Apportionment of Input Tax Credit (ITC) under GST [Section 17(1), (2) & (3) of CGST Act, 2017] |

1. Apportionment of Input Tax Credit (ITC) Where Goods or Services are used Partly for Business Purposes and Partly for Other Purposes [Section 17(1) of CGST Act, 2017]

Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

Example :

Mr. Dust owning a bakery provides the following information for the month of November, 2017:

| Total ITC in respect of milk products received |

Rs. 80,000 |

| Milk products sold in the course of business |

70% |

| Milk products used in the birthday party of his daughter |

30% |

In the above-case, Mr. Dust shall be entitled to take ITC of Rs. 56,000 (Rs. 80,000 × 70%) in terms of provisions of section 17(1)

|

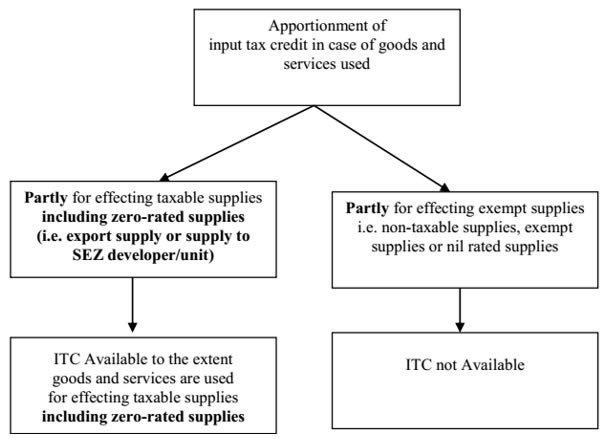

2. Apportionment of Input Tax Credit (ITC) Where Goods and Services are used Partly for effecting Taxable Supply including Zero Rates Supply and Partly for Exempted Supplies [Section 17(2)]

Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

The value of exempt supply under section 17(2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building. [Section 17(3)]

Example :

Mr. Dust, a registered person provides the following information for the month of November 2018:

|

Particulars |

Amount |

(A) |

Eligible Input Tax Credit in respect of services |

Rs. 1,50,000 |

(B) |

Taxable Supplies [excluding Zero-rated Supplies] |

Rs. 8,00,000 |

(C) |

Exports [Zero-Rated Supplies] |

Rs. 4,00,000 |

(D) |

Exempt Supplies |

Rs. 3,00,000 |

(E) |

Supplies on which recipient is liable to pay tax on reverse charge basis |

Rs. 1,00,000 |

(F) |

Total supplies [B+C+D+E] |

Rs. 16,00,000 |

(G) |

Percentage of Taxable Supplies including Zero Rated Supplies to the Total Supplies |

75% [12,00,000/16,00,000×100] |

|

In the above-case, Mr. Dust shall be entitled to take Input Tax Credit of Rs. 1,12,500 [75% of Rs. 1,50,000] |

|

3. Apportionment of Input Tax Credit (ITC) under Optional method for Bank, etc. for taking Input Tax Credit [Section 17(4)]

A banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to either —

— comply with the provisions of section 17(2) (see above), or

— avail of, every month, an amount equal to 50% of the eligible input tax credit on inputs, capital goods and input services in that month and the rest shall lapse.

The option once exercised shall not be withdrawn during the remaining part of the financial year.

Further, the restriction of 50% shall not apply to the tax paid on supplies made by one registered person to another registered person having the same Permanent Account Number.

Example :

State Bank of India provides the following information for the month of November 2017 for their Registration in Punjab:

| Particulars |

Amount (Rs.) |

ITC from suppliers of goods or services or both |

1,00,000 |

ITC from other offices |

20,000 |

Eligible credit for the month of November — 50% of Rs. 1,00,000 i.e. Rs. 50,000 + Rs. 20,000 (ITC from other offices for which restriction of 50% is not applicable) = Rs. 70,000 |

4. Apportionment of Input Tax Credit (ITC) in case of Blocked Credits i.e. Goods or Services or Both on which Input Tax Credit shall Not be Available [Section 17(5)]

Input credit shall not be available in respect of the following:

(1) Motor vehicles and other conveyances except when they are used—

(i) for making the following taxable supplies, namely :—

- further supply of such vehicles or conveyances; or

- transportation of passengers; or

- imparting training on driving, flying, navigating such vehicles or conveyances;

(ii) for transportation of goods.

|

(2) The following supply of goods or services or both:

- food and beverages,

- outdoor catering,

- beauty treatment.

- health services,

- cosmetic and plastic surgery

However, where an inward supply of above goods or services or both of a particular category is used by a registered person

— for making an outward taxable supply of the same category of goods or services or both or

— as an element of a taxable composite or mixed supply input tax credit shall be available.

Example :

R is engaged in providing Beauty Treatment Services. On a particular day, with a view to cater to the demand of large number of customers, he availed the Beauty Treatment Services from G. Accordingly, G raised an invoice on R for stipulated consideration along with applicable GST.

Since in the given case, Beauty Treatment Services have been used by R for making an outward supply of services of the same category of services, he shall be eligible to avail ITC of the Beauty Treatment Services.

Example :

Indigo Airlines is engaged in supply of transport of passengers by air services. With a view to provide its passengers the facility of food and beverages, it avails outdoor catering services from Hotel Taj, New Delhi. Hotel Taj raises a tax invoice on Indigo Airlines for supply of outdoor catering services for stipulated consideration along with applicable GST.

In this case. Indigo Airlines shall be entitled to avail credit of GST charged by Hotel Taj because outdoor catering services are being as an clement of taxable composite supply of transport of passengers by air services. |

|

(3) Membership of a club, health and fitness centre |

(4) Rent-a-cab, life insurance and health insurance except where—

(A) the Government notifies the services which arc obligatory for an employer to provide to its employees under any law for the time being in force; or

(B) such inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as part of a taxable composite or mixed supply. |

(5) Travel benefits extended to employees on vacation such as leave or home travel concession |

(6) Works contract services ss hen supplied for construction of an immovable property (other than plant and machinery) except where it is an Input service for further supply of works contract service. |

(7) Goods or services or both received by a taxable person for Construction of an Immovable Property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

| The expression ‘construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property. |

|

(8) Goods or services or both on which tax has been paid under the Composition Scheme |

(9) Goods or services or both received by a non-resident taxable person except on goods imported by him |

(10) Goods or Services or both used for personal consumption |

(11) Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples |

(12) No credit for any tax paid in accordance with the provisions of sections 74, 129 and 130. These sections prescribe the provisions relating to tax paid as a result of evasion of taxes, or upon detention of goods or conveyances in transit, or towards redemption of confiscated goods/conveyances. |

|

| |

|

| |

|

|