Long-Term & Short-Term Capital Gain Tax |

-

Tax on Short-Term Capital Gain if Security Transaction Tax (STT) is applicable (Section 111A).

-

Tax on Long-Term Capital Gain

|

1. Tax on Short-Term Capital Gain if Security Transaction Tax (STT) is applicable (Section 111A).

Where the total income of an assessee includes any income chargeable under the head "Capital gains", arising from the transfer of a short-term capital asset, being

- an equity share in a company or

- a unit of an equity oriented fund or

- a unit of a business trust

and

- the transaction of sale of such equity share or unit is entered into on or after 1.10.2004;

- such transaction is chargeable to Securities Transaction Tax (STT) ;

the tax payable by the assessee on the total income shall be computed as under—

-

On such Short-Term Capital Gains — 15% [+SC+HEC] ; and

-

On the balance amount of the total income — Special Rates or Normal as applicable.

For the purpose of short-term capital gain, the period of holding in this case of a unit of a business trust shall be 36 months instead of 12 months. |

(A) Deductions Under Section 80C to 80U are NOT available -

Deductions under sections 80C to 80U are not available in respect of short-term capital gain, if securities transaction tax is applicable.

(B) Exemption Limit in some Cases [Proviso to Section111A] -

Short-term capital gain (where securities transaction tax is applicable) is taxable at the rate of 15% . The entire amount is taxable at 15% (no exemption limit).

However, in the case of a resident individual/HUF, the benefit of exemption limit is available if taxable income (minus short-term capital gain, which is subject to securities transaction tax) is less than exemption limit. In such a case, the following shall be deducted from the short-term capital gain –

Exemption limit—(Net income or taxable income–Short-term capital gain, where securities transaction tax is applicable) |

After deducting the aforesaid amount, the balance amount of short-term capital gain is chargeable to tax at the rate of 15% [+ SC + HEC].

Example :

Mr. Clean (58 years) is a resident individual. For the assessment year 2018-19, she has the following incomes—

Short-term capital gain on transfer of shares (securities transaction tax is applicable) (ST) |

24,000 |

| Short-term capital gain on transfer of Gold |

45,000 |

| Bank Interest |

36,000 |

| Salary Income ( After Standard Deduction) |

1,62,000 |

| Net Income (NI) |

2,67,000 |

In this case, Mr. Clean is a resident individual. His exemption limit is Rs. 2,50,000. Taxable income (minus short-term capital gain subject to securities transaction tax) is Rs. 2,43,000. It is less than exemption limit.

Consequently, from the short-term capital gain the following shall be deducted—

Rs. 2,50,000 (exemption limit)—[Rs. 2,67,000 (NI)—Rs. 24,000 (ST)] = Rs. 7,000 |

In this case, the short-term capital gain chargeable to tax will be Rs. 17,000 (i.e., Rs. 24,000 – Rs. 7,000).

Note :

- If Securities Transaction Tax is not applicable, short-term capital gain is taxable like any other income (no special rate). |

|

2. Tax on Long-Term Capital Gain

-

Long-Term Capital Gain is Taxable at a Flat Rate of 20% [+ SC + HEC].

-

However, Long-Term Capital Gain in the hands of Non-Residents under Section 115AB, 115AC, 115AD or 115E is Taxable at the Rate of 10% [+ SC + HEC].

DEDUCTIONS UNDER SECTIONS 80C TO 80U ARE NOT AVAILABLE -

Deductions under sections 80C to 80U are not available in respect of long-term capital gain.

EXEMPTION LIMIT IN SOME CASES [Proviso to Section 112(1)(a)] -

Long-term capital gain is taxable at the rate of 20% (in some cases 10%). The entire amount is taxable at these rates (no exemption limit).

However, in the case of a resident individual/HUF, the benefit of exemption limit is available, if taxable income (minus long-term capital gain) is less than exemption limit. In such a case, the following shall be deducted from the long-term capital gain –

| Exemption limit—(Net income or taxable income—Long-term capital gain) |

After deducting the aforesaid amount, the balance amount of long-term capital gain is chargeable to tax at the rate of 20% or 10% [+ SC + HEC].

10% Tax Rate [+ SC + HEC]

-

Long-Term Capital Gain in the hands of Non-Residents under Section 115AB, 115AC, 115AD or 115E is Taxable at the Rate 10% [+SC+HEC]

-

Long-term capital gain in the hands of a non-resident/foreign company is taxable at the rate of 10% [+ SC + HEC], if such gain arises on transfer of unlisted securities or unlisted shares in a company in which the public are not substantially interested.

However, this rule is applicable only if the indexation benefit is not claimed and capital gain is calculated without giving effect to the first proviso to section 48 (under this proviso capital gain is calculated in foreign currency if a few conditions are satisfied).

-

Moreover, in the case of any taxpayer if listed securities (i.e., shares, bonds, debentures, Government securities) or zero coupon bonds are transferred and the taxpayer does not avail the benefit of indexation, he can pay tax at the rate of 10% [+ SC + HEC].

In other words, in the case of these securities, etc., the taxpayer has an option. He can pay tax at the rate of 20% [+ SC + HEC], if indexation benefit is claimed or at the rate of 10% [+ SC + HEC], if indexation benefit is not taken.

-

In the case of debentures, indexation benefit is not otherwise available. Consequently, if debentures (long-term) are listed, one should opt for 10% Rate.

-

In the case of transfer of bonus shares, cost of acquisition is generally zero. One should opt for 10% Rate if bonus shares are long-term capital assets and are listed.

|

|

Tax on Long-Term Capital Gain in certain Cases (Section 112A)

|

-

Conditions to be satisfied for applicability of Section 112A [Section 112A(1)]

-

Tax Computation on Long-term Capital Gain under Section 112A

-

Mode of Computation of Cost Of Acquisition for Computing Long-term Capital Gain under Section 112A [Section 55(2)(ac)] :

-

Important Points on Computation of Tax on Long-term Capital Gain under Section 112A

|

- Tax on long-term capital gain (which arises on transfer of listed equity shares or units of equity oriented mutual funds on or after April 1, 2018) is calculated as per special provisions given in section 112A.

3. Conditions to be satisfied for applicability of Section 112A [Section 112A(1)]

| Conditions-1 |

The total income includes any income chargeable under the head “Capital gains”. |

| Conditions-2 |

The capital gains arise from the transfer of a long-term capital asset being an equity share in a company or a unit of an equity oriented fund or a unit of a business trust. |

| Conditions-3 |

At the time of transfer of equity share/equity oriented mutual fund unit/unit of business trust, securities transaction tax (STT) has been paid. |

| Conditions-4 |

In case capital gain arises on transfer of equity shares, securities transaction tax (STT) was paid also at the time of acquisition of shares.

However, the Board has clarified that the requirement of STT payment at the time of acquisition is applicable only when shares were acquired after October 1, 2004. |

4. Tax Computation on Long-term Capital Gain under Section 112A

If 4 conditions given above are satisfied, tax on Long-term Capital Gain will be calculated on the basis of parameters given below :

Long-Term Capital Gain in excess of Rs. 1 lakh taxable at 10% -

-

If long-term capital gain (mentioned in Condition 2) does not exceed Rs. 1 lakh, it is not chargeable to tax.

-

If such gain exceeds Rs. 1 lakh, the amount in excess of Rs. 1 lakh will be taxable at the rate of 10% (+ surcharge + 4 per cent health and education cess).

-

The rate of 10% is applicable whether the assessee is a corporate-assessee or a non-corporate assessee.

Benefit of Exemption Limit in some cases -

Proviso to section 112A(2) gives exemption limit benefit. This benefit is available only in the case of a resident individual or a resident HUF (maybe ordinarily resident or not ordinarily resident).

Moreover, this benefit is available only if the total income (as reduced by long-term capital gain mentioned in Condition 2) is less than the exemption limit.

5. Mode of Computation of Cost Of Acquisition for Computing Long-term Capital Gain under Section 112A [Section 55(2)(ac)] :

If tax is payable under section 112A, cost of acquisition of equity shares/units shall be calculated according to the provisions given under section 55(2)(ac). This provision is applicable only in respect of equity shares/units acquired by the assessee before February 1, 2018.

Cost of acquisition shall be calculated as follows –

Step 1 - Find out actual cost of acquisition of equity shares/units.

Step 2 - Find out fair market value of equity shares/units on January 31, 2018 (but it cannot be more than sale consideration of equity shares/units).

Step 3 - Cost of acquisition shall be deemed to be amount computed in Step 1 or Step 2, whichever is Higher.

Fair Market Value (FMV) on January 31, 2018 -

Fair market value on January 31, 2018 shall be calculated as follows –

-

Shares/units which are quoted on January 31, 2018 -

In a case where equity share/unit is listed on any recognised stock exchange, the highest price of share/unit quoted on such exchange on January 31, 2018 is taken as fair market value. Where, however, there is no trading in such share/unit on such exchange on January 31, 2018, the highest price of such share/unit on such exchange on a date immediately preceding January 31, 2018 when such share/unit was traded on such exchange, shall be the fair market value.

-

Units not listed -

In a case where a unit is not listed on a recognised stock exchange, the net asset value (NAV) of such unit as on January 31, 2018 is taken as fair market value.

-

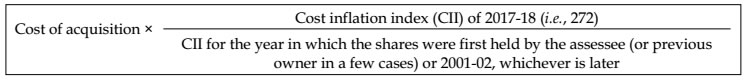

Shares (not listed on January 31, 2018) but listed on the date of transfer -

In a case, where equity share is listed on a recognised stock exchange at the time of transfer (but not listed on January 31, 2018), fair market value on January 31, 2018 will be calculated (after giving indexation benefit in a limited mode up to the previous year 2017-18) as follows –

|

6. Important Points on Computation of Tax on Long-term Capital Gain under Section 112A

-

Indexation benefit (barring the case given above) is not available when tax is payable under section 112A.

-

Mode of computation of capital gain in foreign currency in the case of a non-resident (specified by first proviso to section 48) is not applicable when tax is payable under section 112A.

-

Deductions under sections 80C to 80U are not available from long-term capital gain (mentioned in Condition 2).

-

Rebate under section 87A is not available from income-tax on long-term capital gain mentioned in Condition 2. However, the rebate under section 87A shall be allowed from the income-tax on the total income as reduced by tax payable on such capital gains.

|

|

|

Related Topics....Under the head 'Capital Gain' |

| Capital Assets, Capital Gain & Transfer of Capital Assets for Taxation of 'Capital Gain' |

| Types of Capital Assets for Computing ‘Capital Gain’ |

| Computation Of ‘Period Of Holding of an Asset' for Computing Gapital Gain [Explanation 1(i) to Section 2(42A)] |

| Transfer Of A Capital Asset [Section 2(47)] for Computing Capital Gain |

| Transactions Not regarded as ‘Transfer’ for Computing Capital Gain [Section 46 and 47] |

| Method of Computing Capital Gain [Section 48] |

| Deemed Cost of Acquisition of Asset for Computing Capital Gain |

| [Section 55(2)] : Cost of Acquisiton of Assets for Computation of Capital Gain |

| Capital Gains Accounts

Scheme, 1988. |

| Types of Capital Gain |

| Tax on Long-Term Capital Gain in certain Cases (Section 112A) |

| Exemption of Capital Gains under Section 10 and 115JG |

Exemption of Capital Gains under Sections 54, 54B, 54D, 54EC, 54EE, 54F, 54G, 54GB anf 54H |

|

| (Section 54) : Exemption of Capital Gains from the Transfer of Residential House Property |

| (Section 54B) : Exemption of Capital Gain on Transfer of Land used for Agricultural Purposes |

| (Section 54D) : Exemption of Capital Gains on Compulsory Acquisition Of Land And Buildings forming part of Industrial Undertaking |

| (Section-54EC) : Exemption of Capital Gain on Transfer of any Long Term Capital Asset on the basis of Investment in certain Bonds |

| (Section 54EE) : Capital Gain not to be charged on Investment in Units of a Specified Fund |

| [Section 54F] : Exemption of Capital Gain on Transfer Of Long-Term Capital Assets other than a House Property |

| [Section 54G] : Capital Gain on Shifting of Industrial Undertaking from Urban Areas to Non-Urban Areas : |

| [Section 54GA] : Exemption of Capital Gain on transfer of assets in case of shifting of Industrial Undertaking from an urban area to any Special Economic Zone (SEZ) |

| (Section 54GB) : Exemption of Long term Capital Gain Tax on Transfer of Residential Property if Net Consideration is Invested in the Equity Shares of a new Start-up SME Company : |

| (Section 54H) : Extension of time limit for acquiring new Asset or Depositing or Investing amount of Capital Gain, in case of Compulsory Acquisition : |

|

|

|

Related Topics....Under the head 'Capital Gain' |

| Capital Assets, Capital Gain & Transfer of Capital Assets for Taxation of 'Capital Gain' |

| Types of Capital Assets for Computing ‘Capital Gain’ |

| Computation Of ‘Period Of Holding of an Asset' for Computing Gapital Gain [Explanation 1(i) to Section 2(42A)] |

| Transfer Of A Capital Asset [Section 2(47)] for Computing Capital Gain |

| Transactions Not regarded as ‘Transfer’ for Computing Capital Gain [Section 46 and 47] |

| Method of Computing Capital Gain [Section 48] |

| Deemed Cost of Acquisition of Asset for Computing Capital Gain |

| [Section 55(2)] : Cost of Acquisiton of Assets for Computation of Capital Gain |

| Capital Gains Accounts

Scheme, 1988. |

| Types of Capital Gain |

| Tax on Long-Term Capital Gain in certain Cases (Section 112A) |

| Exemption of Capital Gains under Section 10 and 115JG |

Exemption of Capital Gains under Sections 54, 54B, 54D, 54EC, 54EE, 54F, 54G, 54GB anf 54H |

|

| (Section 54) : Exemption of Capital Gains from the Transfer of Residential House Property |

| (Section 54B) : Exemption of Capital Gain on Transfer of Land used for Agricultural Purposes |

| (Section 54D) : Exemption of Capital Gains on Compulsory Acquisition Of Land And Buildings forming part of Industrial Undertaking |

| (Section-54EC) : Exemption of Capital Gain on Transfer of any Long Term Capital Asset on the basis of Investment in certain Bonds |

| (Section 54EE) : Capital Gain not to be charged on Investment in Units of a Specified Fund |

| [Section 54F] : Exemption of Capital Gain on Transfer Of Long-Term Capital Assets other than a House Property |

| [Section 54G] : Capital Gain on Shifting of Industrial Undertaking from Urban Areas to Non-Urban Areas : |

| [Section 54GA] : Exemption of Capital Gain on transfer of assets in case of shifting of Industrial Undertaking from an urban area to any Special Economic Zone (SEZ) |

| (Section 54GB) : Exemption of Long term Capital Gain Tax on Transfer of Residential Property if Net Consideration is Invested in the Equity Shares of a new Start-up SME Company : |

| (Section 54H) : Extension of time limit for acquiring new Asset or Depositing or Investing amount of Capital Gain, in case of Compulsory Acquisition : |

|

|

|