When Interest Payable by Assessee |

-

Default in furnishing Return of Income [Section 234A(1)]

-

Defaults in furnishing the Return of Income required by a Notice under Section 148 [Section 234A(3)]

-

Defaults in Payment of Advance Tax [Section 234B]

-

Interest for Deferment of Advance Tax [Section 234C]

-

Interest is payable by the Assessee on Excess Refund [Sec. 234D]

-

Fee for Delay in Furnishing of TDS/TCS Statement [Section 234E]

-

Interest for late payment of Demand of Tax, Interest, Penalty, etc. [Section 220(2)]

-

Failure to Deduct and Pay Tax at Source [Section 201(1A)]

|

1. Interest payable by the Assessee for Default in Furnishing Return of Income under Section 139(1) or (4) or in response to a Notice under Section 142(1) [Section 234A(1)]

|

The assessee is liable to pay interest in the following cases:

- where the return of income is furnished after the due date.

[ “Due date” means the date specified in section 139(1) as applicable in case of the assessee.]

- where the return of income is not furnished by the assessee.

Table showing How to Calculate Interest : |

Rate of Interest |

Simple interest @ 1% per month or part of the month. |

Period for which interest is payable |

The interest will be payable for the period commencing on the date immediately following the due date and would end on :

in case of (1) above, the date of furnishing the return of income;

or

in case of (2) above, date of completion of assessment u/s 144 (Best Judgment Assessment) or first time assessment, if done u/s 147/153A if there was no assessment made under section 144. |

Amount on which Interest is Payable |

Interest is payable on tax determined u/s 143(1) or on regular assessment under section 143(3)/144/or first assessment under section 147/153A (whichever section is applicable) if there was no assessment made under section 144 minus the following:

(1) Tax deducted and collected at source,

(2) Advance tax paid by the assessee,

(3) The amount of relief of tax allowed under sections 90 and 90A and deduction from the Indian income-tax payable, allowed under section 91, and

(4) Tax credit allowed to be set off under section 115JAA/ 115JD from the tax on the total income. |

Calculation of Interest |

Though the interest is payable on the balance tax determined as above, but any interest (computed as per the provisions of section 234A) paid under section 140A (relating to self assessment tax) on account of late filing of return shall be deductible [Section 234A(2)]. |

|

OTHER POINTS - The following points shall also be kept in view:

- Self-assessment tax paid before the due date and return submitted after due date –

The Assessing Officer cannot charge interest under section 234A in a situation where the assessee has paid due taxes before the due date of submission of return of income and merely filing of income-tax return is delayed—

- Self-assessment tax paid after due date and return is submitted thereafter –

In case of Pranoy Roy (supra), the Apex Court held that –

- if self-assessment tax is paid before the due date of submission of return of income and return is submitted after the due date, interest under section 234A is not applicable [Case (a)]; and

- if self-assessment tax is paid after the due date of submission of return of income, interest under section 234A is applicable [Case (b)].

|

Computation of Interest to be paid or payable by the Assessee: |

|

|

2. Interest payable by the Assessee for Defaults in Furnishing the Return of Income required by a Notice under Section 148 [Section 234A(3)] |

Once the income has been determined under section 143(1) or the assessment has been done under section 143(3), 144 or 147 and the Assessing Officer issues a notice:

- under section 148 for filing return of income for the purpose of reassessment/ recomputation under section 147, or

- under section 153A for assessment in case of search or requisition, the assessee shall be liable to pay interest in the following cases:

- when the return of income is furnished after the expiry of time allowed in the notice issued under section 148 or under section 153A; or

- where no return of income is furnished by the assessee.

Rate of interest:

Simple interest @ 1% per month or part of the month.

Period for which interest is payable:

The interest will be payable for the period commencing on the date immediately following the expiry of time limit given in the notice under section 148 or under section 153A and would end on:

In case of (a) above, the date of furnishing of return of income; or

In case of (b) above, date of completion of reassessment or recomputation under section 147 or reassessment under section 153A.

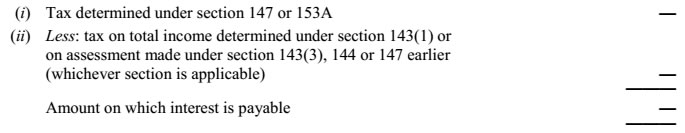

Amount on which interest is payable:

Interest is payable on the amount calculated as under:

|

3. Interest payable by the Assessee for Defaults in Payment of Advance Tax [Section 234B] |

When interest is payable:

The assessee is liable to pay interest in the following cases:

-

advance tax has not been paid by the assessee; or

-

the advance tax paid by the assessee is less than 90% of the 'assessed tax'.

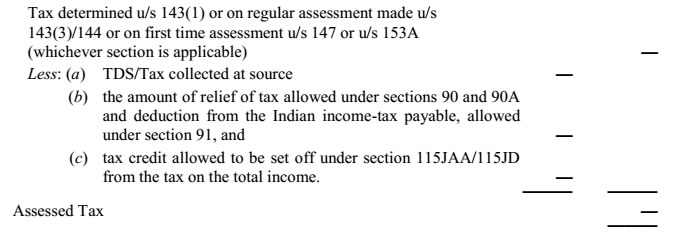

'Assessed tax' means: |

|

Computation of Interest Payable under Section 234B :

Rate of Interest |

Simple interest @ 1% per month or part of the month. |

Period for which Interest is payable |

Interest will be payable from 1st April of the relevant assessment year to the date of determination of income u/s 143(1) and where a regular assessment is made, to the date of such regular assessment under section 143(3)/144 if there was no determination made under section 143(1) or assessment made under section 143(3) or section 144 or first time assessment under section 147/153A, if there was no determination made under section 143(1) or assessment made under section 143(3) or section 144. |

Amount on which interest is payable |

Interest is payable on 'Assessed tax' if no advance tax is paid. However, if any advance tax has been paid, interest will be payable on assessed tax minus advance tax paid. |

Computation of Interest |

Interest will be computed as under :

(a) When no tax is paid on self assessment or otherwise: Interest is payable on assessed tax minus advance tax paid, if any;

(b) Where tax has also been paid on self assessment or otherwise

- interest will be calculated on assessed tax - advance tax paid if any. It will be calculated for a period commencing from 1st April, to the date on which tax under section 140A or otherwise is so paid, and thereafter

- interest shall be calculated on the balance amount (i.e. assessed tax - Advance tax - tax paid) till the date of determination of total income under section 143(1) or regular assessment under section 143(3)/144 or first assessment under section 147/153A, if there was no determination made under section 143(1) or assessment made under section 143(3) or 144.

Note.—Interest, computed as per clause (b) above, shall be reduced by any interest (computed as per provisions of section 234B) paid under section 140A. |

Special points -

Interest under section 234B is not applicable if advance tax paid during the financial year (i.e., April 1 to March 31 immediately preceding assessment year) is 90 per cent (or more) of Assessed Tax . Further interest is not payable if Assessed Tax is less than Rs. 10,000. |

|

4. Interest for Deferment of Advance Tax [Section 234C] |

An assessee, (other than an eligible assessee in respect of the eligible business referred to in section 44AD or in respect of eligible profession referred to in section 44ADA), who is liable to pay advance tax under section 208 has failed to pay such tax or has made late payment of advance tax, shall pay the interest under section 234C as under—

Circumstances in which interest is pitiable u/s 234C |

Rate of interest |

Period |

Amount on which interest is

to be paid |

(1) |

(2) |

(3) |

(4) |

Where advance tax paid on or before June 15th is less than 12% of tax due on returned income |

Simple interest 1% p.m. |

Three months |

15% of tax due on returned income minus advance tax paid upto 15th June |

Where advance tax paid on or before 15th September is less than 36% of tax due on returned income |

Simple Interest 1% p.m. |

Three months |

45% of tax due on returned income minus total advance

tax paid upto 15th September |

Where advance tax paid on or before 15th December is less than 75% of tax due on returned income |

Simple Interest (a 1% p.m. |

Three months |

75% of tax due on returned income minus total advance

tax paid upto 15th December |

Where advance tax is paid on or before 15th March is less than 100% of tax due on returned income |

Simple Interest . 1% p.m. |

One month |

100% of tax due on returned income minus total advance tax paid upto 15th March |

However, if the advance tax paid by the assessee on the current income, on or before the 15th day of June or the 15th day of September, is not less than 12%, or, as the case may be, 36%, of the tax due on the returned income, then, the assessee shall not be liable to pay any interest on the amount of the shortfall on those dates.

Meaning of tax due on returned income:

It shall be computed as under:

Tax on Returned Income

Less:

-

tax deducted and collected at source;

-

the amount of relief of tax allowed under sections 90 and 90A and deduction from the Indian income-tax payable, allowed under section 91, and

-

tax credit allowed to be set off under section 115JAA/115JD from the tax on the total income.

|

5. Interest is payable by the Assessee on Excess Refund [Sec. 234D] |

Section 234D is applicable if any refund is granted under section 143(1) but no refund is due on regular assessment. It is further applicable if any refund is granted to the assessee under section 143(1) and the refund so granted exceeds the amount refundable on regular assessment.

-

Rate of interest - 0.5 % or (1/2) per cent per month or part of a month.

-

Period for which interest is payable - The period commencing from the date of grant of refund under section 143(1) to date of regular assessment

-

Amount on which interest is payable - The excess of amount refunded under section 143(1) over the amount refundable on regular assessment.

|

6. Fee for Delay in Furnishing of TDS/TCS Statement [Section 234E] |

- If a person fails to deliver a quarterly TDS/ TCS return within the prescribed time, he shall be liable to pay, by way of fee, a sum of Rs. 200 for everyday during which the failure continues.

This fees is in addition to other consequences under the Act. However, the fees shall not exceed the amount of tax deductible/collectible. After July 1, 2012, it is not possible to submit belated quarterly TDS/TCS returns without payment of fees under section 234E. |

|

7. Interest for late payment of Demand of Tax, Interest, Penalty, etc. [Section 220(2)] |

As per section 156, when any tax, interest, penalty, fine or any other sum is payable in consequence of any order passed under the Income-tax Act, the Assessing Officer shall serve upon the assessee a notice of demand in Form No. 7 specifying the sum so payable.

Further as per section 220(1) the amount specified in the notice of demand u/s 156 should be paid within 30 days of the service of notice at the place and to the person mentioned in the notice. However, the Assessing Officer in some cases, with prior approval of Joint Commissioner can ask the assessee to deposit the amount in less than 30 days.

As per section 220(2), if the amount specified in any notice of demand under section 156 is not paid within 30 days of the service of notice, the assessee shall be liable to pay simple interest at 1% for every month or part of a month comprised in the period commencing from the day immediately following the end of the period of 30 days and ending with the day on which the amount is paid.

However, where the Assessing Officer has any reasons to believe that it will be detrimental to revenue if the full period of 30 days aforesaid is allowed, he may with the previous approval of Joint Commissioner, direct that the sum specified in the notice of demand shall be paid within such period being a period less than 30 days aforesaid as may be specified by him in the notice of demand. If the period allowed by the Assessing Officer is less than 30 days, then period for payment of interest shall commence from the day immediately following the said period. |

| |

8. Failure to Deduct and Pay Tax at Source [Section 201(1A)] |

As per section 201(1A), without prejudice to the provisions of section 201(1), if any person including the principal officer of a company does not deduct the whole or any part of the tax or after deducting fails to pay the tax as required by or under this Act, he or it shall be liable to pay simple interest as under:

| Period of Default |

Rate of Interest |

(a) From the date the tax was deductible to the date on which such tax is deducted [Section 201(1A)(i)] |

1% p.m. or part of the month |

(b) From the date on which such tax is deducted to the date on which such tax is actually paid [Section 201(1A)(ii)] |

1.5% p.m. or part of the month |

|

|