Income from 'House Property' ( Section 22 to 27 )

(Graphical Table Presentation) |

|

Section 22 : "Charges" under the head ' Income from House Property' |

|

Section - 27 : Deemed Owner ( under Income from House Property) |

|

Section - 23 : Annual Value ( Under House Property Income) |

|

Section - 24a : Standard Deduction ( Under House Property Income) |

|

Section - 24b : Interest on Borrowed Capital ( Under House Property Income) |

|

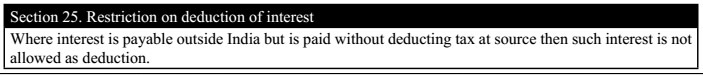

Section - 25 : Restriction on Deduction of Interest ( Under House Property Income) |

|

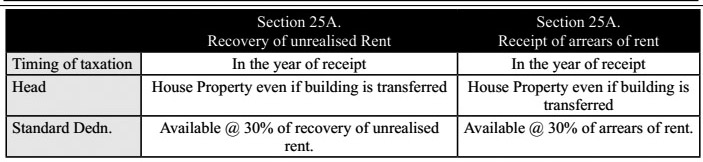

Section - 25A : Recovery of Unrealised Rent Vs. Receipt of Arrear of Rent |

|

Section - 26 : Co-Owner (Under House Property Income) |

|

| |

|

|