INCOME under Income Tax Act. 1956 |

(A) Definition of Income [Section 2(24)]:

(B) Gross Total Income:

(C) Total Income:

(D) Rounding off of Total Income [Section 288A]:

(E) How to Compute Tax Liability on Total Income:

(F) Rounding Off of Tax, etc. [Section 288B]:

(G) Heads of Income [Section-14 ] |

To understand Total Income one must know the following:

(A) Definition of Income [Section 2(24)]:

Income includes:

-

profits and gains;

-

dividend;

-

voluntary contributions received by a trust created wholly or partly for charitable or religious purposes or by an institution established wholly or partly for such purposes, or by an association or institution referred to in clause (21) or clause (23), or by a fund or trust or institution referred to in sub-clause (iv) or sub-clause (v) or by any university or other educational institution referred to in sub-clause (iiiad) or sub-clause (vi) or by any hospital or other institution referred to in sub-clause (iiiae) or sub-clause (via) of clause (23C), of section 10 or by an electoral trust.

-

the value of any perquisite or profit in lieu of salary taxable under clauses (2) and (3) of section 17;

-

any special allowance or benefit, other than perquisite included under sub-clause (iii), specifically granted to the assessee to meet expenses wholly, necessarily and exclusively for the performance of the duties of an office or employment of profit;

-

any allowance granted to the assessee to meet his personal expenses at the place where the duties of his office or employment of profit are ordinarily performed by him or at a place where he ordinarily resides or to compensate him for the increased cost of living;

-

the value of any benefit or perquisite, whether convertible into money or not, obtained from a company either by a director or by a person who has a substantial interest in the company, or by a relative of the director or such person, and any sum paid by any such company in respect of any obligation which, but for such payment, would have been payable by the director or other person aforesaid;

-

the value of any benefit or perquisite, whether convertible into money or not, obtained by any representative assessee mentioned in clause (iii) or clause (iv) of sub-section (1) of section 160 or by any person on whose behalf or for whose benefit any income is receivable by the representative assessee (such person being hereafter in this sub-clause referred to as the “beneficiary”) and any sum paid by the representative assessee in respect of any obligation which, but for such payment, would have been payable by the beneficiary;

-

any sum chargeable to income-tax under clauses (ii) and (iii) of section 28 or section 41 or section 59;

-

any sum chargeable to income-tax under clause (iiia) of section 28;

-

any sum chargeable to income-tax under clause (iiib) of section 28;

-

any sum chargeable to income-tax under clause (iiic) of section 28;

-

the value of any benefit or perquisite taxable under clause (iv) of section 28;

-

any sum chargeable to income-tax under clause (v) of section 28;

-

any capital gains chargeable under section 45;

-

the profits and gains of any business of insurance carried on by a mutual insurance company or by a co-operative society, computed in accordance with section 44 or any surplus taken to be such profits and gains by virtue of provisions contained in the First Schedule;

(viia) the profits and gains of any business of banking (including providing credit facilities) carried on by a co-operative society with its members;

-

* * * * *

-

any winnings from lotteries, crossword puzzles, races including horse races, card games and other games of any sort or from gambling or betting of any form or nature whatsoever;

-

any sum received by the assessee from his employees as contributions to any provident fund or superannuation fund or any fund set up under the provisions of the Employees State Insurance Act, 1948 or any other fund for the welfare of such employees;

-

any sum received under a Keyman insurance policy including the sum allocated by way of bonus on such policy

-

any sum referred to in clause (va) of section 28;

-

any sum referred to in clause (v) of sub-section (2) of section 56;

-

any sum referred to in clause (vi) of sub-section (2) of section 56;

-

any sum of money or value of property referred to in clause (vii) or clause (viia) of subsection (2) of section 56;

-

any consideration received for issue of shares as exceeds the fair market value of the shares referred to in clause (viib) of sub-section (2) of section 56;

-

any sum of money referred to in clause (ix) of sub-section (2) of section 56;

-

any sum of money or value of property referred to in clause (x) of sub-section (2) of section 56;

-

assistance in the form of a subsidy or grant or cash incentive or duty drawback or waiver or concession or reimbursement (by whatever name called) by the Central Government or a State Government or any authority or body or agency in cash or kind to the assessee other than,—

-

the subsidy or grant or reimbursement which is taken into account for determination of the actual cost of the asset in accordance with the provisions of Explanation 10 to clause (1) of section 43; or

-

the subsidy or grant by the Central Government for the purpose of the corpus of a trust or institution established by the Central Government or a State Government, as the case may be.

|

(B) Gross Total Income:

As per section 14, all income shall, for purposes of Income-tax and computation of total income, be classified under the following heads of income:

-

Salaries,

-

Income from House Property,

-

Profits and Gains of Business or Profession,

-

Capital Gains,

-

Income from Other Sources.

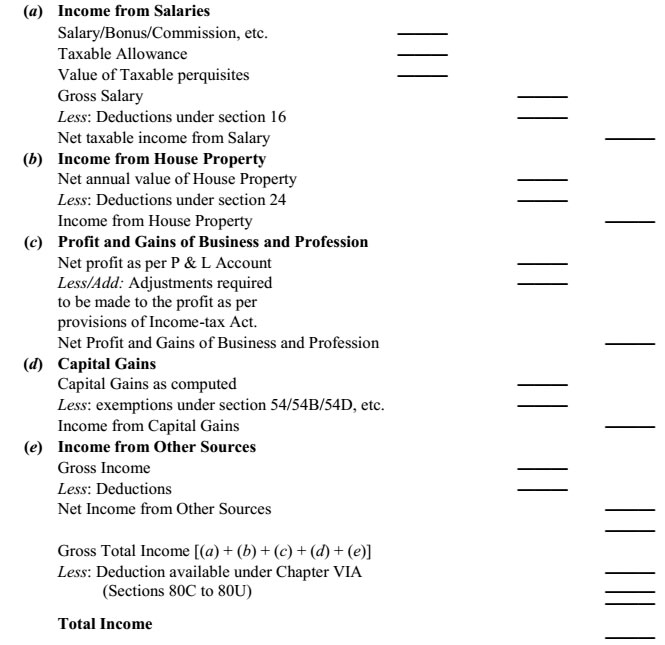

Aggregate of incomes computed under the above 5 heads, after applying clubbing provisions and making adjustments of set off and carry forward of losses, is known as Gross Total Income (GTI). [Section 80B(5)] |

(C) Total Income:

The total income of an assessee is computed by deducting from the gross total income, all deductions permissible under Chapter VIA of the Income-tax Act i.e., deductions under sections 80C to 80U.

How to Compute Total Income :

The steps in which the Total Income, for any assessment year, is determined are as follows:

-

Determine the residential status of the assessee to find out which income is to be included in the computation of his Total Income.

-

Classify the income under each of the following five heads. Compute the income under each head after allowing the deductions prescribed for each head of income.

|

(D) Rounding off of Total Income [Section 288A]:

The total income, as computed above, shall be rounded off to the nearest multiple of ten rupees and for this purpose any part of a rupee consisting of paise shall be ignored. Thereafter if such amount is not a multiple of ten, then, if the last figure is 5 or more, the amount shall be increased to the next higher multiple of 10 and if the last figure of Total Income is less than 5, the amount shall be reduced to the next lower multiple of 10. For example, if the total income is Rs. 8,79,467, it shall be rounded off to Rs. 8,79,470 and if it is Rs. 8,79,464.90, it shall be rounded off to Rs. 8,79,460.

(E) How to Compute Tax Liability on Total Income:

On the Total Income, tax is calculated according to the normal rates prescribed under the relevant Finance Act and special rates prescribed in the Income Tax Act.

The amount so computed, shall be increased by a surcharge, if applicable and education cess calculated @ 2% + SHEC @ 1% of (tax + surcharge if any). The amount so arrived at is the tax liability of the person for that year. W.e.f. A.Y. 2010-11, the surcharge was applicable only in case of a company assessee. However, w.e.f. A.Y. 2014-15 surcharge has been made applicable to all assessees provided the total income of the assessee exceeds the specified amount.

(F) Rounding Off of Tax, etc. [Section 288B]:

The amount of tax (including tax deductible at source or payable in advance), interest, penalty, fine or any other sum payable, and the amount of refund due, under the provisions of the Income-tax Act, shall be rounded off to the nearest multiple of ten rupees and, for this purpose, where such amount contains a part of ten rupees then, if such part is five rupees or more, it shall be increased to ten rupees and if such part is less than five rupees it shall be ignored.

(G) Heads of Income [Section-14 ]

Section-14 of Income-tax Act 1961 provides for the computation of total income of an assessee which is divided under five heads of income. Each head of income has its own method of computation. These five heads are

- Income from ‘Salaries’;

- Income from House Property’;

- Income from ‘Profits and Gains of Business or Profession’;

- Income from ‘Capital Gains’; and

- Income from ‘Other Sources’.

Income from all these heads shall be computed separately according to the provisions given in the Act. Income computed under these heads shall be aggregated after adjusting past and present losses and the total so arrived at is known as ‘Gross Total Income’.

Out of Gross Total Income, Income-tax Act 1961 allows certain deductions under section 80. After allowing these deductions the figure which we arrive at is called ‘Total Income’ and on this figure tax liability is computed at the prescribed rates.

These five heads of income are water tight compartments. Income from one source of Income, which is to be included in a particular head, cannot be included in any other head. Each head of income has its own deductions. After computing income from various sources of income within a particular head its own deductions are allowed and thus we arrive at income from that head. (See Chart on page 2/2). |

| |

|