Meaning. Appeal refers to an act of referring the case/matter/situation to a higher authority against the order passed by a lower authority in respect of that case or matter. It implies a complaint to a higher authority against the order or judgement (alleged to be erroneous) of an administrative authority or appellate authority. The complex nature of Income Tax Act and the various rules often, create a situation where there is difference of opinion among the assessee and the assessing officer (i.e.,Income tax department). Quite often, an assessee is not satisfied by an assessment order/any other order issued by any income tax authority and such an aggrieved assessee can present his case before specified authorities prescribed under Income Tax Act. Such prescribed authorities constitute ‘appellate machinery’ or ‘appellate authorities’.

1. ‘Right To Appeal’ Is A Statutory Right Under Income Tax Act.

The right to appeal is not the natural or inherent right of the assessee. It is available to him only if specifically granted under Income Tax Act. Thus, it is a statutory, right of the assessee and cannot be denied to him by ny orde f Central Board of Direct Tax (CBDT). It can be snatched from the assessee only by a express provision provided under Income Tax Act.

A. Parties to an Appeal

There are following two parties to\any appeal :

-

Appellant. The person filing an appeal is c,1ied ‘appellant’ or ‘applicant’. Under Income Tax, the first appeal can only be filed by assesseeand—hence only assessee can be appellant in such a case. However, in subsequent appeals (i.e., appeal to ITAT, HC or SC) appellant can be assessee or C.I.T.

-

Defendant / Respondent. The person against whom the appeal is filed is called ‘defendant’ or ‘respondent’.

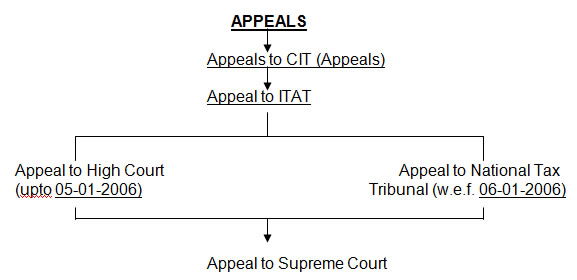

B. Various Appellate Authorities under Income Tax Act

-

Commissioner (Appeals).

-

Income Tax Appellate Tribunal (ITAT).

-

High Court / NTT.

-

Supreme Court.

2. Appeal to the Commissioner (Appeals) [Sectiàn 246 (2)]

Any assesse,e aggrieved by any of the following orders (which are made before or after the appointed day) may appeal to the Commissioner (Appeals) against such order

Appealable Order Before Commissioner (Appeals) [Section 246A]

-

Against an

-

An order passed by a Joint Commissioner u/s 1 15VP (3)(ii) or an order making the assessee liable to tax but where he denies his liability,

-

An intimation u/s 143(1) or 143(1B) objecting to the adjustments made,

-

An order of assessment made u/s 143(3) or section 144 as regards income assessed or to an amount of loss computed or to the status under which he is assessed.

-

An order of assessment made under section 1 15WE(3) or u/s 1 15WF, where the assessee being an employer objects to the value of fringe benefits assessed.

-

An order of assessment or reassessment made uls 1 15WG.

-

An order of assessment, reassessment, or re-computation of income u/s 147 or u/s 150 ;or u/s 153A

-

An order u/s 154 or 155 by which his tax liability is enhanced or refund is reduced or to allow the claim made by him under either of these sections

-

An order issued under section 163 regarding treating a person as agent

-

An order made u/s 170(2) or (3) regarding assessment on succession

-

An order made u/s 171 regarding partition of H.U.F.

-

An order issued under section 185(1)(B), or 185(2) or 185(3) or 185(5) in respect of assessment of registered firms as they before 1-4-1992

-

An order issued under section 186(1), or 186(2) in respect of assessment of firms as they existed before 1-4-1992

-

An order made u/s 201

-

An order made u/s 206C (6A)

-

An order made u/s 237 regarding refund

-

An order of penalty made

-

u/s 221, regarding payment.Of tax in default,

-

u/s 271, regarding non-filing of return,

-

u/s 271A, regarding failure to keep or maintain accounts, documents etc., u/s 271AAA

-

u/s 271 F, regarding failure to file return of income,

-

u/s 271 FB for failure to furnish return f fringe benefits,

-

u/s 272AA regarding failure to comply) with the provisions of section 133B,

-

u/s 272BB regarding failure to comply Avith the provisions of section 203A regarding tax deduction account number.

-

An order of imposing or enhancing penal u/s 275(1A)

-

An order of assessment nade by Assesg Officer under section 158BC©, in respect of search commenced u/s 32 in resyet of requisitioning of books of accounts, other documents or any asset u/432A-in or after 1-1-1997;

-

An order imposing a penalty u/s 158BFA(2) regarding levy of interest on assessment under search and seizure

-

An order imposing a penalty u/s 271B and 271BB regarding failure to get the accounts audited or failure to subscribe in eligible issue;

-

An order made by a Deputy Commissioner (Joint Commissioner with effect from 1-10-98) imposing a penalty u/s 271C, section 271CA for not deducting tax at source, or u/s 271D o?271E for accepting or giving deposit or loan exceeding Rs. 20,000 in cash

-

An order made by a Deputy Commissioner or Deputy Director (Joint Commissioner or Joint Director from 1-10-98) imposing a penalty u/s 272A regarding failure to sign, answer questions etc.

-

An order imposing any penalty under chapter XXI

-

An order made by an Assessing Officer except by Deputy Commissioner, (Joint Commissioner with effect from 1-10-98) under the provisions of this Act in the case of such persons or class of persons as directed by CBDT.

3. Fee for Filing Appeal [Section 249(1)]:

Form 35 shall be accompanied by a fee as under: `

-

Where the total income/loss of the assessee as computed by the A.O. in the case to which appeal relates is Rs.1,00,000 or less : Rs. 250

-

Where the total income/loss of the assessee, computed as aforesaid in the case to which appeal relates exceeds Rs. 1,00,000 but does not exceed Rs. 2,00,000 : Rs. 500

-

Where total income/loss of the assessee, computed as aforesaid in the case to which appeal relates exceeds Rs. 2,00,000 : Rs. 1,000

-

Where the subject matter of appeal relates to any matter other than specified in clauses (a), (b) and (c) above : Rs. 250

The fee should be credited in a branch of the authorised bank or a branch of the State Bank of India or a branch of the Reserve Bank of India after obtaining a challan from the Assessing Officer and a copy of challan sent to the Commissioner of Income-tax (Appeals).

4. Time Limit for Filing Appeal [Section 249(2)]:

The appeal should be presented within a period of 30 days of—

-

the date of payment of tax, where appeal is under section 248; or

-

the date of service of notice of demand relating to assessment or penalty if the appeal relates to assessment or penalty; or

However, where an application has been made under section 270AA(1), the period beginning from the date on which the application is made, to the date on which the order rejecting the application is served on the assessee, shall be excluded.

-

the date on which intimation or the order sought to be appealed against is served if it relates to any other cases.

Exclusion of time for calculating time limit for filing appeal [Section 268]:

For this purpose, the date on which the order complained of is served is to be excluded. Further, if the assessee was not furnished with a copy of the order when the notice of the order (say notice of demand) was served upon him then the time required for obtaining a copy of the order should be excluded, i.e. period taken for obtaining the order shall be added to the time limit of 30 days.

5. Pre-requisites for Appeal

No appeal shall be admitted unless at the time of filing of the appeal

-

where a return has been filed by the assessee, the assessee has paid the tax due on the income returned by him ; or

-

where the return has not been filed by the assessee, the assessee has paid an amount equal to the amount of advance tax which was payable by him. Provided that, on an application made by the appellant in this behalf, the Deputy Commissioner (Appeals) may, for reason to be recorded in writing, exempt him from the operation of these provisions.

6. Procedure in Appeal [Section 250]

-

Under Section 250 (1), the D.C. (A) and Commissioner (Appeals) shall fix a day and place for the hearing of the appeal and shall give notice of the same to the appellant and to the I.T.O. against whose order the appeal is preferred.

-

The following shall have the right to be heard at the hearing of the appeal

-

the appellant either in person or by an uthorized representative

-

Assessing Officer, either in person or by a representative [Section 250(2)].

-

The Commissioner (Appeals) shall have the power to adjourn the hearing of the appeal from time to time. [Section 250 (3)].

-

The Commissioner (Appeals), may before disposing off any appeal, make such further inquiries as they think fit or may direct the Assessing Officer to make further enquiry and report the result of the same. [Section 250 (4)].

-

The Commissioner (Appeals) may, at the hearing of an appeal, allow the appellant to go into any ground of appeal, not specified in the grounds of appeal, the Commissioner (Appeals) is satisfied that omission of that ground from the form of appeal was not uthori or unreasonable. [Section 251 (5)].

-

The order of the Commissioner (Appeals) disposing of the appeal shall be in writing and shall state the points for determination, decision thereon and the reason for the decision. [Sec. 250 (6)].

-

Limitation of period to decide the appeal by Commissioner (Appeals) [Section 250(6)]. With effect from 1-6-1999, the Commissioner (Appeals) may decide upon the appeal (where it is possible) within a period of One year from the end of financial year in which appeal is made.

-

8. On the disposal of the appeal, the orders passed by them shall be passed on the assessee as well as to the Commissioner. [Section 250 (7)]

|