

|

2. Select the Financial Year from the drop-down list.

3. In the Credit/Debit Note No. field, enter the credit or debit note number which you want to amend from earlier tax period.

4. Click the AMEND NOTE button. |

|

5. In the Revised Debit/ Credit Note No. field, enter the revised credit or debit number.

6. Select the Revised Debit/ Credit Note Date using the calendar. Make amendments to the details as required. You cannot amend the unregistered nature of original supply (Export/B2CL) in CDNA of the credit/debit note furnished earlier.

7. Click the SAVE button. |

|

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added note is Processed.

Here, you can also edit/delete the amended notes (under Actions).

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 9C - Amended Credit/ Debit Notes (Unregistered) tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

| |

|

To add details of taxable outwards supplies to a customer where invoice value is less than Rs. 2.5 lakh and intra-state supplies to customers, perform the following steps:

1. Click the B2C (Others) tile to enter the details for B2C transactions. |

|

2. The B2C (Others) Details – Summary page is displayed. Select E-commerce tab to add a line item for a transaction through E-commerce or else select Other than E-commerce tab in case transaction is through non E-commerce. |

|

3. Click the ADD DETAILS button to add the line item details. |

|

4. In the POS field, select the Place of Supply (State Code) where the supplies were delivered. Based on the state selected in POS, Supply Type field is auto-populated.

5. In the Taxable Value field, enter the collated amount of all the unique goods or services supplied.

6. In the Rate field, enter the applicable Rate.

7. In the GSTIN of the e-commerce operator field, enter the GSTIN of the e-commerce operator.

Note: This field will appear when you select the E-commerce tab. |

|

In case of Intra-State transaction:

Notice, fields for Central Tax, State/UT Tax & CESS will appear in the screen.

Note: The Central Tax, State/UT Tax fields are auto-populated based on the value entered in Rate field. However, these can be edited. The CESS field is not auto populated and has to be entered by the taxpayer. |

|

In case of Inter-State transaction:

Notice, fields for Integrated Tax & CESS will appear in the screen.

Note: The Integrated Tax field is auto-populated based on the value entered in Rate field. However, these can be edited. The CESS field is not auto populated and has to be entered. |

|

8. Click the SAVE button to save the details added. |

|

9. Click the BACK button to go back to the GSTR-1 page. |

|

You will be directed to the GSTR-1 landing page and the B2C (Others) tile in GSTR-1 will reflect the number of invoices added along with total tax liability. |

|

|

|

To add an invoice for Nil Rated Supplies, Exempted and Non-GST Outward supplies, perform the following steps:

1. Click the Nil Rated Supplies tile to enter the details for Nil rated supplies. |

|

2. The Nil Rated Supplies page is displayed with section for Goods and Services. Click the EDIT button at the bottom of the page to enable the fields displayed on the page. |

|

3. Enter the data in Nil Rated Supplies, Exempted (Other than Nil rated/non-GST supply), and Non-GST Supplies Amount fields for the following categories of transactions:

a. Inter-state supplies to registered person

b. Inter-state supplies to unregistered person

c. Intra-state supplies to registered person

d. Intra-state supplies to unregistered person |

|

4. Click the SAVE button to save the details.

A success message is displayed on the top of the page. |

|

5. Click the BACK button to go back to the GSTR-1 page. |

|

You will be directed to the GSTR-1 landing page and the Nil Rated Supplies tile in GSTR-1 will reflect the updated value. |

|

|

To add details of Tax Liability (Advances Received) arising on account of Time of Supply without issuance of Invoice in the same period, perform the following steps:

1. Click the Tax Liability (Advances Received) tile to enter the tax liability details |

|

2. The Tax Liability (Advance Received) – Summary page is displayed. Click the ADD DETAILS button to add the advance tax receipt and related liability details. |

|

3. In the POS field, select the State code of the place of supply applicable for the advances received. .

Note: Based on the state code selected, Supply Type column would be auto-populated as Inter-state or Intra-state.

In case of Intra-State transaction:

Notice, fields for Central Tax, State/UT Tax & CESS will appear in the screen.

a) In the Gross Advance Received field, enter the amount paid by the receiver to the supplier for the goods/service provided by the supplier without issuing of any invoice for the goods/services against the applicable Rate (%).

b) In the Central Tax, State/UT Tax field, system will auto-populate the Central Tax and State/UT Tax amount. The same will be editable.

c) In the CESS field, enter the CESS amount. |

|

In case of Inter-State transaction:

Notice, fields for Integrated Tax & CESS will appear in the screen.

a) In the Gross Advance Received field, enter the amount paid by the receiver to the supplier for the goods/service provided by the supplier without issuing of any invoice for the goods/services against the applicable Rate (%).

b) In the Integrated Tax field, system will auto-populate the Integrated Tax amount. This will be an editable field. .

c) In the CESS field, enter the CESS amount.

7. Click the SAVE button. |

|

8. The line item details are added in a tabular format. Notice the line item details. In case, the details are incorrect, you can edit or delete the line item by using the Edit and Delete icons that appear under the Actions column.

9. Click the BACK button to go back to the GSTR-1 page. |

| |

You will be directed to the GSTR-1 landing page and the Tax Liability (Advance Recieved) tile in GSTR-1 will reflect the updated total value and no. of entries. |

|

|

|

To fill details of Adjustment of Advances on invoices issued in the current period, perform the following steps.

1. Click the 11B(1), 11B(2)- Adjustment of Advances tile to enter the details of tax already paid on invoices issued in the current period. |

|

2. The Tax already paid on invoices issued in the current period – Summary page is displayed. Click the ADD DETAILS button to add details for invoices issued in the current period on which tax has already been paid. |

|

3. The Tax already paid on invoices issued in the current period - Add Details page is displayed. |

|

In case of Inter-State transaction:

Notice, fields for Integrated Tax & CESS will appear in the screen.

a) In the Gross Advance adjusted field, enter the amount paid by the receiver to the supplier for the goods/services against the applicable Rate (%)

b) In the Integrated Tax field, system will auto-populate the Integrated Tax amount. This will be an editable field.

c) In the CESS field, enter the CESS amount. |

|

In case of Intra-State transaction:

Notice, fields for Central Tax, State/UT Tax & CESS will appear in the screen.

a) In the Gross Advance adjusted field, enter the amount paid by the receiver to the supplier for the goods/services against the applicable Rate (%)

b) In the Integrated Tax field, system will auto-populate the Integrated Tax amount. This will be an editable field.

c) In the CESS field, enter the CESS amount. |

|

4. Click the SAVE button to save the details. |

|

A success message will be displayed on the top of the Page. |

|

5. You can also Edit/Delete the added invoices (under Actions tab). |

|

6. Click the BACK button to go back to the GSTR-1 page. |

|

You will be directed to the GSTR-1 landing page and the Adjustment of Advances tile in GSTR-1 will reflect the number of line items added. |

|

|

|

To furnish the HSN-wise summary of outward supplies and rate wise along with quantitative details, perform the following steps:

Note: This field is applicable only if Annual turnover is more than 1.5 cr.

1. Click the HSN-wise summary of outward supplies tile to furnish the summarized details of all outward supplies HSN-wise along with quantitative details. |

|

2. The HSN-wise summary of outward supplies– Summary page is displayed. Click the ADD DETAILS button to add details for invoices issued in the current period on which tax has already been paid. |

|

3. The HSN summary of outward supplies – Add/Edit Details page is displayed. |

|

4. In the HSN field, enter the applicable provision of reporting HSN code of the outward supplied.

5. In the Description field, enter the description. (Either HSN or Description should be mandatorily entered)

6. In the UQC field, select UQC.

7. In the Total Quantity field, enter the quantity.

8. In the Total Value field, enter the Total Value of the outward supply.

9. In the Total Taxable Value field, enter the Total Taxable Value of the outward supply. |

|

In case of Intra-State transaction:

Notice, fields for Central Tax, State/ UT Tax & CESS will appear in the screen.

In the Central TAX, State Tax and CESS field, enter the Central TAX, State Tax and CESS amount. |

|

In case of Inter-State transaction:

Notice, fields for Integrated Tax & CESS will appear in the screen.

In the Integrated Tax and CESS field, enter the Integrated Tax and CESS amount. |

|

10. Click the ADD button. |

|

11. You will be directed to Added/Edited line iems to be saved page and a message is displayed that Request accepted successfully. |

|

12. Click the BACK button to go back to the GSTR-1 page. |

|

You will be directed to the GSTR-1 landing page and the HSN summary of outward supplies tile in GSTR-1 will be updated. |

|

|

|

To Upload the details of Documents issued perform the following steps.

1. Click the Documents Issued tile to add the details for document issued during the current tax period. |

|

2. To update the document for Invoices for outward supply, Click on Add Document: |

|

| |

3. Add the details: |

|

Similarly the documents for below categories can be added: |

|

|

|

|

You will be directed to the GSTR-1 landing page and the Documents Issued summary tile in GSTR-1 will be updated. |

|

|

To amend statement of Advances Received in earlier tax period, perform the following steps:

1. Click the 11A - Amended Tax Liability (Advance Received) tile. |

|

2. Select the Financial Year of the line item declarations of previous tax period you wish to amend from the drop-down list.

3. Select the POS of the line item of the declarations of previous tax period from the drop-down list.

4. Select the Return Filing Period of the declarations of previous tax period from the drop-down list.

5. Click the AMEND INVOICE button. |

|

6. Make the amendments as required. You cannot amend the Advance Tax Place of Supply (PoS) field/s of the line items furnished earlier.

7. Click the SAVE button. |

|

| |

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the amended invoices (under Actions).

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 11A - Amended Tax Liability (Advance Received) tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

|

To amend statement of Advances Adjusted in earlier tax period, perform the following steps:

1. Click the 11B - Amended of Adjustment of Advances tile. |

|

2. Select the Financial Year of the line item of the declarations of previous tax period from the drop-down list.

3. Select the POS of the line item of the declarations of previous tax period from the drop-down list.

4. Select the Return Filing Period of the line item of the declarations of previous tax period from the drop-down list.

5. Click the AMEND INVOICE button. |

|

6. Make the amendments as required. You cannot amend the Advance Tax Place of supply (PoS) field/s of the line items furnished earlier.

7. Click the SAVE button. |

|

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the amended invoices (under Actions).

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 11B - Amended of Adjustment of Advances tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

|

|

To amend details of B2C furnished in earlier tax period, perform the following steps:

1. Click the 10 - Amended B2C (Others) tile. |

|

2. Select the Year of the line item of the declarations of previous tax period from the drop-down list.

4. Select the Month of the line item of the declarations of previous tax period from the drop-down list.

3. Select the Original POS of line item of the declarations of previous tax period from the drop-down list.

5. Click the AMEND DETAILS button. |

|

6. Select the Revised/Original State Code (Place of Supply) from the drop-down list. Make the amendments as required. You cannot amend the Place of Supply field/s of the line items furnished earlier.

7. Click the SAVE button. |

|

You will be directed to the previous page and a message is displayed that Request accepted successfully.

Note: The status of the added invoice is Processed.

Here, you can also edit/delete the amended invoices (under Actions).

8. Click the BACK button. |

|

You will be directed to the GSTR-1 landing page and the 10 - Amended B2C (Others) tile in GSTR-1 will reflect the number of such invoices amended along with Total Tax Liability. It should be noted that you have to pay the tax in this tax period only on the differential liability. |

|

| |

|

Once you have generated the GSTR-1 Summary to added invoices, click the PREVIEW button. This button will download the draft Summary page of your GSTR-1 for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections with patience before submitting the GSTR-1. The PDF file generated would bear watermark of draft as the details are yet to be submitted. |

|

| |

|

1. Select the acknowledgement checkbox stating that you have reviewed the details of preview and the information furnished is correct and are aware that no changes can be made after submit. Once you click the acknowledgement, the SUBMIT button will be enabled.

2. Click the SUBMIT button in the landing page to submit GSTR-1.

Note: The submit button will freeze the invoices uploaded in the GSTR-1 for that particular month. You will be not able to upload any further invoices for that month. In case you have missed adding any invoice, you can upload those invoices in the next month or you can wait for receiver to add it in receiver GSTR-2. |

|

3. Click the PROCEED button. |

|

A success message is displayed. |

|

4. Refresh the page and the status of GSTR-1 changes to Submitted after the submission of GSTR-1.

5. Click the PREVIEW button again at the bottom of the page, to download the submitted GSTR-1 in PDF format. The PDF file generated would now bear watermark of final |

|

| |

|

1. Click the FILE RETURN button. |

|

2. The Returns Filing for GSTR1 page is displayed. Select the Declaration checkbox.

3. In the Authorised Signatory drop-down list, select the authorized signatory. This will enable the two buttons - FILE WITH DSC or FILE WITH EVC.

4. Click the FILE WITH DSC or FILE WITH EVC button to file GSTR-1.

Note: On filing of the GSTR-1, notification through e-mail and SMS is sent to the Authorized Signatory. |

|

|

|

|