GST Enrollment Process |

| 1. Enrolment of Existing Taxpayer with Provisional ID and Password [

I have procured a DSC. How can I register my DSC with the GST Common Portal ? ]

1-A. Login with Username and Password [ How can I login to the GST Common Portal with new Username and Password ? ]

2. Forgot Username [ I have forgettin my UserName. How do I retrieve my Username ? ]

3. Forgot Password [ I have forgetten my Password. How do I retrieve my Password ? ]

4. Change Password [ How do I change my password ? ]

5. Register DSC [ I have procured a DSC. How can I register my DSC with the GST Common Portal ? ]

6. Update DSC [ I have renewed my DSC. How do I update my new DSC ? ]

7. View My Saved Application [ I am an existing taxpayer. I had saved my enrolment application but not completed it. How can I access my saved application ? ]

8. Track Application Status [ I am an existing taxpayer. How can I track status of my application for enrolment with GST that I have submitted ? ] |

| |

1. I have procured a DSC. How can I register my DSC with the GST Common Portal ?

To register your DSC with the GST Common Portal, you need to perform the following steps:

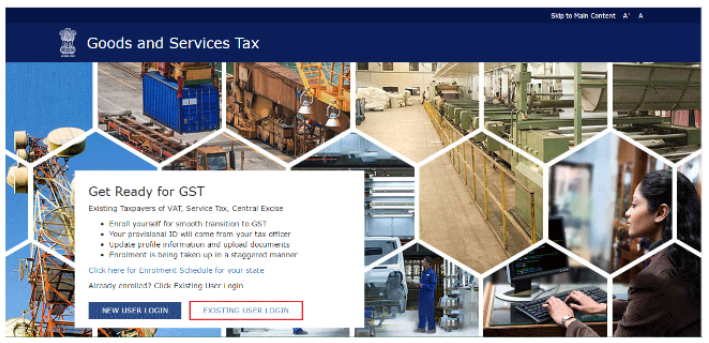

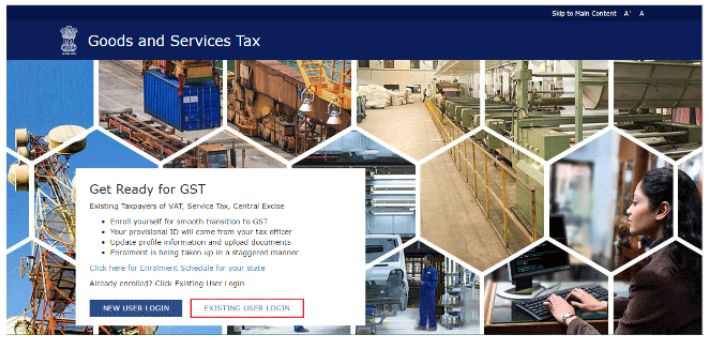

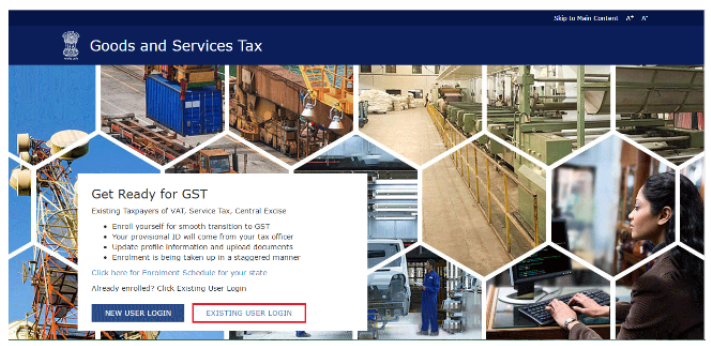

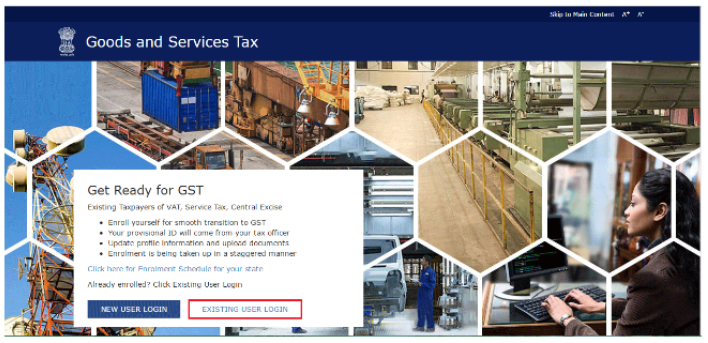

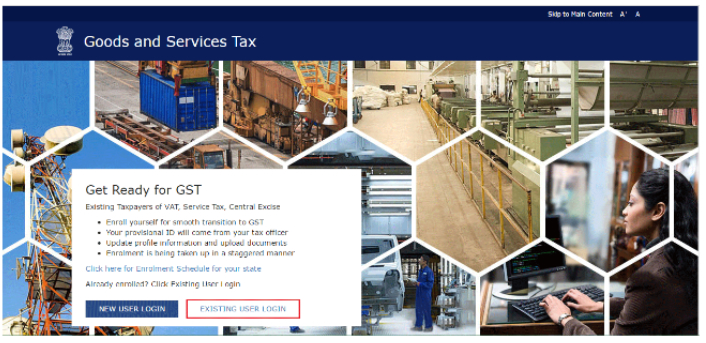

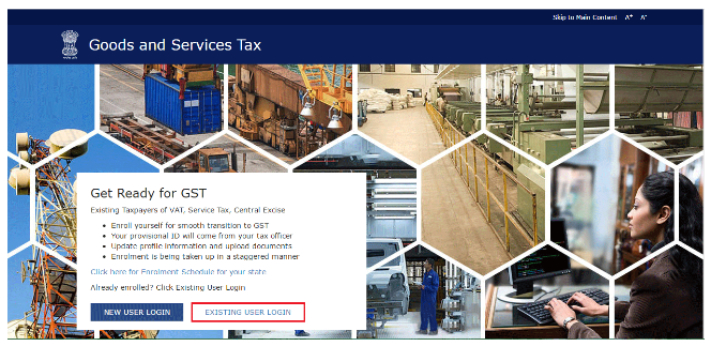

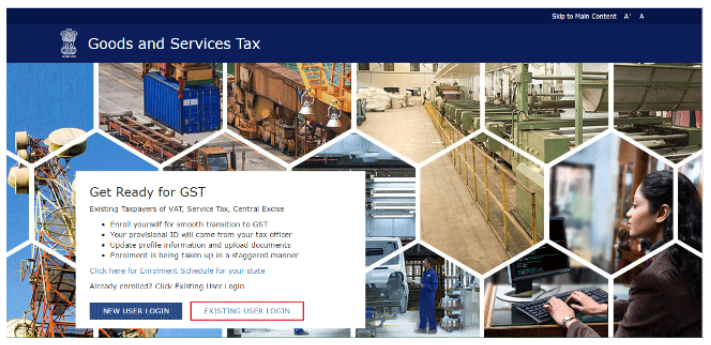

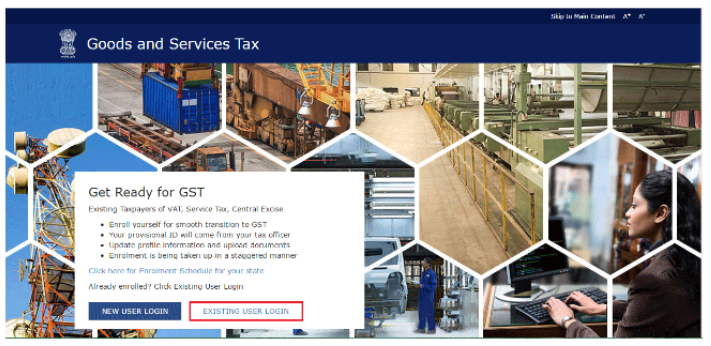

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

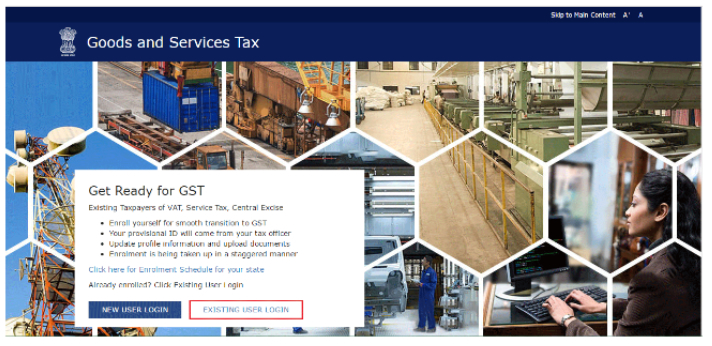

2. Click the EXISTING USER LOGIN button. |

|

| |

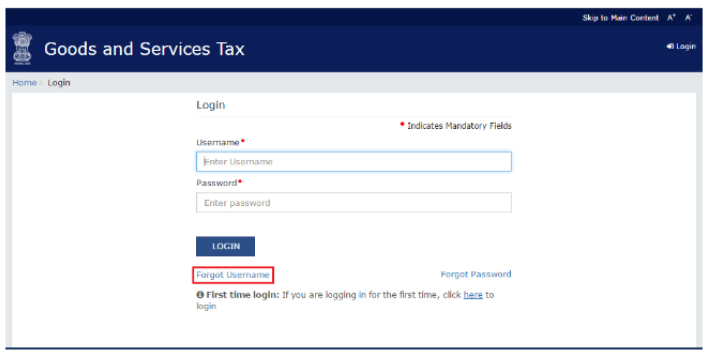

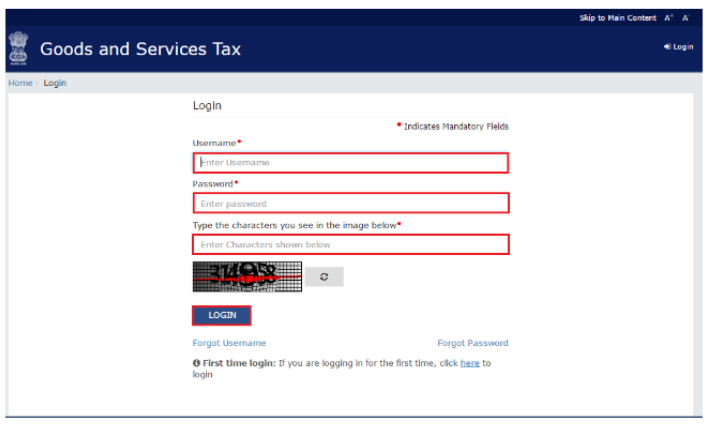

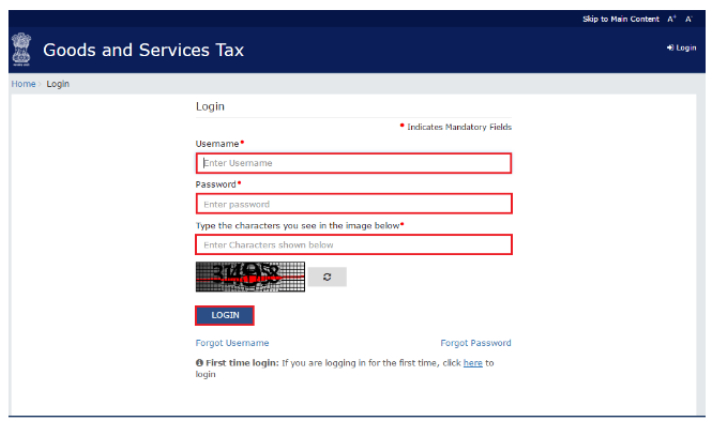

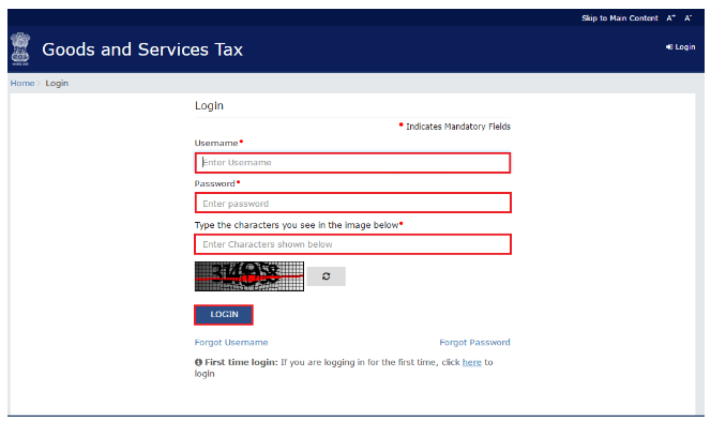

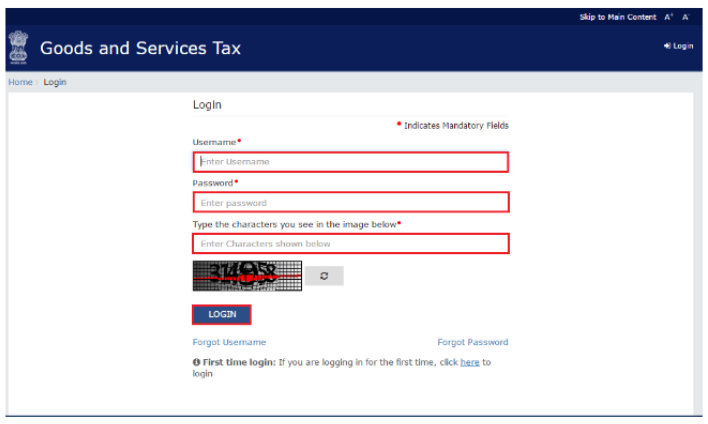

3. The Login page is displayed. In the Username field, type the username that you created.

4. In the Password field, type the password.

5. In the Type the characters you see in the image below field, type the captcha text as shown on the screen.

6. Click the LOGIN button. |

|

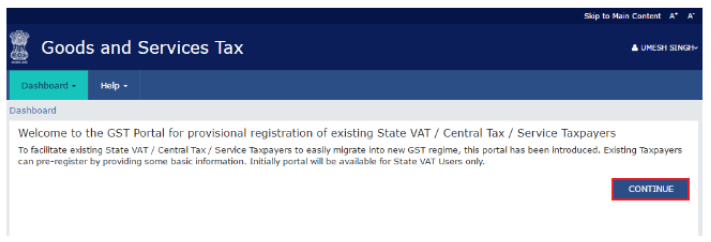

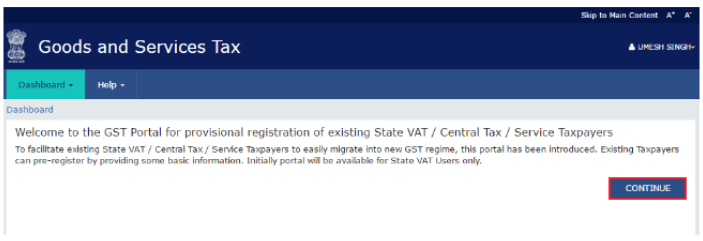

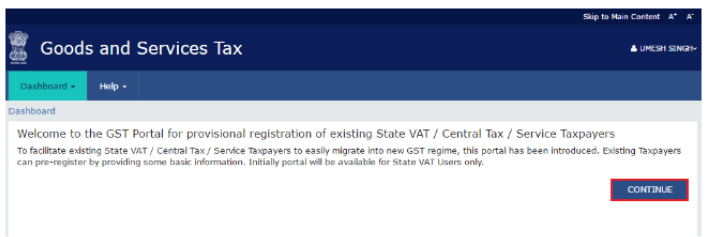

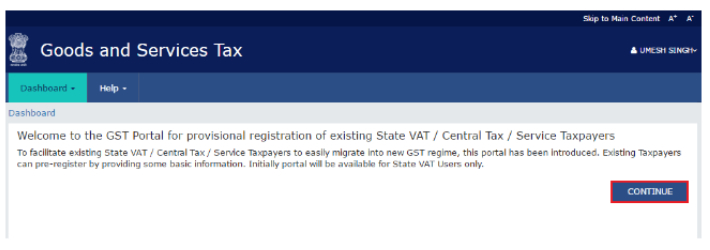

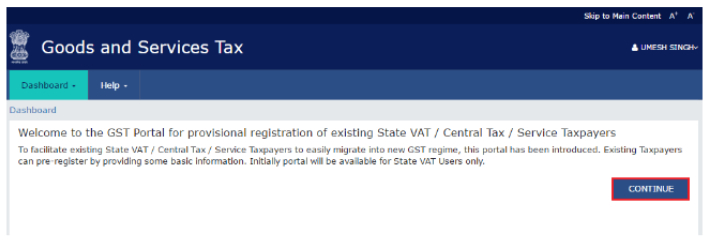

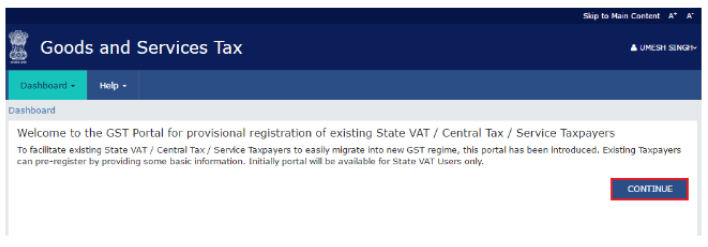

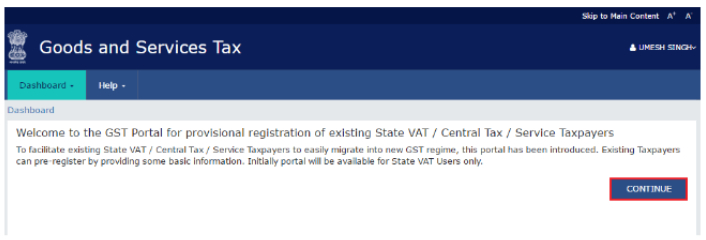

| 7. The Welcome page is displayed . Click the CONTINUE button. |

|

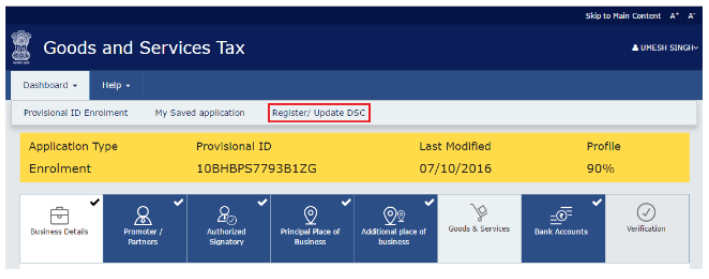

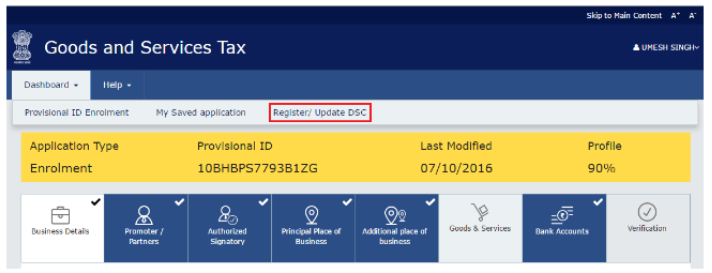

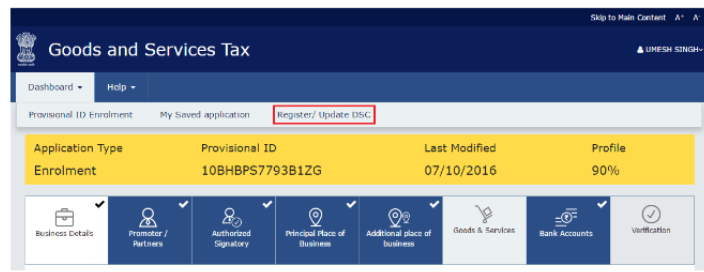

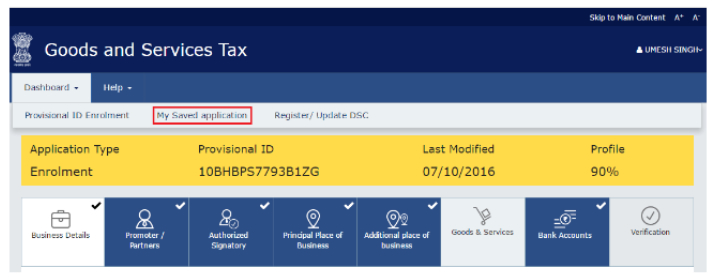

| 8. The Dashboard is displayed . Click the Dashboard > Register / Update DSC command. |

| |

|

| |

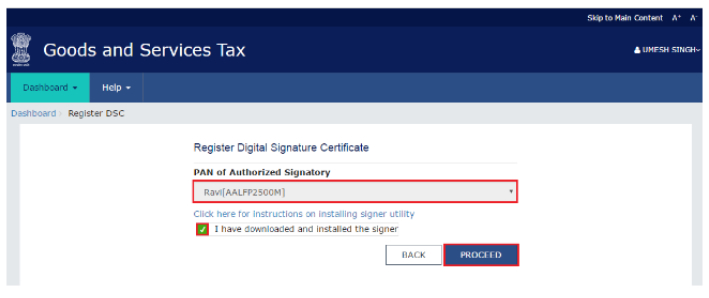

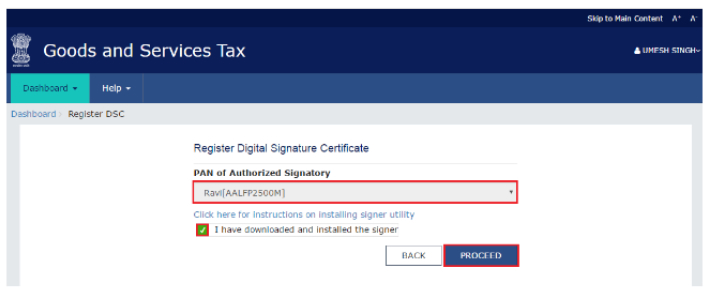

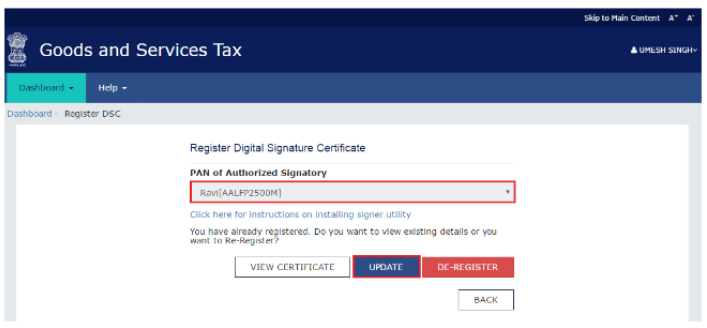

10. The Register Digital Signature Certificate page is displayed. In the PAN of Authorised Signatory drop-down list, select the PAN of the authorised Signatory that you want to register. |

| |

| 11. Select the I have downloaded and installed the signer checkbox. |

| |

| 12.Click the PROCEED button. |

|

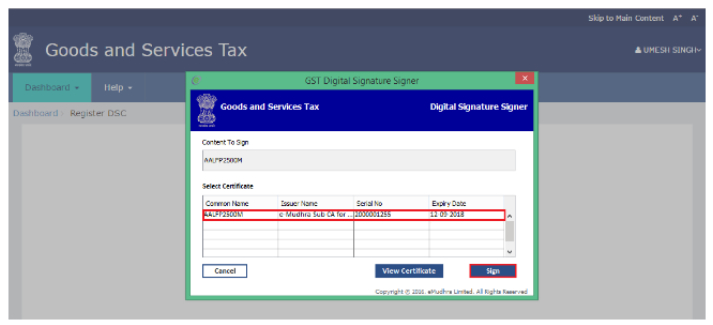

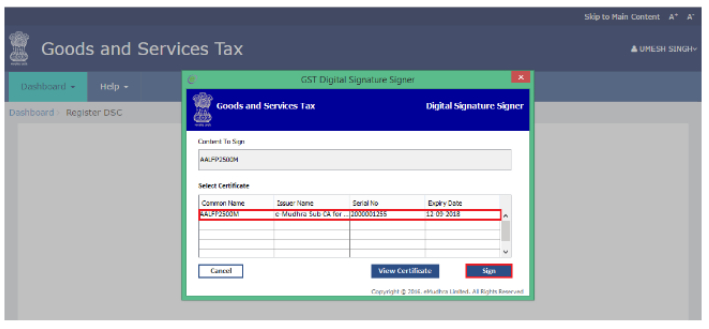

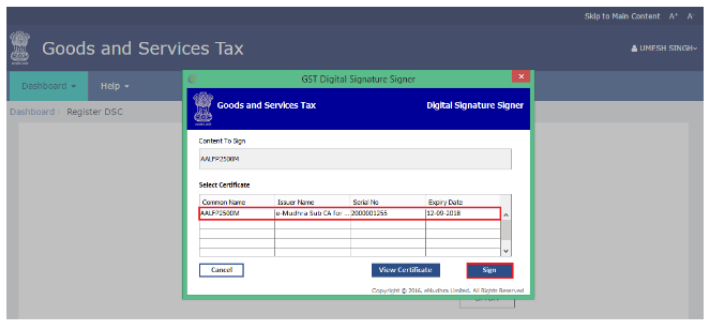

| 13. Select the Certificate . Click the Sign button. |

|

|

| |

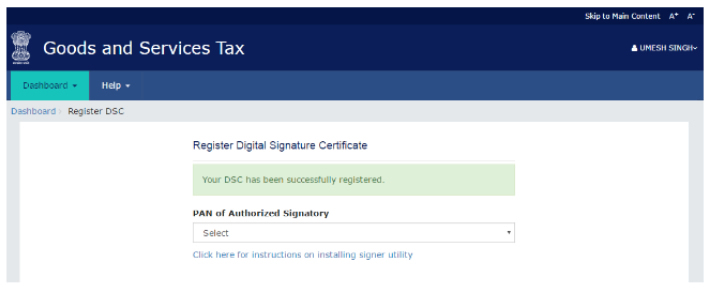

| A successful message that " Your DSC has been successfully registered" is displayed. |

| |

|

|

| 1-A. How can I login to the GST Common Portal with new Username and Password ? |

| |

To login to the GST Common Portal with your new username and password, you need to perform the following steps : |

| |

| 1. Access the www.gst.gov.in URL. The GST Home Page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed. In the Username field, type the username that you created. |

| |

| 4. In the Password field, type the password. |

| |

| 5. In the Type the characters you see in the image below field, type the captcha as shown on the screen. |

| |

| 6. Click the LOGIN button. |

| |

| Note : |

| In case you are lgging for the first time, click the here link to login. |

| |

|

| |

| 7. The Welcome page is displayed. Click the CONTINUE button. |

| |

|

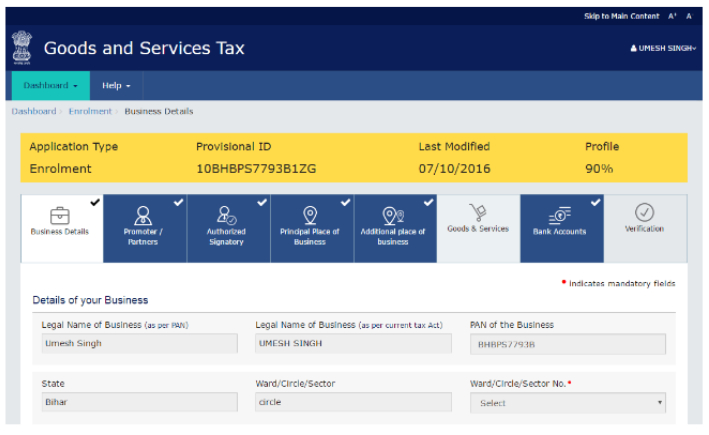

| The Dashboard is displayed. |

| |

|

| |

2. I have forgettin my UserName. How do I retrieve my Username ? |

| |

| To retrieve you username, you need to perform the following steps : |

| |

| 1. Access the www.gst.gov.in URL. The GST Home Page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

|

| 3. The Login page is displayed . Click the Forgot Username link, given below the LOGIN button. |

| |

|

| |

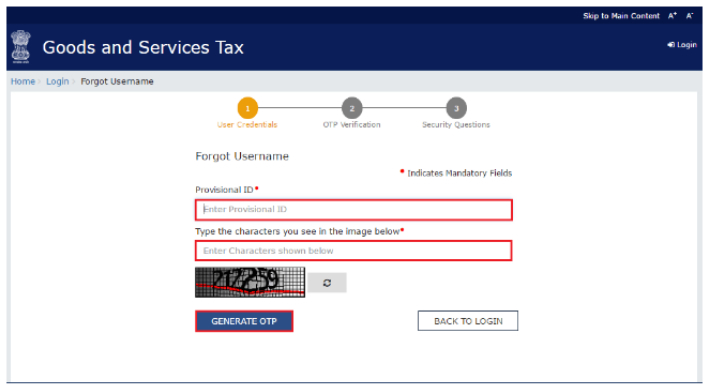

4. The Forgot Username page is displayed . In the Provisional ID field, type the Provisional ID that you received in the e-Mail, SMS or communication received from the State VAT Department. |

| |

5. In the Type the characters you see in the image below field, type the captcha text shown on the screen. |

| |

| 6. Click the GENERATE OTP button. The One Time Password (OTP) will be sent to your registered e-mail address and mobile number. |

| |

|

| |

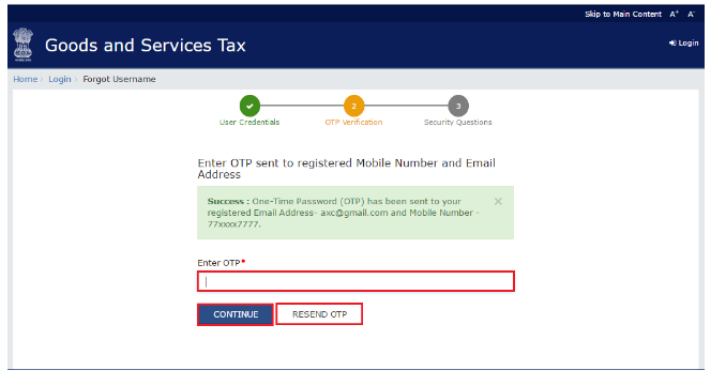

| 7. In the Enter OTP field , enter the OTP that was sent to your e-mail address and mobile number. |

| |

| 8. Click the CONTINUE button. |

| |

| Note : |

In case you OTP is expired and you want to receive the OTP agian on your e-mail address and mobile number, click the RESEND OTP link. |

| |

|

| |

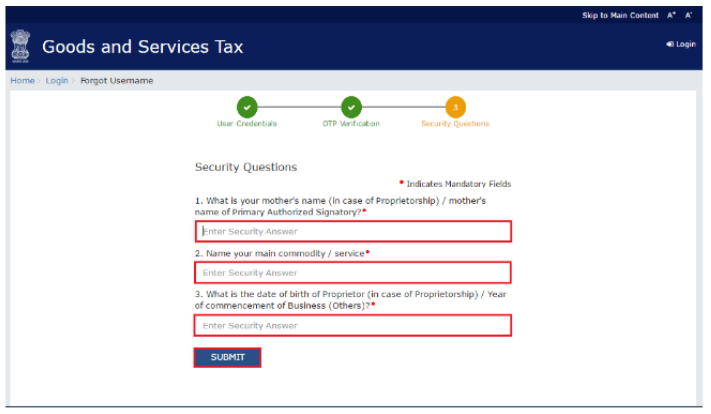

9. The Security Questions page is displayed . Enter the snswers to security questions that you had mentioned during first-time enrolling with GST. |

| |

| 10. Click the SUBMIT button. |

| |

|

| |

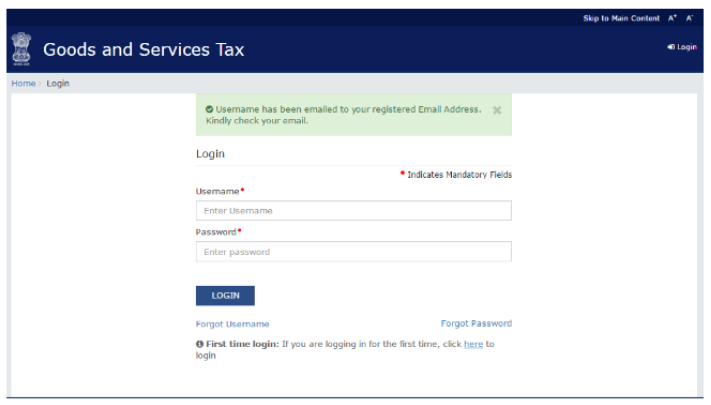

The message "Username had been emailed to your registered Email address. Kindly check your email " is displayed. Check your registered e-Mail to retrieve the username. |

| |

|

|

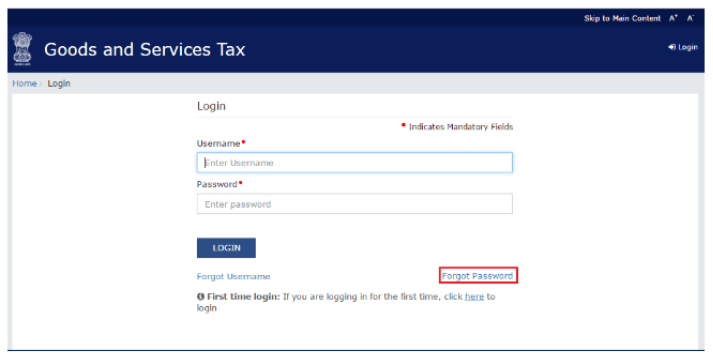

| 3. I have forgetten my Password. How do I retrieve my Password ? |

| |

| To retrieve your password, you need to perform the following steps: |

| |

| 1. Access the www.gst.gov.in URL. The GST Home page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed . Click the Forgot Password link, given below the LOGIN button. |

| |

|

| |

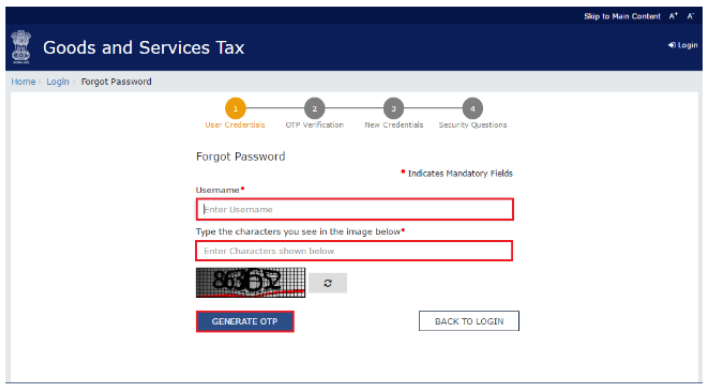

4. The Forgot Password page is displayed. In the Username field, type the username that you created while enrolling with GST. |

| |

5. In the Type the characters you see in the image below field, type the captcha text shown on the screen. |

| |

6. Click the GENERATE OTP button. The One Time Password (OTP) will be sent to your registered e-mail address and mobile number. |

| |

|

| |

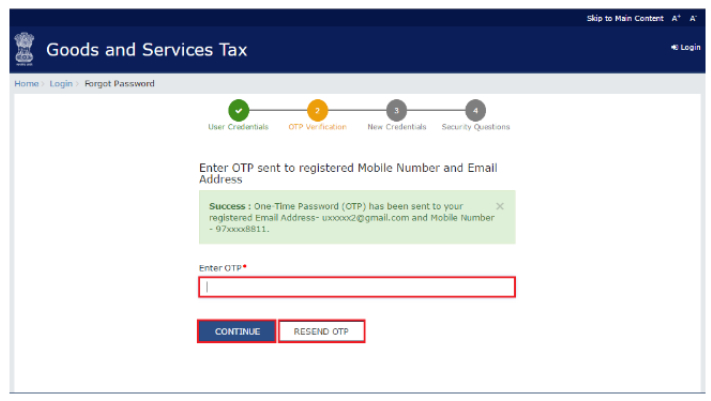

| 7. In the Enter OTP field, enter the OTP that was sent to your e-mail address and mobile number. |

| |

| 8. Click the CONTINUE button. |

| |

| Note : |

In case your OTP is expired and you want to receive the OTP again on your e-mail address and mobile phone number, click the RESEND OTP link. |

| |

|

| |

9. In the New Password field, enter a password of your choice that you will be using from next time onwards. |

| |

| 10. In the Re-confirm Password field, reenter the password. |

| |

| Note : |

Password should be of 8 to 1 5 characters which should comprise of at least one number, one special character, one upper case and one lower case letter. |

| |

| 11. Click the CONTINUE button. |

| |

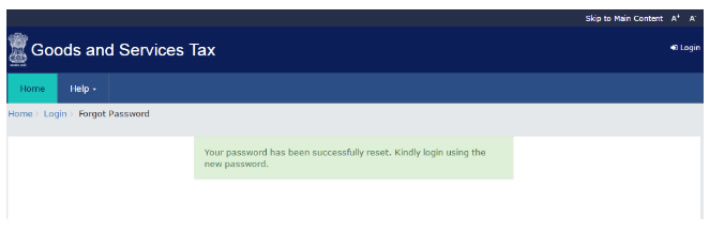

|

| |

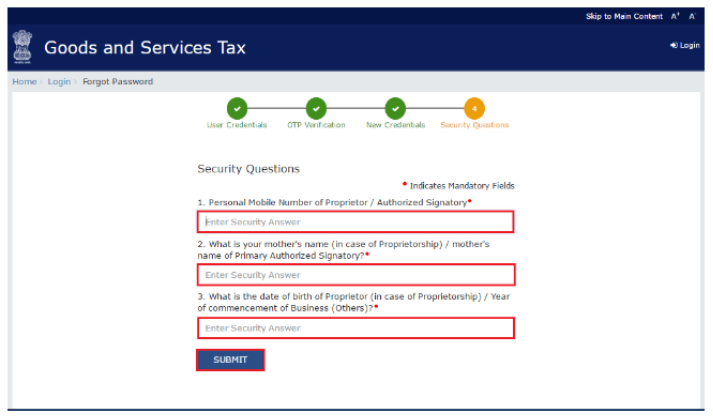

| 12. The Security Questions page is displayed. Enter the answers to security questions that you had mentioned during first-time enrolling with GST. |

| |

| 13. Click the SUBMIT button. |

| |

|

| |

The message Your password has been successfully reset. Kindly login using the new password.” is displayed. You can login to the GST Common Portal using the new password from next time. |

| |

|

|

| 4. How do I change my password ? |

| |

| To change your password, you need to perform the following steps: |

| |

| 1. Access the www.gst.gov.in URL. The GST Home page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed. In the Username field, type the

username that you created. |

| |

| 4. In the Password field, type the password. |

| |

5. In the Type the characters you see in the image below field, type

the captcha text as shown on the screen. |

| |

| 6. Click the LOGIN button. |

| |

|

| |

| 7. The Welcome page is displayed. Click the CONTINUE button. |

| |

|

| |

8. The Dashboard is displayed. Click the Change Password link, on the top right-hand corner of the page. |

| |

9. The Change Password page is displayed. In the Old Password field, enter the old password that you used to login. |

| |

10. In the New Password field, enter a password of your choice that you will be using from next time onwards. |

| |

| Note : |

Password should be of 8 to 1 5 characters (where the minimum length is 8 characters and maximum length is 1 5 characters) which should comprise of at least one number, special character and letters (at least one upper and one lower case). |

| |

| 11. In the Re-confirm Password field, reenter the password. |

| |

| 12. Click the CHANGE PASSWORD button. |

| |

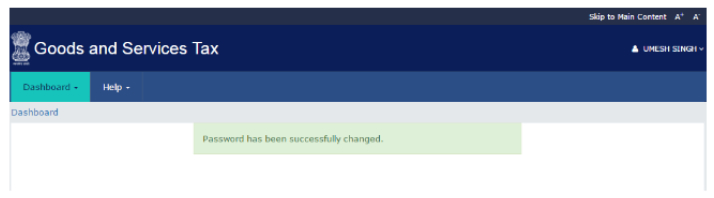

|

| |

The message “Password has been successfully changed” is displayed. You can login to the GST Common Portal using the new password from next time. |

| |

|

| |

5. I have procured a DSC. How can I register my DSC with the GST Common Portal ? |

| |

| To register your DSC with the GST Common Portal, you need to perform the following steps: |

| |

| 1. Access the www.gst.gov.in URL. The GST Home page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed. In the Username field, type the

username that you created. |

| |

| 4. In the Password field, type the password. |

| |

5. In the Type the characters you see in the image below field, type

the captcha text as shown on the screen. |

| |

| 6. Click the LOGIN button. |

| |

|

| |

| 7. The Welcome page is displayed. Click the CONTINUE button. |

| |

|

| |

| 8. The Dashboard is displayed. Click the Dashboard > Register / Update DSC command. |

| |

|

| |

10. The Register Digital Signature Certificate page is displayed. In the PAN of Authorized Signatory drop-down list, select the PAN of the authorized Signatory that you want to register. |

| |

| 11. Select the I have downloaded and installed the signer checkbox. |

| |

| 12. Click the PROCEED button. |

| |

|

| |

| 13. Select the certificate . Click the Sign button. |

| |

|

| |

| A successful message that “Your DSC has been successfully registereC is displayed. |

|

| 6. I have renewed my DSC. How do I update my new DSC ? |

| |

| To update your DSC with the GST Common Portal, perform the following steps: |

| |

| 1. Access the www.gst.gov.in URL. The GST Home page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed. In the Username field, type the username that you created. |

| |

| 4. In the Password field, type the password. |

| |

5. In the Type the characters you see in the image below field, type the captcha text as shown on the screen. |

| |

| 6. Click the LOGIN button. |

| |

|

| |

| 7. The Welcome page is displayed. Click the CONTINUE bttuon |

| |

|

| |

| 8. The Dashboard is displayed. Click the Dashboard > Register I Update DSC command. |

| |

|

| |

10. The Register Digital Signature Certificate page is displayed. In the PAN of Authorized Signatory drop-down list, select the PAN of the authorized Signatory that you want to update. |

| |

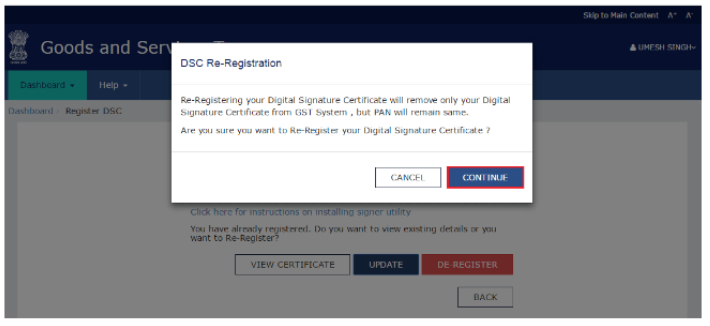

| 11. Click the UPDATE button. |

| |

|

| |

| 12. Click the CONTINUE button. |

| |

|

| |

| 13. Select the certificate . Click the Sign button. |

| |

|

| |

| A successful message that “DSC has been successfully updated” is displayed. |

|

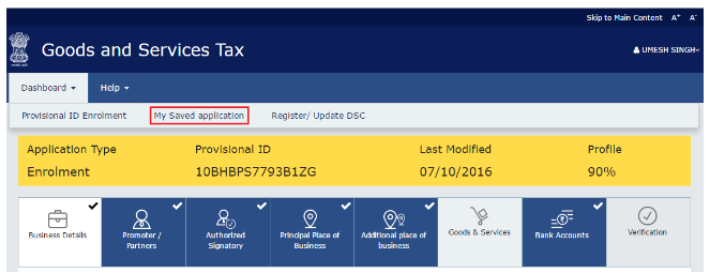

7. I am an existing taxpayer. I had saved my enrolment application but not completed it. How can I access my saved application ? |

| |

As an existing taxpayer, you can enroll with GST at the GST Common Portal.

You can complete your application intermediately and keep saving the application. You can view your saved application at the GST Common Portal after login. |

| |

| To view your saved application, you need to perform the following steps: |

| |

| 1. Access the www.gst.gov.in URL. The GST Home page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed. In the Username field, type the username that you created. |

| |

| 4. In the Password field, type the password. |

| |

5. In the Type the characters you see in the image below field, type the captcha text as shown on the screen. |

| |

| 6. Click the LOGIN button. |

| |

|

| |

| 7. The Welcome page is displayed. Click the CONTINUE button. |

| |

|

| |

| 8. The Dashboard is displayed. Click the Dashboard > My Saved application command. |

| |

|

| |

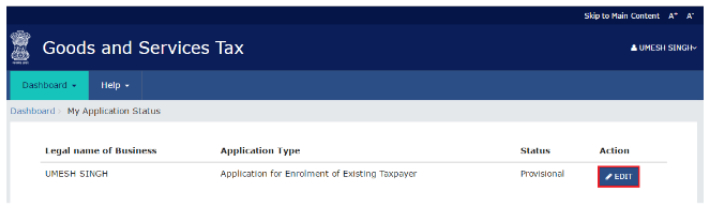

| 9. The My Application Status page is displayed. Here, application you have created are displayed. To application, click the Edit icon under the Action column. |

| |

|

| |

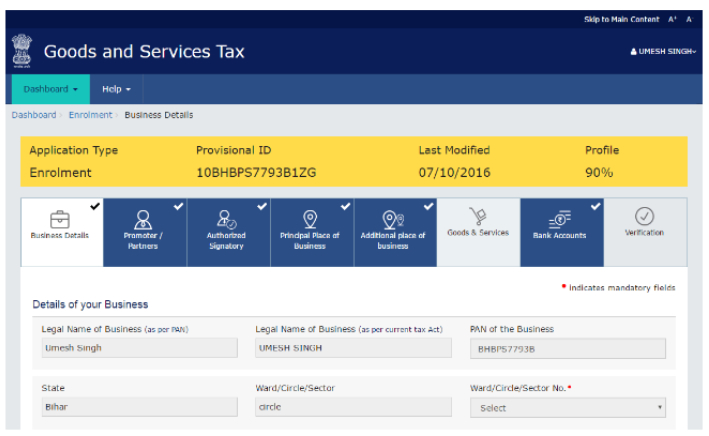

| 10. The application will open in edit mode. You can make changes to the application and submit it. |

| |

|

| |

8. I am an existing taxpayer. How can I track status of my application for enrolment with GST that I have submitted ? |

| |

As an existing taxpayer, you can enrol with GST at the GST Common Portal. On submission of the Enrolment Application, you will be given an Application Reference Number (ARN). You can track status of your application by tracking this ARN. |

| |

| To track application status of Enrolment Application, you need to perform the following steps: |

| |

| 1. Access the www.gst.gov.in URL The GST Home page is displayed. |

| |

| 2. Click the EXISTING USER LOGIN button. |

| |

|

| |

| 3. The Login page is displayed. In the Username field, type the username that you created. |

| |

| 4. In the Password field, type the password. |

| |

5. In the Type the characters you see in the image below field, type the captcha text as shown on the screen. |

| |

| 6. Click the LOGIN button. |

| |

|

| |

| 7. The Welcome page is displayed. Click the CONTINUE button. |

| |

|

| |

| 8. The Dashboard is displayed. Click the Dashboard > My Saved application command. |

| |

|

| |

| 9. The My Application Status page is displayed. Here, you can see the status of your Enrolment Application. |

| |

|

|