Which Capital Asset — Short-Term or Long-Term is eligible for Exemption under these Sections 54, 54B, 54D, 54EC, 54F, 54G, 54GA and 54H ? |

-

Section-54 : Long-Term

-

Section-54B : Long-Term / Short-Term

-

Section-54D : Long-Term / Short-Term

-

Section-54EC : Long-Term

-

Section-54F : Long-Term

-

Section-54G : Long-Term / Short-Term

-

Section-54GA : Long-Term / Short-Term

|

1. The Provisions of Section 54 towards Exemption of Capital Gains are given below –

-

Who can claim exemption :

An individual or a Hindu undivided family

-

Which specific asset is eligible for exemption :

If a residential house property (long-term) is transferred

-

Which asset the taxpayer should acquire to get the benefit of exemption :

Exemption is available if one residential house is purchased or con structed in India

-

What is time-limit for acquiring the new asset :

Purchase - Residential house can be purchased within 1 year before transfer or within 2 years after transfer

Construction - Residential house can be constructed within 3 years from transfer.

In the case of compulsory acquisition, these time-limits shall be determined from the date of receipt of compensation (original or additional)

-

How much is Exempt (Quantum of Deduction):

Amount of long-term capital gain; or Amount invested in the purchase or construction of the residential house

, whichever is less.

-

Is it possible to revoke the exemption in a subsequent year :

If the new asset is transferred within 3 years of its acquisition, exemp tion will be taken back. For calculating capital gain on transfer of new asset, cost of acquisition will be calculated (as original cost of acquisition – exemption availed under section 54).

|

2. The Provisions of Section 54B towards Exemption of Capital Gains arising from the transfer of Land used for Agricultural Purpose are given below –

-

Who can claim exemption :

An individual or a Hindu undivided family

-

Which specific asset is eligible for exemption :

Any short-term or long-term capital asset (being agricultural land), if it was used by the individual (or his parents) [or by the Hindu undivided family] for agricultural purpose for 2 years immediately prior to transfer.

-

Which asset the taxpayer should acquire to get the benefit of exemption :

Agricultural land (maybe in rural area or urban area).

-

What is time-limit for acquiring the new asset :

Within 2 years from the date of transfer.

-

How much is Exempt (Quantum of Deduction):

Investment in the New Asset or Capital Gain, whichever is lower.

In other words, capital gain will be exempt to the extent it is invested for acquiring the new agricultural land.

-

Is it possible to revoke the exemption in a subsequent year :

If the new asset is transferred within 3 years of its acquisition, exemption will be taken back. For calculating capital gain on transfer of new asset, cost of acquisition will be calculated as (original cost of acquisition – exemption availed under section 54B).

|

3. The Provisions of Section 54D towards Exemption of Capital Gains on Compulsory Acquisition Of Land And Buildings forming part of Industrial Undertaking are given below –

-

Who can claim exemption :

Any Taxpayer

-

Which specific asset is eligible for exemption :

Land or building (short-term or long-term) forming part of an industrial undertaking which is compulsorily acquired by the Government and which is used 2 years for industrial purposes prior to its acquisition

-

Which asset the taxpayer should acquire to get the benefit of exemption :

Land or Building for industrial purposes.

-

What is time-limit for acquiring the new asset :

Within 3 years from the date of receipt of compensation.

-

How much is Exempt (Quantum of Deduction):

Investment in the New Asset or Capital Gain, Whichever is Lower.

In other words, capital gain shall be exempt to the extent it is invested in the purchase/construction of new land/building for the industrial undertaking.

The new asset should not be transferred within 3 years from the date of acquisition of the new asset.

-

Is it possible to Revoke the Exemption in a Subsequent Year :

If the new asset is transferred within 3 years of its acquisition, exemption will be taken back.

For calculating capital gain on transfer of new asset, cost of acquisition will be calculated as (original Cost of Acquisition – Exemption availed under Section 54D).

|

4. The Provisions of Section 54EC towards Exemption of Capital Gains on Transfer of any Long Term Capital Asset on the basis of Investment in certain Bonds are given below –

-

Who can claim exemption :

Any Taxpayer

-

Which specific asset is eligible for exemption :

Long-term capital asset (being land or building or both) (may be residential or commercial, may be situated in India or outside India).

-

Which asset the taxpayer should acquire to get the benefit of exemption :

Bonds of National Highways Authority of India (NHAI) or Rural Electrification Corporation (REC) or notified bonds. Maximum investment in one financial year is Rs. 50 lakh, Moreover, investment made by an assessee in the NHAI/REC bonds/notified bonds, out of capital gains arising from transfer of one or more original asset, during the financial year in which the original asset or assets are transferred and in the subsequent financial year should not exceed Rs. 50 lakh.

-

What is time-limit for acquiring the new asset :

Within 6 months from the date of transfer.

-

How much is Exempt (Quantum of Deduction):

Investment in the new asset or capital gain, whichever is lower.

In other words, capital gain shall be exempt to the extent it is invested in the long-term specified assets within a period of 6 months from the date of such transfer.

The new asset should not be transferred within 3 years, if investment is made before April 1,2018.

-

Is it possible to Revoke the Exemption in a Subsequent Year :

In the following cases, exemption will be taken back (and the amount of exemption given earlier will become long-term capital gain of the year in which the assessee commits the following default) –

7. Investment in Bonds limited to Rs. 50 Lakh :

The investment made in the long-term specified asset by an assessee out of capital gains arising from transfer of one or more original asset during any financial year in which the original asset or assets are transferred and in the subsequent financial year cannot exceed Rs. 50 lakh.

8. Consequences if the long-term specified asset is transferred or converted into money within 3 years:

Where the long term specified asset is transferred or converted (otherwise than by transfer) into money at any time within a period of 3 years from the date of its acquisition, the amount of capital gain exempt u/s 54EC earlier, shall be deemed to be long-term capital gain of the previous year, in which the long term specified asset is transferred or converted (otherwise than the transfer) into money.

-

If the assessee takes any loan or advance on the security of such long-term specified asset, he shall be deemed to have converted (otherwise than by transfer) such long-term specified asset into money on the date on which such loan or advance is taken.

-

The Board has decided that the period of six months for making investment in specified assets for the purpose of section 54EC should be taken from the date such stock in trade is sold or otherwise transferred and not from the date when it is converted in to stock in trade.

-

"Long-term specified asset" means the bonds redeemable after 3 years issued on or after 1.4.2007 by the National Highways Authority of India (NHAI) and the Rural Electrification Corporation Ltd. (RECL) or any other bond notified by the Central Government in this behalf The Power Finance Corporation Limited has since been notified by the Central Government.

|

Example :

Mr. Dust acquired shares of G Ltd., on 15.12.2008 for Rs. 8,00,000 which were sold on 15.5.2017 for Rs. 19,50,000. Expenses of transfer were Rs. 20,000. He invests Rs. 3,00,000 in the bonds of Rural Electrification Corporation Ltd. on 16.10.2017.

-

Compute the capital gain for the assessment year 2018-19.

-

State the period for which the bonds should be held by the assessee. What will be the consequences if such bonds are sold within the specified period?

-

What will be the consequences if R takes a loan against the security of such bonds ?

Solutions :

-

-

Mr. Dust should not transfer or convert (otherwise then transfer) into money such bonds within 3 years from the date of their acquisition. If these bonds are transferred or converted into money within 3 years, capital gain of Rs. 3,00,000 exempt under section 54EC earlier, will be long-term capital gain of the previous year in which such asset is transferred or converted into money.

-

If any loan is taken against the security of such bonds, it will be treated as if it is converted into money as such capital gain exempt earlier on such bonds, shall be long-term capital gain of the previous year in which such loan is taken against the security of such bonds.

|

|

|

5. The Provisions of Section 54F towards Exemption of Capital Gains on Transfer Of Long-Term Capital Assets other than a House Property are given below –

-

Who can claim exemption :

An individual or a Hindu Undivided Family (HUF)

-

Which specific asset is eligible for exemption :

Capital gain arising on transfer of any long-term capital asset (other than a residential house property) is qualified for exemption provided on the date of transfer the taxpayer does not own more than one residential house property (except the new house property given below)

-

Which asset the taxpayer should acquire to get the benefit of exemption :

One Residential House Property in India.

-

What is time-limit for acquiring the new asset :

Purchase - Residential house can be purchased within 1 year before transfer or within 2 years after transfer

Construction - Residential house can be constructed within 3 years from transfer.

In the case of compulsory acquisition, these time-limits shall be determined from the date of receipt of compensation (original or additional)

-

How much is Exempt (Quantum of Deduction):

1. If the net sale consideration of the original asset is equal to or less than the cost of the new house, the entire capital gain shall be exempt.

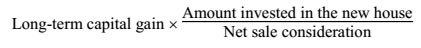

2. If the net sale consideration of the original asset is greater than the cost of the new house then the exemption shall be allowed in the same proportion in which the cost of the new house bears to the net sale considerations i.e. it shall be allowed proportionately as under:

-

Is it possible to Revoke the Exemption :

In the following cases, exemption will be taken back (and the amount of exemption given exemption earlier will become long-term capital gain of the year in which the assessee commits the following default) –

-

If the new asset is transferred within 3 years from the date of its acquisition

-

If within 2 years from the date of transfer of the original assets, the taxpayer purchases another residential house property in India or outside India

-

If within 3 years from the date of transfer of original assets, the taxpayer completes construction of another residential house property in India or outside India.

IMPORTANT NOTES :

-

Exemption is available under section 54F in respect of capital gains arising on transfer of any asset other than a residential house. Capital gain on sale of plots are also eligible for exemption.

-

As per the circular of CBDT, the cost of the land is an integral part of the cost of the residential house, whether purchased or constructed.

-

The construction of the new house may start before the date of transfer, but it should be completed after the date of transfer of the original asset.

-

Net consideration means the full value of the consideration as a result of the transfer of the capital asset minus any expenditure incurred wholly or exclusively in connection with such transfer.

|

|

6. The Provisions of Section 54G towards Exemption of Capital Gains on Shifting of Industrial Undertaking from Urban Areas to Non-Urban Areas are given below –

The exemption is available to all categories of assessees in respect of capital gain arising on the transfer of fixed assets other than furniture and fixtures of industrial undertaking effected to shift it from an urban area.

The conditions for claiming exemptions are as under:

-

the transfer is effected in the course of or in consequence of shifting the undertaking from an urban area to any other area. Any other area means an area not declared as an urban area.

'Urban area' means any such area within the limits of a municipal corporation or municipality, as the Central Government may, having regard to the population, concentration of industries, need for proper planning of the area and other relevant factors, by general or special order, declare to be an urban area for the purposes of this sub-section;

-

asset transferred is machinery, plant, building, land or any right in building or land used for the business of industrial undertaking in an urban area;

-

the capital gain arising on the asset transferred may be short-term or long-term capital gain. Normally, it will be short-term capital gain because most of the assets of the industrial undertaking will be depreciable assets;

-

the capital gain is utilised within one year before or 3 years after the date of transfer for the specified purpose.

Specified purpose includes the following:

-

for purchase of new machinery or plant for the purpose of business of the Industrial Undertaking in the area to which the said undertaking is shifted;

-

acquisition of building or land or construction of building for tax payer's business in that other area;

-

expenses on shifting of the old undertaking and its establishment to the other area; or

-

incurring of expenditure on such other purposes as specified by the Central Government for this purpose.

|

How much is Exempt (Quantum of Deduction):

-

If the capital gain, on transfer of the original asset, is equal to or less than the cost and expenses incurred for the above specified purposes, the entire capital gain shall be exempt.

-

If the capital gain on transfer of the original asset is greater than the cost and expenses incurred for the specified purposes then the exemption shall be allowed to the extent of the cost and expenses incurred.

In other words, capital gain shall be exempt to the extent it is spent for the specified purpose. |

7. The Provisions of Section 54GA towards Exemption of Capital Gain are given below –

-

Who can claim exemption :

Any Taxpayer.

-

Which specific asset is eligible for exemption :

On transfer of short-term/long-term capital assets being land, building, plant or machinery. These assets should be transferred in order to shift an industrial undertaking from an urban area to any special economic zone. The Special Economic Zone may be developed in any urban area or any other area.

-

Any other area means an area not declared as an urban area.

-

'Urban area' means any such area within the limits of a municipal corporation or municipality, as the Central Government may, having regard to the population, concentration of industries, need for proper planning of the area and other relevant factors, by general or special order, declare to be an urban area for the purposes of this sub-section;

-

"Special Economic Zone" means each Special Economic Zone notified under the proviso to subsection (4) of section 3 and sub-section (1) of section 4 of the Special Economic Zones Act, 2005 (including Free Trade and Warehousing Zone) and includes an existing Special Economic Zone. [Section 2(za) of the Special Economic Zones Act, 2005].

|

-

Which asset the taxpayer should acquire to get the benefit of exemption :

Land, building, plant or machinery in order to shift undertaking to any special economic zone.

-

What is time-limit for acquiring the new asset :

New asset should be purchased within 1 year before transfer or within 3 years after transfer of the original asset.

-

How much is Exempt (Quantum of Deduction):

Investment in the New Asset or Capital Gain,

whichever is lower.

-

Is it possible to revoke the exemption in a subsequent year :

If the new asset is transferred within 3 years of its acquisition, exemp tion will be taken back. For calculating capital gain on transfer of new asset, cost of acquisition will be calculated (as original cost of acquisition – exemption availed under section 54GA)

|

|

|