Profits and Gains of Business or Profession ( Section 28 to 44D)

(Graphical Table Presentation) |

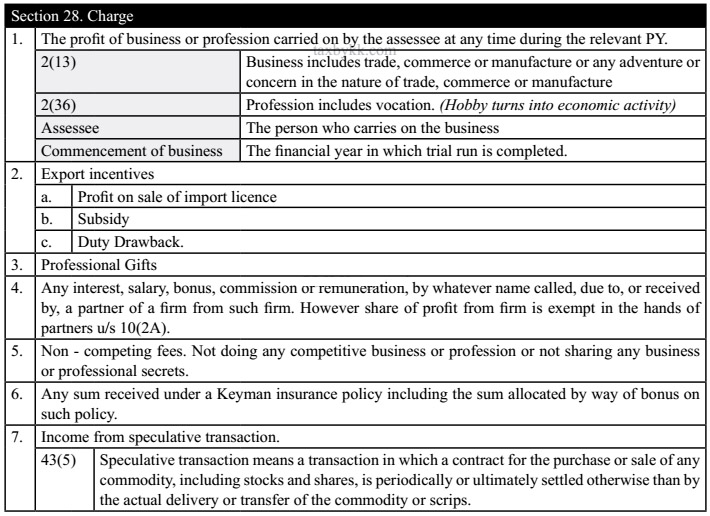

Section 28 : 'Charges' under the head ' Profits and Gains of Business or Profession' |

|

|

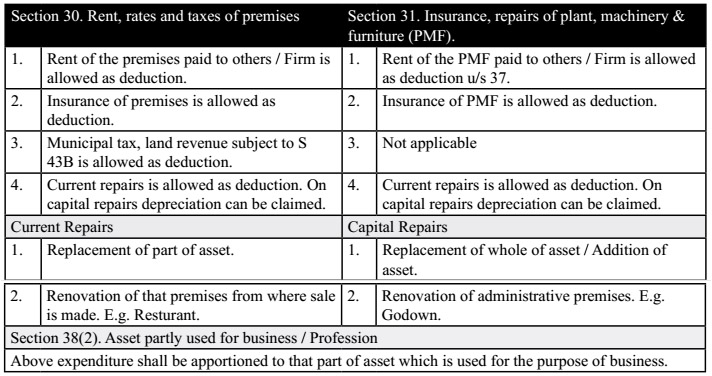

Section - 30 : Rent, Rates, and Taxes of Premises Vs. Section - 31 : Insurance, Repairs of Plant, Machinery & Furniture (PMF) |

|

| |

Section - 36(1) : Amount Expressly Allowed as Deduction |

- Amount Expressly Allowed as Deduction.jpg) |

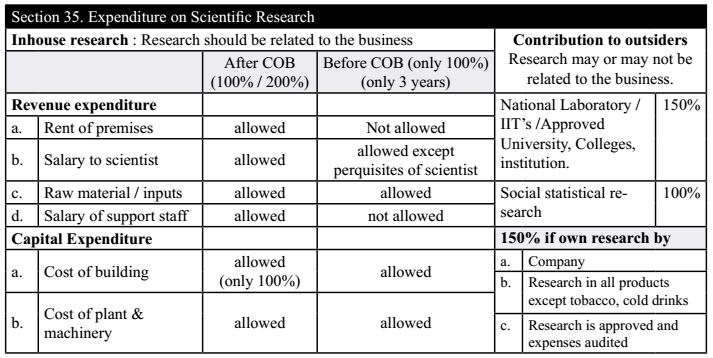

Section - 35 : Expenditure on Scientific Research |

|

Section - 35D : Amortisation of Preliminary Expenses |

|

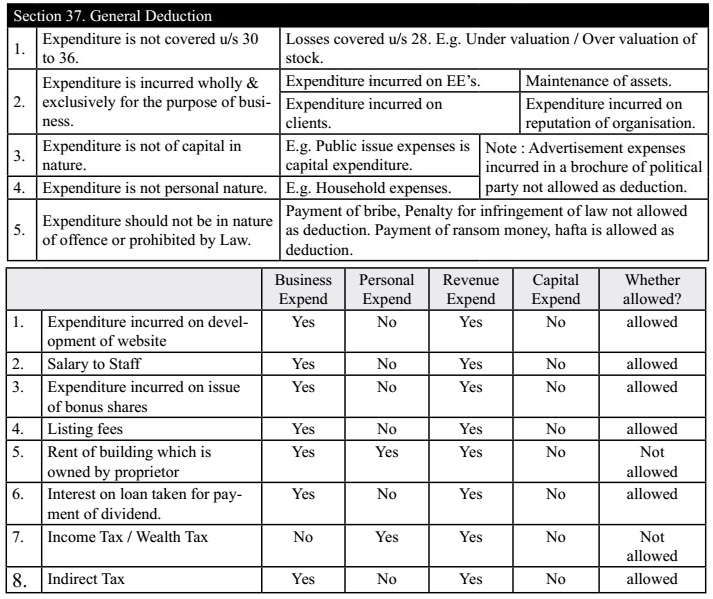

Section - 37 : General Deduction |

|

Section 40A(2) : Unreasonable payment to Relatives/ Substantial interest |

Unreasonable payment to Relatives-Substantial interest.jpg) |

Section 40A(3) : Cash Expenditure |

Cash Expenditure.jpg) |

Section 43B : Certain Expenses Deduction Allowed on actual payment basis |

|

| Section - 44AD, 44ADA & 44AE. : Presumptive Basis of Taxation |

|

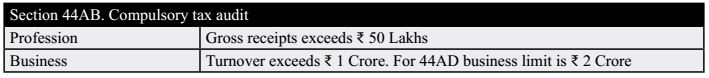

| Section 44AB : Compulsory Tax Audit |

|

| |

|

|