Gross Total Income(GTI) [Section-80B(5)] : Definition under I.Tax |

As per section 14, all income shall, for purposes of Income-tax and computation of total income, be classified under the following heads of income:

-

-

-

-

-

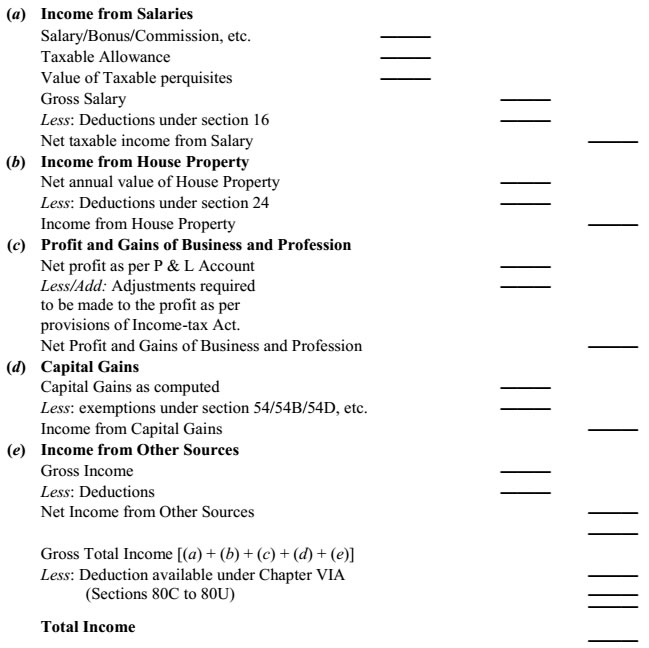

Aggregate of incomes computed under the above 5 heads, after applying clubbing provisions and making adjustments of set off and carry forward of losses, is known as Gross Total Income (GTI). [Section 80B(5)]

G. T. I. = Salary Income + House Property Income + Business or Profession Income + Capital Gains + Other Sources Income + Clubbing of Income - Set-off of Losses |

Total Income:

The total income of an assessee is computed by deducting from the gross total income, all deductions permissible under Chapter VIA of the Income-tax Act i.e., deductions under sections 80C to 80U.

How to Compute Total Income

The steps in which the Total Income, for any assessment year, is determined are as follows:

- Determine the residential status of the assessee to find out which income is to be included in the computation of his Total Income.

-

Classify the income under each of the following five heads. Compute the income under each head after allowing the deductions prescribed for each head of income.

|

![Gross Total Income(GTI) [Section-80B(5)] Gross Total Income(GTI) [Section-80B(5)]](income.jpg)

Rounding off of Total Income [Section 288A]:

The total income, as computed above, shall be rounded off to the nearest multiple of ten rupees and for this purpose any part of a rupee consisting of paise shall be ignored. Thereafter if such amount is not a multiple of ten, then, if the last figure is 5 or more, the amount shall be increased to the next higher multiple of 10 and if the last figure of Total Income is less than 5, the amount shall be reduced to the next lower multiple of 10. For example, if the total income is Rs. 8,79,467, it shall be rounded off to Rs.8,79,470 and if it is Rs.8,79,464.90, it shall be rounded off to Rs.8,79,460. |

How to compute tax liability on Total Income:

On the Total Income, tax is calculated according to the normal rates prescribed under the relevant Finance Act and special rates prescribed in the Income Tax Act.

The amount so computed, shall be increased by a surcharge, if applicable and education cess calculated @ 2% + SHEC @ 1% of (tax + surcharge if any). The amount so arrived at is the tax liability of the person for that year. W.e.f. A.Y. 2010-11, the surcharge was applicable only in case of a company assessee. However, w.e.f. A.Y. 2014-15 surcharge has been made applicable to all assessees provided the total income of the assessee exceeds the specified amount. |

Rounding off of tax, etc. [Section 288B]:

The amount of tax (including tax deductible at source or payable in advance), interest, penalty, fine or any other sum payable, and the amount of refund due, under the provisions of the Income-tax Act, shall be rounded off to the nearest multiple of ten rupees and, for this purpose, where such amount contains a part of ten rupees then, if such part is five rupees or more, it shall be increased to ten rupees and if such part is less than five rupees it shall be ignored. |

|