|

A SIP or systematic investment plan is where you ask the mutual fund to deduct a certain amount from your bank on day selected by you each month. You will be allotted units in your folio as per the NAV on the purchase date. In a lump sum investment, you buy units on any given day. Just to make it much simpler think of it as, a lump sum is occasionally buying of units while a SIP is periodic buying of units. As units are bought at different rates the investors benefit from Rupee-Cost Averaging, which means you get more units when market is low and less units when market is high and hence market averaging happens.

STP i.e. Systematic Transfer Plan gives you a facility by which you can transfer a fixed or variable amount or units of funds from one scheme to other at regular intervals (weekly, monthly or quarterly). Provided the schemes belong to the same Fund house. STP is majorly used to transfer money from debt funds scheme to Equity schemes. As during volatile markets, you may not feel confident to invest a lumpsum amount in Equities. So, in that case good strategy is to invest the lumpsum in Debt and start an STP to Equity, which spreads your investment in selected time frame. This is a good risk mitigation strategy.

SWP i.e. Systematic Withdrawal Plan is a facility to withdraw fixed amount at regular periodic intervals. As per the investor’s requirement, it could be monthly, quarterly, semi-annually or annually. In SIP, money is invested from savings account in mutual funds while in SWP it is redeemed from mutual funds and goes to savings account. It is the opposite of SIP. SWP allows you to redeem mutual fund investments in a phased manner. This helps in dealing with the market volatility.

MIPs i.e. Monthly Income Plans invest in a mix of equity and debt instruments. These are meant to provide a steady source of income for investors. MIPS are ideal for retirees and risk averse investors

When you transfer funds out of an equity or debt fund it will be treated as a sale and taxed accordingly.

1. Transfer of money from debt into equity fund-

before three years will be principal + short-term capital gains (STCG) and in that STCG will be taxed as per your slab rate.

Alternatively, any sale after three years will have principal + long-term capital gains (LTCG) and LTCG part will attract tax at 20% after indexation.

2. On the other hand, if you transfer out of an equity fund then taxation of STCG & LTCG part will be taxed according to Equity taxation.

SWPs are normally done on debt funds or hybrid funds as they are more predictable compared to equity funds. In case of debt funds, it is LTCG only if held for more than three years. In case of SWP, each withdrawal will be treated as a mix of principal and capital gains withdrawal and only the capital gains portion will be taxed. That makes an SWP a lot more tax efficient.

Example —

Suppose, you invested 6 Lakhs in Nippon India Short Term Fund on 1st Apr, 2015 and started SWP of Rs. 10,000/month from it immediately from 1 0th Apr, 2015. So, this is how your taxation (Assuming you are in 30% tax bracket) will be —

Financial Year |

Total Withdrawal (Rs.) |

Principal (Rs.) |

Capital Gain (Rs.) |

Taxation |

2015-16 |

1,20,000 |

1,11,000 |

9,000 |

30% of 9000 |

2016-17 |

1,20,000 |

1,04,000 |

16,000 |

30% of 16,000 |

2017-18 |

1,20,000 |

95,000 |

25,000 |

30% of 25,000 |

2018-19 |

1,20,000 |

80,000 |

40,000 |

20% of 40,000 (after indexation) — As investment was held for more than 3 years |

Important points:

>> Fund of funds and international fund are considered as debt fund for the taxation purpose and are taxed accordingly.

>> In terms of taxation, in India, capital gains from mutual fund investments are treated in only one of two forms. So for the hybrid funds, if a fund’s portfolio is holding more than 65% of its assets as investments in the domestic equity market, then it is taxed as Equity Funds. Otherwise, it is taxed as Debt funds.

Selecting the right debt fund is important. Analysing qualitative and quantitative parameters can help you pick the right fund. Here are steps involved to do the same:

Picking the right fund category is most important before you turn towards qualitative and quantitative parameters. Within pure debt funds there are various types having different investment horizon as discussed in Q29. Each category has different risk profile and accordingly different return profile too. So, this selection is most important step in selecting a debt fund.

There are thousands of schemes to choose from. Once you have finalized the fund type, you should consider following factors to finalize which scheme suits you the most:

(i) Fund House pedigree:

You should be comfortable with pedigree of fund house – years in business, overall long-term performance of funds, their compliance record, their governance etc. This criterion will help you remove few fund house schemes from further selection.

(ii) Historical Performance:

An important criterion for selection of the debt scheme but not the most important one. You should choose the scheme which has a very good long-term & consistent returns record both against benchmark and peers. This returns record will also give you an understanding of bad performances in the past (if any) and the reasons of those bad performance like credit defaults or interest rate risks.

Please remember – In Debt funds, a fund performing (in terms of returns) much better than category average mostly takes more risk too.

(iii) Debt’s Risk parameters:

Most important parameter in debt fund selection is to understand how much risk the fund is taking. Fund majorly takes two types of risk – Interest Rate Risk and Credit Risk. Parameter like average maturity, modified duration and YTM gives us good understanding of Interest Rate risk Fund is taking. We have discussed them in detail in Q57 onwards.

Credit Ratings of the assets bought by Fund and comparison with the category average gives a good understanding of what kind of assets fund invests in and how much credit risk it takes. We have discussed this in detail in Q60

(iv) Other Factors you should consider too but should not be your only criterion:

(a) Asset Under Management:

Net assets of any scheme gives a fair idea of the confidence level of investors in the mutual fund scheme. Fund houses usually deploy their best fund managers for mutual fund schemes with high AUM. High AUM is good in Debt funds as these funds also have purchasing power to get better debt papers as well from the market esp. in Primary markets.

(b) Expense Ratio:

You should avoid schemes with very high Expense ratio. Expense Ratio is a very important parameter in Debt funds as the returns difference between funds and average is usually very narrow. We should always opt for debt funds with low expense ratio.

(c) Exit Load:

Since debt funds’ investments are mostly for shorter horizon, so it is important that you should look at the Exit load of the debt funds too. Avoid funds which have Exit loads within your investment horizon.

(d) Riskometer –

Always check fund’s Riskometer to understand the potential risk the fund is taking. This parameter is mentioned in every fund’s factsheet. Explained in Q62

(e) Fund Manager:

The credit for outperformance or underperformance of a mutual fund scheme lies with the fund manager. Fund Managers role in debt funds is limited due to restrictions by SEBI and Fund house processes except in Dynamic category.

To start Mutual Fund investment, you need a PAN, a Bank account and be KYC (Know your Customer) compliant. If you are not sure about your KYC status, you should check at any of following website of KYC registration agency by entering your PAN.

> www.cvlkra.com

> www.camskra.com

> www.karvykra.com

> www.kra.ndml.in

> www.nsekra.com

The need for KYC is to comply with the SEBI’s regulation in accordance with the Prevention of Money laundering Act, 2002 ('PMLA'). If your KYC is not done, you need to get it done at any place you choose to invest through, in Mutual Funds by submitting following documents

> Filled KYC form

> Recent passport size photograph

> Self-attested PAN Card copy

> Self-attested Proof of address copy

Remember, KYC is just a one-time process and once done, you can invest in any mutual fund scheme through any way mentioned in Q72

There are several ways in which one can invest in Mutual Funds. There are both online and offline methods mentioned as follows:

You can go to any fund house office and open your mutual fund account. Account can be opened online as well if your KYC is done.

You can also invest through AMFI registered distributors who can give you basic Mutual Fund advise, explain all the Mutual Fund jargons, and can help you in doing all the paperwork as well as sending reports etc. But if you wish to go with this option then you cannot invest in Direct schemes.

RIA are investment advisors registered with SEBI. They act on fiduciary capacity. They do not get any commission from Mutual Fund and would have you invest in direct plans but do charge a fixed or variable fee for their advice.

CAMS and Karvy are R&T agents of Mutual Funds and gives free online access to many AMC’s schemes. Individuals can go to CAMS / Karvy office to open their Mutual Fund account and KYC registered customer can do it online as well through their website.

Similarly, MFU (Mutual Fund Utility) is a new initiative of Mutual Fund industry where many AMCs have come together to bring investor convenience, information consolidation and bring operational efficiencies

Most of the banks also act as Mutual Fund distributors. So, you can approach your bank to open a Mutual Fund account as well which can be easily integrated with your online banking account. But there is always a risk of getting a biased advice through banks.

Today, there are several online Robo-advisory portals, which gives you online financial advice, execute your mutual fund transactions and few also give you access to a on call financial expert. There are number of new business models available and coming up in this space. Few worth mentioning:

a) FundsIndia:

One of the first and biggest in this space where you can invest in various recommended Mutual Fund schemes. They also help in all your paperwork for free. They do not allow investments in direct plans.

b) Invezta:

They allow investment in direct plans but charge a fixed yearly fee for opening and managing the mutual fund account.

c) Paytm Money, Groww, ETMoney –

They allow investments in direct plans without any fees. Currently are completely free. There are many others like them.

As we have seen in earlier article that Bonds behave differently than that of Equity. Therefore, there are some additional parameters we need to consider while reviewing a Debt fund. In this article we will discuss on what all parameters would help you review your debt fund:

AUM i.e. (Assets Under Management) of the fund plays a pivotal role in reviewing a fund. A higher AUM enables the fund manager to diversify his portfolio by getting better quality papers for fund portfolio. High AUM also shows larger trust in Fund’s management.

You should not just check standalone performance of a fund. Performance is a relative issue. Always compare it with Category/Peers or suitable Benchmark if available. Comparing fund with benchmark may not be right in case of debt funds as liquidity plays a major role in shorter duration debt fund categories. So, it is important to compare fund performance with its top performing peers or overall category. But in Debt Funds, always compare the fund’s performance w.r.t. to risk it takes. Many a times fund may be given excellent returns but then it also may be taking high credit or interest rate risk as compared to category.

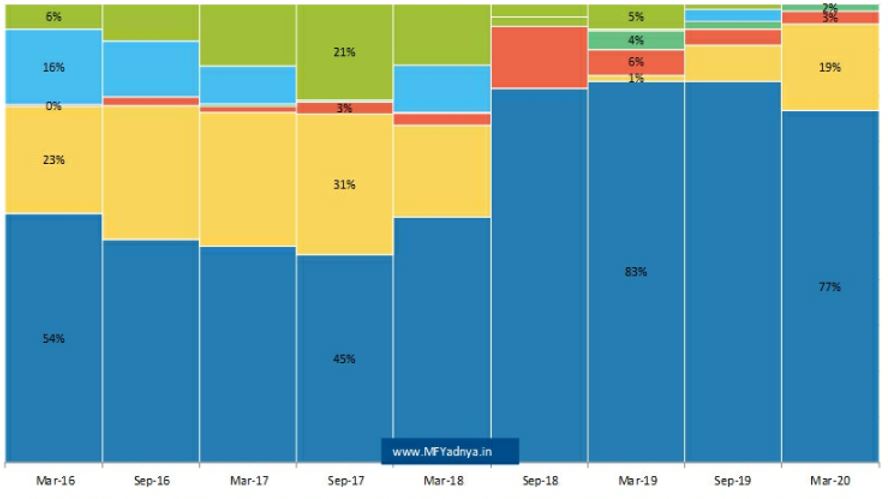

Before investing in a fund it is important to know in what type of securities does the fund invest. Does the allocation match your risk profile? You must keep an eye on the changing allocations by the fund manager.

# Corporate Debt # Government Securities # Cash & Cash Equivalents and Net Assets # PTC & Securitized Debt # Certificate of Deposit # Treasury Bills # Commercial Paper

The above chart belongs to ICICI Pru Corporate Bond Fund, here we can see that in last 6 months fund manager has increased the allocations to government securities by reducing the corporate debt. A point to note here is that even though government securities are a safer investment home, they offer a much lower return. This change could directly affect the performance of the fund.

There are various risk parameters which affect your decision making. A risk averse investor shall not invest in a fund which has a high Interest rate risk. If a fund has a higher Average Maturity and Modified duration, then that fund is supposed to be more volatile. E.g.: If a fund has a modified duration of 2.1%. This means if the Interest rate increases by 1%, value of fund portfolio falls by 2.1% and vice versa.

Credit risk measures the probability of loss on account of default by borrower towards interest payments or principal. In last few years management of Credit risk has been of utmost importance. The IL&FS crisis has only highlighted the need. If the fund has majority of his portfolio in low rated bonds it is said to have a higher credit risk, i.e. a risk of default by the issuer. (for more details refer articles on Average Maturity, Modified Duration and Credit Ratings)

The above chart shows credit ratings of the bonds held in portfolio by Kotak Medium Term Fund. It shows that fund is slowly taking a safer approach of nvestment by increasing the allocations to highest rated bonds i.e. in AAA/A1+.

Reviewing your investment is a time consuming job. Gathering the required data only takes up major portion of your time away. This is one major reason why we tend to skip the review part. To cater this issue we at mfYadnya.in offer regular review of 50+ Debt Mutual fund schemes across 10 categories. It is an unbiased review based on various parameters like Fund Background, AUM, Returns, Credit Risk, Interest Rate risk, Asset Allocations etc. The parameters are rated with proprietary star rating where Green star indicates funds above average performance, Yellow star indicates near average performance and a Red star means below average performance. This makes your investment review process easy and more effective. The below table indicates how debt mutual fund schemes are reviewed on mfYadnya.in (as of Mar 2020):

[Review of Mutual Fund Schemes]

Thinking of making an investment is a good thought. But it is only when you are actually ready to invest, a bunch of questions shoot up. Like, is it really a good idea to invest in Mutual funds? Should I invest Lumpsum? Should I stagger my investments over a period of time through SIP? Should I choose Equity funds, Debt funds or Liquid funds? In the earlier questions we have already discussed about how to select a suitable category and fund. Now here, just to simplify let us discuss which is a suitable strategy for investing through a hypothetical scenario.

Let us assume that you have sold a piece of land and received Rs. 10,00,000 at once from it (net of tax). You want to productively invest these funds for your future needs. Now the first option comes to your mind is to invest it Lumpsum.

Mostly it is absolutely fine to invest in Debt Funds as the volatility is much lesser. Important is to make sure that your investment horizon matches with the Average maturity of the fund to reduce the interest rate risk. If you have different investment horizons for a large lumpsum investment, then you should split the amount in different funds. YTM should be used as an indicator for you on expectations of returns in future.

Yes, many investor use the shorter duration categories to park their lumpsum investments till they don’t get good entry in equity markets. Many investors also use Debt funds to invest their money in Equities through STPs to help invest their lumpsum money in staggered way. Good categories for such investments are – Liquid Funds, Ultra Short Term Fund, Low Duration Fund and Money Market Funds.

There is a lot of information on the web where you can know about Mutual Fund markets, schemes and news. Following are few good ones:

(i) SEBI website:

SEBI website has info on all the Mutual Fund regulations and all the latest NFO’s offer documents. There is also a lot of educational material in their investor education section.

(ii) Mutual Fund house’s website:

Most of the fund houses have all the latest and extensive information about their own fund schemes: Daily NAVs, latest news, Scheme information documents, Monthly factsheet, investment forms and online transaction option.

(iii) AMFI website:

All the latest information about Mutual Fund schemes and industry numbers: Daily NAV, AUM data, NFO info, distributor info, all historical data etc.

(iv) mfYadnya.in:

mfYadnya.in is a knowledge portal which has comprehensive & these kind of transparent Reviews of Mutual Fund Schemes. Currently more than 200+ top Equity Funds, ETF/Index Funds, Hybrid Funds & many Debt Funds are reviewed with proprietary Green, Yellow & Red star Rating on this platform. There are category comparisons of funds too which would clear your doubts. |