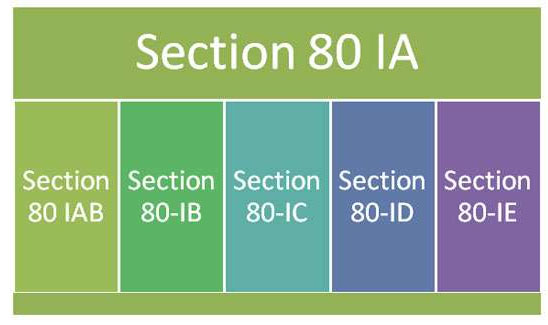

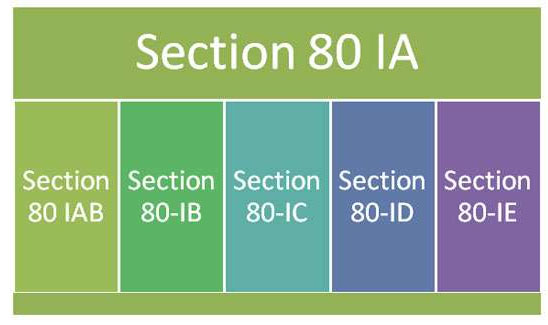

Deduction in respect of Profit and Gains from Industrial Undertaking or Enterprises engaged in infrastructure Development [Section 80-IA] |

-

Essential Conditions for Enterprises Carrying on the Business of Infrastructure Facility [Section 80-IA(4)(i)]

-

Essential Conditions of undertaking which is engaged in Generation, Transmission, Distribution of Power, etc. [Section 80-IA(4)(iv)]

-

An undertaking which is enganged in 'Telecommunication Services'.

-

An undertaking which is enganged in 'Industrial Park or Sepcial Economic Zone'

-

An undertaking which is enganged in 'Reconstruction of Power Unit'

-

Conditions applicable to all Undertakings / Enterprises mentioned above.

|

|

The deduction under this Section 80IA is available to an assessee whose Gross Total Income includes any profits and gains derived by:

-

Any enterprise carrying on the business of (i) developing, (ii) operating and maintaining, or (iii) developing, operating, maintaining and any infrastructure facility; [Section 80-IA(4)(i)]

-

An undertaking which is engaged in generation, transmission, distribution of power, etc. [Section 80-IA(4)(iv)]

-

An undertaking which is enganged in 'Telecommunication Services'.

-

An undertaking which is enganged in 'Industrial Park or Sepcial Economic Zone'

-

An undertaking which is enganged in 'Reconstruction of Power Unit'

-

Conditions applicable to all Undertakings / Enterprises mentioned above.

(A) Essential Conditions for Enterprises Carrying on the Business of Infrastructure Facility [Section 80-IA(4)(i)]

- The enterprise should carry on the business of—

- developing,

- operating and maintaining, or

- developing, operating and maintaining, any infrastructure facility.

- the enterprise is owned by an Indian company or a consortium of such companies or by an authority or a Board or a Corporation or any other body established or constituted under any Central or State Act.

- the enterprise has entered into an agreement with Central/State Government or a local authority or any other statutory body for

- developing,

- operating and maintaining or

- developing, operating and maintaining, a new infrastructural facility.

- the enterprise has started or starts operating and maintaining the infrastructural facilities on or after 1.4.1995.

Meaning of infrastructural facility :

For the purposes of this clause, "infrastructure facility" means:

- a road including toll road, a bridge or a rail system;

- a highway project including housing or other activities being an integral part of the highway project;

- a water supply project, water treatment system, irrigation project, sanitation and sewerage system or solid waste management system;

- a port, airport, inland waterway or inland port or navigational channel in the sea.

Amount and Period of Deduction under Section [Section 80-IA(4)(i)] -

100% of profits and gains derived from such business for 10 consecutive assessment years out of 15 years beginning with the year in which undertaking or the enterprise develops and begins to operate any infrastructure facility or generates power or commences transmission or distribution of power or undertakes substantial renovation or modernisation.

However, in case of enterprises engaged in developing, etc of any infrastructure facility other than port, airport, inland waterway or inland port or navigational channel in the sea, the period of 15 years shall be substituted by 20 years.

The deduction commences from the 'Initial Assessment Year'.

What is 'Initial Assessment Year' for the purpose of Section 80IA -

Initial assessment year, for this purpose, means the assessment year specified by the assessee at his option to be the initial year. But it should not fall beyond the 15th. of assessment year starting from the previous year in which the enterprise begins operating and maintaining the infrastructure facility.

However, the benefit of deduction is available only for 10 consecutive assessment years falling within a period of 15th. Assessment Years beginning with the assessment year in which an assessee begins operating and maintaining infrastructure facility.

Provisions of section 80-IA shall not apply to any enterprise which starts the development or operation and maintenance of the infrastructure facility on or after 1.4.2017 as such enterprise shall be eligible for 100% deduction of capital expenditure under section 35AD. [Second proviso to section 80-IA(4) inserted by the Finance Act, 2016] |

|

| |

(B) Essential Conditions of undertaking which is engaged in Generation, Transmission, Distribution of Power, etc. [Section 80-IA(4)(iv)]

The following Conditions should be satisfied by the undertaking :

It is an undertaking which:—

-

is set up in any part of India for the generation or generation and distribution of power if it begins to generate power at any time during the period beginning on 1.4.1993 and ending on 31.3.2017;

-

starts transmission or distribution by laying a network of new transmission or distribution lines at any time during the period beginning on 1.4.1999 and ending on 31.3.2017.

However, the deduction in this case shall be allowed only in relation to the profits derived from laying of such network of new lines for transmission or distribution;

-

undertakes substantial renovation and modernisation of the existing transmission or distribution lines at any time during the period 1.4.2004 to 31.3.2017. "Substantial renovation and modernisation" shall mean an increase of plant and machinery by atleast 50% of the book value of such plant and machinery as on 1.4.2004.

Other Conditions for Undertaking referred to in clause (B) above [Section 80-IA(3)]

-

Such undertaking should not be formed by splitting up, or the reconstruction, of a business already in existence. However, this condition shall not apply to an undertaking which is formed as a result of the re-establishment or revival of an undertaking, in circumstances specified u/s 33B.

-

It should not be formed by the transfer to a new business of machinery or plant previously used for any purpose.

However, plant and machinery, already used for any purpose, can be transferred to the new industrial undertaking, provided value of such plant and machinery does not exceed 20% of the total value of plant and machinery of the new industrial undertaking. It may be noted that it is not essential that the building in which the undertaking carries on the business should also be new. Deduction u/s 80-IA will be available even if the industrial undertaking is set up in an old building.

Amount and Period of Deduction under Section [Section 80-IA(4)(iv)] -

100% of profits and gains derived from such business for 10 consecutive assessment years out of 15 years beginning with the year in which undertaking or the enterprise develops and begins to operate any infrastructure facility or generates power or commences transmission or distribution of power or undertakes substantial renovation or modernisation.

However, in case of enterprises engaged in developing, etc of any infrastructure facility other than port, airport, inland waterway or inland port or navigational channel in the sea, the period of 15 years shall be substituted by 20 years.

The deduction commences from the 'Initial Assessment Year'.

What is 'Initial Assessment Year' for the purpose of Section 80IA -

Initial assessment year, for this purpose, means the assessment year specified by the assessee at his option to be the initial year. But it should not fall beyond the fifteenth* of assessment year starting from the previous year in which the enterprise begins operating and maintaining the infrastructure facility.

However, the benefit of deduction is available only for 10 consecutive assessment years falling within a period of 15th. Assessment Years beginning with the assessment year in which an assessee begins operating and maintaining infrastructure facility. |

(C) An undertaking which is enganged in 'Telecommunication Services'.

The provisions are given below –

Conditions - The following conditions should be satisfied by the undertaking—

-

It should be a new undertaking.

-

It should not be formed by transfer of old plant and machinery.

-

The undertaking should be engaged in providing telecommunication services. It should start providing telecommunication services (whether basic or cellular including radio paging, domestic satellite service or network of broadband network and internet services and electronic data interchange service) at any time after March 31, 1995 but before March 31, 2005. “Domestic satellite” for this purpose means a satellite owned and operated by an Indian company for providing telecommunication service.

Amount and Period of Deduction -

100% of profits and gains derived from such business for 10 consecutive assessment years out of 15 years beginning with the year in which undertaking or the enterprise develops and begins to operate any infrastructure facility or generates power or commences transmission or distribution of power or undertakes substantial renovation or modernisation.

However, in case of enterprises engaged in developing, etc of any infrastructure facility other than port, airport, inland waterway or inland port or navigational channel in the sea, the period of 15 years shall be substituted by 20 years.

The deduction commences from the 'Initial Assessment Year'.

What is 'Initial Assessment Year' for the purpose of Section 80IA -

Initial assessment year, for this purpose, means the assessment year specified by the assessee at his option to be the initial year. But it should not fall beyond the fifteenth* of assessment year starting from the previous year in which the enterprise begins operating and maintaining the infrastructure facility.

However, the benefit of deduction is available only for 10 consecutive assessment years falling within a period of 15th. Assessment Years beginning with the assessment year in which an assessee begins operating and maintaining infrastructure facility. |

(D) An undertaking which is enganged in 'Industrial Park or Sepcial Economic Zone'

The provisions are given below—

Conditions - The following conditions should be satisfied by the undertaking —

-

It develops, develops and operates or maintains and operates an industrial park or a special economic zone.

-

The industrial park must start operating during April 1, 2007 and March 31, 2011 or the special economic zone must start operating during April 1, 1997 and March 31, 2005.

Amount and Period of Deduction -

100% of profits and gains derived from such business for 10 consecutive assessment years out of 15 years beginning with the year in which undertaking or the enterprise develops and begins to operate any infrastructure facility or generates power or commences transmission or distribution of power or undertakes substantial renovation or modernisation.

However, in case of enterprises engaged in developing, etc of any infrastructure facility other than port, airport, inland waterway or inland port or navigational channel in the sea, the period of 15 years shall be substituted by 20 years.

The deduction commences from the 'Initial Assessment Year'.

What is 'Initial Assessment Year' for the purpose of Section 80IA -

Initial assessment year, for this purpose, means the assessment year specified by the assessee at his option to be the initial year. But it should not fall beyond the fifteenth* of assessment year starting from the previous year in which the enterprise begins operating and maintaining the infrastructure facility.

However, the benefit of deduction is available only for 10 consecutive assessment years falling within a period of 15th. Assessment Years beginning with the assessment year in which an assessee begins operating and maintaining infrastructure facility. |

(E) An undertaking which is enganged in 'Reconstruction of Power Unit'

- The provisions are given below—

Conditions - The following conditions should be satisfied by the undertaking —

-

It should be owned by an Indian company and set up for reconstruction or revival of a power generating plant.

-

It should be formed before November 30, 2005 with majority equity participation by public sector companies for the purposes of enforcing the security interest of the lenders to the company owning the power generating plant and such Indian company is notified before December 31, 2005 by the Central Government.

-

Such undertaking begins to generate or transmit or distribute power before March 31, 2011.

Amount and Period of Deduction -

100% of profits and gains derived from such business for 10 consecutive assessment years out of 15 years beginning with the year in which undertaking or the enterprise develops and begins to operate any infrastructure facility or generates power or commences transmission or distribution of power or undertakes substantial renovation or modernisation.

However, in case of enterprises engaged in developing, etc of any infrastructure facility other than port, airport, inland waterway or inland port or navigational channel in the sea, the period of 15 years shall be substituted by 20 years.

The deduction commences from the 'Initial Assessment Year'.

What is 'Initial Assessment Year' for the purpose of Section 80IA -

Initial assessment year, for this purpose, means the assessment year specified by the assessee at his option to be the initial year. But it should not fall beyond the fifteenth* of assessment year starting from the previous year in which the enterprise begins operating and maintaining the infrastructure facility.

However, the benefit of deduction is available only for 10 consecutive assessment years falling within a period of 15th. Assessment Years beginning with the assessment year in which an assessee begins operating and maintaining infrastructure facility. |

|

(F) Conditions applicable to all Undertakings / Enterprises mentioned above.

-

Audit of accounts [Section 80-IA(7)]:

The deduction under section 80-IA from profits and gains derived from an undertaking shall not be admissible unless the accounts of the undertaking for the previous year relevant to the assessment year for which the deduction is claimed have been audited by a chartered accountant and the assessee furnishes, alongwith his return of income, the report of such audit in Form No. 10CCB duly signed and verified by such accountant.

-

Inter-unit transfer of goods or services [Section 80-IA(8)]:

Where any goods or services held for the purposes of the eligible business are transferred to any other business carried on by the assessee, or where any goods or services held for the purposes of any other business carried on by the assessee are transferred to the eligible business and, in either case, the consideration, if any, for such transfer as recorded in the accounts of the eligible business does not correspond to the market value of such goods or services as on the date of the transfer, then, for the purposes of the deduction under this section, the profits and gains of such eligible business shall be computed as if the transfer, in either case, had been made at the market value of such goods or services as on that date:

However, where in the opinion of the Assessing Officer, the computation of the profits and gains of the eligible business in the manner hereinbefore specified presents exceptional difficulties, the Assessing Officer may compute such profits and gains on such reasonable basis as he may deem fit. "Market value" in relation to any goods or service, means the price that such goods or service, would ordinarily fetch on sale in the open market.

-

Double deduction not allowed [Section 80-IA(9)]:

Where any amount of profits and gains of an undertaking or of an enterprise in the case of an assessee is claimed and allowed under this section for any assessment year, deduction to the extent of such profits and gains shall not be allowed under the heading "deductions in respect of certain incomes", and shall in no case exceed the profits and gains of such eligible business of undertaking or enterprise, as the case may be.

-

Restriction of excessive profits [Section 80-IA(10)]:

Where it appears to the Assessing Officer that, owing to the (i) close connection between the assessee carrying on the eligible business to which this section applies and any other person, or (ii) for any other reason, the course of business between them is so arranged that the business transacted between them produces to the assessee more than the ordinary profits which might be expected to arise in such eligible business, the Assessing Officer shall, in computing the profits and gains of such eligible business for the purposes of the deduction under this section, take the amount of profits as maybe reasonably deemed to have been derived therefrom.

-

Power of Central Government to declare that the section shall not apply [Section 80-IA(11)]:

The Central Govt. may, after making such inquiry as it may think fit, direct, by notification in the Official Gazette, that the exemption conferred by this section not apply to any class of industrial undertaking or enterprise with effect from such date as it may specify in the notification.

-

Deduction not to be allowed in cases where return is not filed within the specified time limit [Section 80AC]:

No deduction shall be allowed to the assessee under this section unless he furnishes a return of his income of the relevant assessment year on or before the due date specified u/s 139(1).

|

|

|

|

| |

|