Interest income is one of the common sources of income for individuals and businesses alike. When it comes to the taxability of interest on securities, Section 56(2)(id) of the Indian Income Tax Act, 1961 plays a significant role. This section deals with the taxation of interest income earned from certain specified securities. In this article, we will explore the provisions of Section 56(2)(id) and understand the tax implications of interest income on securities.

Income, by way of interest on securities, is chargeable under the head “income from other sources”, if such income is not chargeable to income-tax under the head, “Profits and Gains of Business or Profession”.

Understanding Section 56(2)(id)

Section 56(2)(id) of the Indian Income Tax Act, 1961 is applicable to individuals and Hindu Undivided Families (HUFs) who earn interest income from specified securities. Specified securities include any interest-bearing securities issued by the Central Government, State Government, or any local authority. It also includes any debentures or bonds issued by a company in which the public are substantially interested.

According to this section, any interest income earned from the specified securities is taxable under the head 'Income from Other Sources'. This means that it is subject to tax at the individual's applicable income tax slab rate. The interest income is added to the individual's total income and taxed accordingly.

According to section 2(28B) “Interest on securities” means:

(i) interest on any security of the Central Government or a State Government;

(ii) interest on debentures or other securities for money issued by, or on behalf of a local authority or a company or a corporation established by Central, State or Provincial Act.

Thus securities may be divided into following categories:

(i) securities issued by Central/State Governments;

(ii) debentures/bonds issued by a local authority;

(iii) debenture/bonds issued by companies;

(iv) debenture/bonds issued by a corporation established by a Central, State or Provincial Act, i.e., autonomous and statutory corporations.

Interest on securities may be taxed on receipt basis or on due basis, depending upon the system of accounting if any, adopted by the assessee. If the assessee follows the cash system of accounting, interest is taxable on receipt basis otherwise it shall be taxable on due basis. If no system of accounting is followed, it will always he taxable on ‘due’ basis.

In case of certain securities issued by Central Government or State Government or in case of certain notified bonds or debentures issued by public sector companies, the interest is fully exempt under section 10(15). The interest in this case is normally 6% p.a. or less except in the case of capital indexed bonds which carries the interest rates of 7%. Such interest which is around 6% p.a. (7% in case of capital indexed bonds) is fully exempt under section 10(15). |

Interest on securities accrues or becomes due on a specified date and not on a day-to-day basis. The date on which the interest shall become due is specified by the issuing authority. Interest may become due on quarterly basis, half yearly basis or annual basis, depending upon the term of the issue.

For example, if a company issues 12% debentures and specifies that interest shall become due on 31St of December every year, the due date is 31st. of December and the interest for the entire year shall become due only on 31st of December every year. The person, who is the registered owner of the debentures as on 31st December, shall be entitled to receive the interest of the full year irrespective of his period of holding.

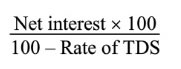

Tax is also to be deducted at source on interest on securities at the prescribed rates of tax. For Income-tax purposes what is to be charged to tax is the gross amount of interest. Therefore, if net- interest is given, it has to be grossed up to arrive at the taxable amount.

in the case of Government securities other than 8% / 7.75% / floating rate Saving (Taxable) Bonds, grossing up is not required as there is no deduction of tax at source. However, grossing up is required in the case of the following securities:—

(i) 8% / 7.75% / floating rate Saving (Taxable) Bonds if the amount of interest payable exceeds Rs. 10,000 ;

(ii) securities issued by a statutory corporation or a local authority or by any company. Net Interest can be grossed up as under:

The rates of T.D.S. are as under:

(a) In case of 8% / 7.75% / floating rate taxable saving bonds 10%

(b) Non-government securities whether or not listed or recognized stock exchange 10%.

1. Interest on saving account with Post Office in case of an individual is exempt upto Rs.3,500 under section 10(15)(i). Hence, such interest will be included in the gross total income of the individual to the extent it exceeds Rs.3,500and thereafter deduction shall be allowed under section 80TTA.

2. No tax is deductible on debentures issued by a widely held company if interest is paid/payable to an individual, resident in India and the aggregate amount of such interest paid or payable during the financial year does not exceed Rs. 2,500. |

As discussed in the case of dividends, the following deductions will also be allowed from the gross interest on securities:

Any reasonable sum paid by way of commission or remuneration to a banker, or any other person for the purpose of realising the interest.

Interest on money borrowed for investment in securities can be claimed as a deduction.

Any other expenditure, not being an expenditure of a capital nature, expended wholly and exclusively for the purpose of making or earning such income can be claimed as a deduction.

Tax Deduction at Source (TDS)

When it comes to interest income on securities, Tax Deduction at Source (TDS) plays a crucial role. As per the provisions of Section 194A of the Income Tax Act, any person who is liable to pay interest on securities is required to deduct TDS at the time of payment. The current rate of TDS on interest income is 10%.

It is important to note that TDS is applicable only if the interest income exceeds Rs. 10,000 in a financial year. If the interest income is below this threshold, no TDS will be deducted. However, the individual is still required to report and pay tax on the interest income while filing their income tax return.

Tax Planning Strategies

When it comes to tax planning, there are a few strategies that individuals can employ to minimize the tax liability on interest income from securities:

(i) Investing in Tax-Free Bonds:

Tax-Free Bonds are issued by government entities and provide tax-free interest income. By investing in these bonds, individuals can earn interest income without any tax liability.

(ii) Spreading Investments:

Instead of investing a large sum in a single security, individuals can consider spreading their investments across different securities. This can help in reducing the overall tax liability as the interest income from each security can be managed within the tax-free threshold.

(iii) Claiming Deductions:

Individuals can explore various deductions available under the Income Tax Act to reduce their overall taxable income. Deductions such as Section 80C (for investments in specified instruments) and Section 80D (for health insurance premiums) can help in lowering the tax liability. |