Valuation of Rent Free Unfurnished & Furnished Accomodation [Rule 3(1)]

|

1. Rent-Free Un-Furnished Accommodation

For the purpose of valuation of the perquisite in respect of unfurnished accommodation, employees are divided in the following two categories:

CASE-1 : Central and State Government Employees

CASE-2 : Private Sector Employees or Other Employees. |

|

CASE-1 : Central and State Government Employees

Basis of Valuation of Perquisites-

The value of perquisite in respect of accommodation provided to such employee is equal to the licence fee which would have been determined by the Central or State Government in accordance with the rules framed by the Government for allotment of houses to its officers.

Exception (Exempt from Tax)-

-

Rent-Free official residence provided to a Judge of a High Court or to a Judge of the Supreme Court is exempt from tax.

-

Rent-Free official residence provided to an official of Parliament, a Union Minister, a Leader of Opposition in Parliament and serving Chairman/members of UPSC is exempt from tax

Category of Employees -

-

includes Central Government employees and State Government employees.

-

includes those Central Government employees and State Government employees who are on deputation to a public sector undertaking but the accommodation is provided by the Central Government or State Government.

CASE-2 : Private Sector Employees or Other Employees.

In this category, value of the perquisite in respect of rent-free accommodation depends on salary of the employee and lease rent of the accommodation.

Basis of Valuation of Perquisites-

Population of city as per 2001 census where accommodation is provided |

Where the accommodation is owned by the employer |

Where the accommodation is taken on lease or rent by the employer |

| If Populations > 25 Lakh |

15% of Salary in respect of the period during which the accommodation is occupied by the employee |

a. 15% of Salary ; or

b. Lease Rent ( paid or payable) by Employer,

whichever is Less |

| If Populations > 10 lakh but <= 25 lakh |

10% of Salary in respect of the period during which the accommodation is occupied by the employee |

| Any other |

7.5 % of Salary in respect of the period during which the accommodation is occupied by the employee |

Salary - How to Calculate :

- Salary Includes ...

- basic salary;

- dearness allowance/pay, if terms of employment so provide;

- bonus;

- commission;

- fees;

- all other taxable allowances (excluding amount not taxable); and

- any monetary payment which is chargeable to tax (by whatever name called).

- Salary Does Not Includes ...

- dearness allowance/pay, if not taken into account while calculating retirement benefits, like provident fund, gratuity, etc., or if term of employment does not so provide;

- employer’s contribution to provident fund account of an employee;

- all allowances which are exempt from tax;

- value of perquisites [under section 17(2)]; and

- lump-sum payments received at the time of termination of service or superannuation or voluntary retirement, like gratuity, severance pay leave encashment, voluntary retrenchment benefits, commutation of pension and similar payments.

Important Points :

-

“Salary” shall be determined on “accrual” basis - In other words, salary accrued for the period during which rent-free accommodation is occupied by the employee will be considered, whether it is received during the previous year or not.

-

Salary from two or more employers - Salary from all employers in respect of the period during which an accommodation is provided will be taken into consideration.

-

Monetary payments v. Perquisites - Consider the following monetary payments —

-

- Payments of gas, electricity, water and income-tax bills [being perquisites under section 17(2)(iii)/(iv)] are not taken into consideration.

-

- Overtime payment (it is not a perquisite) is taken into consideration.

|

|

2. Rent-Free Furnished Accommodation

The perquisite in respect of rent-free furnished accommodation may be provided in the following two different ways —

1. A Furnished Accommodation (not being in a Hotel, Motel, Service Apartment or Guest House) -

Value of the perquisite shall be calculated as follows —

-

Step 1 - Find out value of the perquisite on the assumption that the accommodation is unfurnished

-

Step 2 - To the value so arrived at, add value of furniture.

Value of furniture for this purpose is as follows—

-

10% per annum of the original cost of furniture, if furniture is owned by the employer;

-

actual hire charges payable (whether paid or payable), if furniture is hired by the employer.

Meaning of furniture - “Furniture” here includes radio sets, television sets, refrigerators, air-conditioners and other household appliances.

2. A Furnished Accommodation in a Hotel, Motel, Service Apartment or Guest House -

The value of the perquisite is determined on the basis of lower of the following two —

-

24% of “salary” paid or payable for the period during which such accommodation is provided in the previous year.

-

Actual charges paid or payable by the employer to such hotel.

Exception -

If an accommodation is provided in a hotel, motel, service apartment or guest house in the case of relocation of an employee from one place to another place, nothing is chargeable to tax for 15 days (in aggregate during the financial year). |

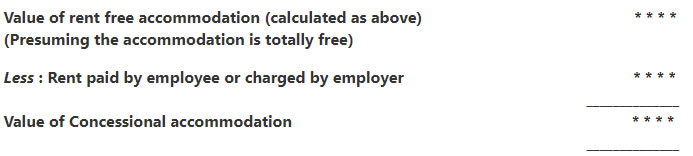

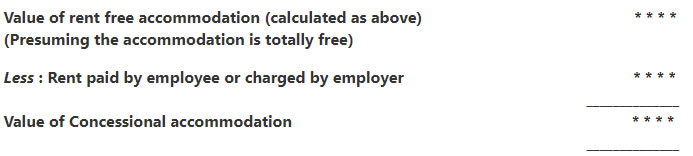

3. Valuation of Accommodation provided at Concessional Rent

If an accommodation is provided to an employee at concessional rent, the valuation should be made as follows (these rules are applicable whether the accommodation is furnished or unfurnished or it is provided in a hotel) —

Step-1 : Find out the value of the perquisite on the assumption that no rent is charged by the employer

Step-2 : From the value so arrived at, deduct the rent charged by the employer from the employee.

The balance amount (if it is positive) is the taxable value of the perquisite in respect of concession in rent.

|

|