Here the focus is on managing a portfolio of mutual fund schemes — a key role that a financial planner needs to perform. This calls for a background understanding of risk profiling and asset allocation.

1. Risk Profiling in Mutual Fund

A participant in one of my seminars shared a joke. A heart patient won a lottery worth 1 00 crore. The family wanted to break the good news as softly as possible.

The job was delegated to the family doctor. The conversation went along the following lines:

>> Doctor: What will you do if you win a lottery of 1 ,000?

>> Heart Patient: I will take my family out for dinner.

>> Doctor: What will you do if you win a lottery of Rs. 1 Crore?

>> Heart Patient: I will repay my housing and car loans.

>> Doctor: What will you do if you win a lottery of Rs.100 crore?

>> Heart Patient: I will give you 50 per cent of it.

The doctor immediately suffered a heart attack!

Depending on the health risk a doctor is in the best position to advise a patient on whether she should climb the Himalayas, or whether she should satisfy herself climbing up Malabar Hill in Mumbai. Similarly, a financial planner has to advise investors on their finances depending on their risk profile. She has to look for verbal and non-verbal cues to assess the investor’s risk appetite. At one end of the spectrum would be an aggressive risk taker — and at the other, an impulsive risk avoider.

“The most striking thing about Graham’s discussion of how to allocate your assets between stocks and bonds is that he never mentions the word “age”. That sets his advice firmly against the winds of conventional wisdom — which holds that how much investing risk you ought to take depends mainly on how old you are. A traditional rule of thumb was to subtract your age from 100 and invest that percentage of your assets in stocks, with the rest in bonds or cash.” ‘

While risk profiling is a highly subjective exercise, it can safety be said that appetite for risk reduces with:

> Age;

> Increase in dependents;

> Reduction in earning members;

> Any serious health related issues in the family; and

> Job insecurity. On the other hand, a person would be inclined to take more risks when:

> Major expenses are taken care of. For instance, when the investor owns a house and loans are repaid;

> Other major aspirations are met or provided for;

> The investor is a professional whose income streams are on the upswing; and

> The investor has hit a jackpot.

It would be possible to generate a standard list of questions, the answers to which would be pointers to an investor’s risk profile. Some websites do have such risk profilers. However, no ready reckoner of questions can substitute the need for a financial planner to keenly observe the investor and her behaviour. For instance:

A person who jumps the red signal in a traffic crossing is clearly a person who is inclined to take risks.

A person who complains for half an hour about the extra one-rupee wrongly charged by a bus conductor is a difficult equity investor.

If discussions indicate certain submissiveness on an investor’s part to the views of her superior at work, and an obsessive concern about job security, then the person is likely to be risk averse.

Even the type of dreams mentioned would be an indication of an investor’s risk profile. A Richard Branson who wants to circumnavigate the earth in a hot air balloon would top the chart in terms of risk preference!

Also, in phases of economic uncertainty (layoffs), it would be better for an investor to tone down the risks taken.

“For early savers, the ship is at the dock. Navigational aids help guide the ship out of the harbour and into open water. Early savers need to follow navigational aids to get their ship on its way, even though they do not know yet where it is heading. . . There is a safe harbour out there waiting for the Early Saver, but it is much too early to pick a specific retirement date or to set a specific dollar amount for a retirement nest egg. Later in the journey, after 15 or 20 years of experience, it will be time to think about a retirement time clock and establish a specific dollar and goal to complete the voyage. . . The beacon that should guide investment decisions for Early Savers is known in financial industry as risk tolerance. Risk tolerance is a measure of how rough the financial markets can get before you get seasick and abandon ship. The ideal portfolio has only enough risk in it to make you queasy during stormy market conditions, but not so much up-and-down movement that you make a wild decision to abandon your investment strategy.-

A risk profiling exercise would result in suggestions on how an investor should distribute her portfolio between different asset classes.

Debt, Equity, Gold and Real Estate are the commonly held asset classes.

Debt is generally viewed as a very safe asset class. Yet, investing the entire portfolio in debt is not necessarily a prudent option. Inflation and re-investment risks can wreak havoc to the lives of such investors. Prudence, therefore, lies in investing in a mix of asset classes.

The performance of different asset classes hinges on how the economy performs. Economies tend to move in cycles — often referred to as business cycles. From a trough, the economy expands, then reaches a peak, and then contracts back into a trough.

The financial planner’s reading of the economic environment is important. For instance, while the economy is booming, equity investment would generate good returns. But in a contractionary phase in the business cycle, debt investments may be more prudent.

Financial planners need to be able to anticipate the cycles. To draw an analogy, it is difficult to predict the day-to-day temperature and rainfall — but the seasonal cycle can be reasonably predicted. So also financial planners may not be able to read the short-term fluctuations, but the long-term business cycles need to be factored in the financial plans they make.

Every asset class and mutual fund type implies a risk-return trade off. Generally, one has to take a greater risk for a chance to earn a higher return.

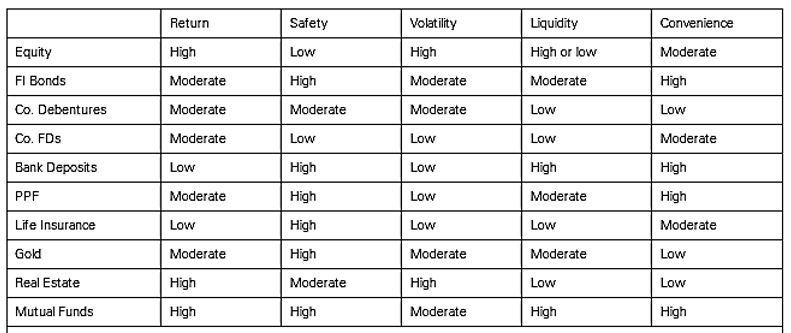

[Asset Classes of Mutual Fund)

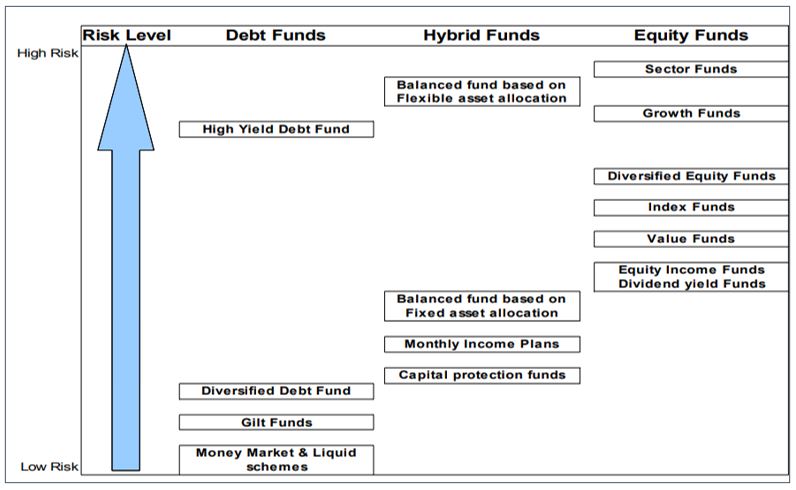

An asset categorization relevant for a mutual fund distributor is liquid schemes, gilt schemes, bond schemes, balanced schemes, index schemes, diversified equity schemes, sectoral or focused schemes, etc.

The generic risk in different kinds of mutual fund Schemes, as shown in the table below :

[Generic Risk in different kinds of Mutual Fund Schemes]

A financial planner has to obtain information about the investor’s current distribution of investment between asset classes and investment types. These would determine what is already available to finance the client’s goals, and the risk underlying her investment portfolio. They may also offer clues to possible needs of re-balancing the portfolio (discussed in the following sections).

Credit card issuers use a decision support model to decide whether or not to issue a credit card to the applicant and the exposure limit in case they decide to issue one. It is the same with loan companies. In all these cases, the back-end of the model synthesizes the information given by the applicant and throws up a decision. The parameters of this decision support model are based on statistics of past experiences.

Similarly, it would be possible to have a model that would suggest the mix of asset categories for a client. However, judgement plays a key role — hence the role of financial planner, as distinct from standard tools. The optimum asset allocation for a client would depend on her wealth cycle and life cycle.

People typically go through three wealth cycle phases:

ACCUMULATION I SOWING

Where the person’s saving is much more than current needs. So she is in a position to set apart something for the future.

DISTRIBUTION I REAPING I HARVESTING

Where the person’s needs cannot be fully met by current savings. The gap would need to be met out of savings or loans.

TRANSITION

This is a phase between the accumulation and distribution phases, when the distribution needs are very clearly in the person’s radar, although the harvesting may not have commenced.

WINDFALL

This is a phase that touches people’s lives occasionally. It could be winning from a lottery, super-normal profits booked on investments, inheritance etc.

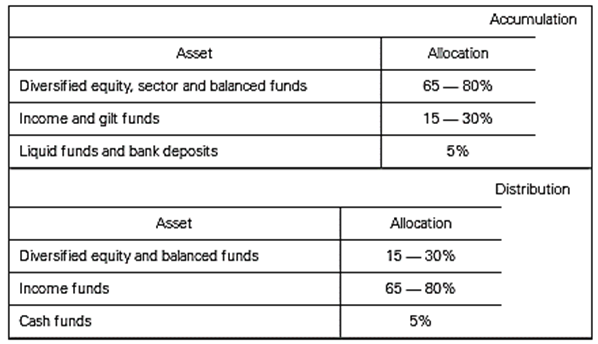

The risk-based asset allocation would be different for each phase.

The AMFI Mutual Fund Testing Programme Workbook proposes the following mix:

People often work with a thumb rule to set the debt portfolio percentage at the same level as the age of the person in years. The thumb rule should not be stretched too much — else a person who lives beyond 100 would end up short- selling equity — hardly an age for such portfolio management style! The approach of determining the asset allocation based on client’s situation is referred to as “strategic asset allocation”.

During the transition stage, the investor would be well advised to park increasing proportions of money in liquid assets. Once the expected goals have been achieved, the investor can go back to the distribution suggested by strategic asset allocation.

The windfall situation is interesting. When the client wins a lottery, she realises there are so many so-called friends or relatives — including many who have not bothered to maintain contact for several years. Money in the bank is always a temptation for a splurge (a person happily accustomed to train travel, overnight deciding to buy a Mercedes Benz!) or altruism.

It would be prudent not to blow up the money, nor invest all of it at the same time. The money could first be invested in a safe and liquid avenue — liquid schemes, for instance. Progressively, the money can be invested in equity or other investments, as per the preferred asset allocation. Through progressive investments, the investor can avail of the benefits of SIP described earlier.

Thus, during the transition and windfall stages, the investor’s asset allocation would be temporarily at variance from that suggested by the strategic asset allocation approach.

Birth, childhood, graduation, early employment, marriage, children, education I marriage of children and retirement — these are the life phases that people normally go through. The asset allocation and investment choices that are made would need to keep the life cycle in mind.

Thus, in the early stages of one’s professional career, the investment mix would be more like that set out above for the “Accumulation” phase in the wealth cycle. Towards retirement, it would be more like the “Distribution” phase in the wealth cycle. The investment mix would need to specifically provide for expected spikes in expenses in between (“Transition” phase), such as for buying house, marriage of children, etc.

An aggressive growth fund would find a place in the portfolio of younger investors with a propensity to take risk. Older investors would find the equity portion of their portfolio dominated by equity income funds. As seen earlier, closer to a large and sure fund outflow for people who are in the transition phase (some requirement of funds in the radar), moneys would be transferred to money market or other debt funds. Thus, scheme selection becomes a function of both risk profile and cash flow needs of an investor.

The choice of funds for an investor would depend on her investment philosophy and portfolio. According to Benjamin Graham, the kind of investment portfolio that is appropriate for different types of investors is as follows:

>> Defensive investor:

- There should be adequate, though not excessive, diversification (10 — 30 stocks);

- Each company should be large, prominent, and conservatively financed;

- Each company should have a long record of dividend payments; and

- The investor should impose some limit on the price he will pay for an issue in relation to its average earnings over, say, the past seven years. (25 times average; 20 times last 12-month period).

>> Enterprising investor:

- Buying in low markets and selling in high markets;

- Buying carefully chosen “growth stocks”;

- Buying bargain issues of various types; and

- Buying into “special situations”.

Some experts believe that there is nothing like a moderately aggressive investor, mildly conservative investor, and such other shades of differences. Investors are either aggressive or conservative. Benjamin Graham states this emphatically:

“The aggressive (enterprising) investor must have a considerable knowledge of security values — enough, in fact, to warrant viewing his security operations as equivalent to a business enterprise. There is no room in this philosophy for a middle ground, or a series of gradations, between the passive and aggressive status. Many, perhaps most, investors seek to place themselves in such an intermediate category; in our opinion that is a compromise that is more likely to produce disappointment than achievement. As an investor you cannot become “half a business-man”, expecting thereby to achieve half the normal rate of business profits on your funds.

As an old Turkish proverb says, “After you burn your mouth on hot milk, you blow on your yogurt. Hurt badly by the crash of 2000-2002, many investors now view stocks as scoldingly risky; but, paradoxically, the very act of crashing has taken much of the risk out of the stock market. It was hot milk before, but it is room-temperature yogurt now.”

The risk profiling and asset allocation process would indicate what ought to be the distribution of an investor’s assets. The financial planner would also have obtained the details of what the current distribution is. Based on this, she can decide on the need to re-balance the client’s portfolio.

Based on risk-profile, if asset allocation between debt and equity is recommended at 30:70 and the current mix is 35:65, then re-balancing may not be recommended, given the transaction costs involved in selling and buying investments. Only new investments may be directed towards the asset category where the client is short. However, if instead of 30:70, the client is at 70:30, then the difference is significant enough to recommend re-balancing even the current portfolio.

At a seminar many years ago, a participant mentioned about his 88-year old father whose entire portfolio was in equity — blue chips invested at ridiculously low prices. Such an investor (the father) had, perhaps unknowingly, built a high- risk portfolio. Just to re-balance the portfolio by selling some equity, there would have been a heavy incidence of capital gains tax (now withdrawn for most equities). In retrospect, a few thoughts on human behavior came to my mind. If the old investor was being cared for by the son at his age of 88, then chances of the son abdicating his responsibility are remote. Add to that the tax on capital gains. This may well have been that odd case one encounters in life — where a financial planner may be comfortable recommending 100% equity portfolio for an 88-year old investor!

As Richard Fern puts it: “Bear markets should only be a minor nuisance in your life and should have no effect on your retirement savings plan or your ability to sleep at night. They occur as a normal part of the economic cycle in every free market economy and are a natural part of economic growth. If you live to be in your 80s or older, there is a good chance you will be involved in at least two lengthy bear markets during your life and many more short-term market corrections.”

“A market decline of 10% to 20% is known as a correction. A bear market is a correction of 20% or more. It is widely believed that bear markets coincide with economic recessions. The truth is, sometimes a bear market forecasts a recession and sometimes it does not. It did not in 1987, but it did in 2000. Economic data is always behind actual economic conditions, so we never know if the market is telling the truth. A standing joke on Wall Street is that the stock market forecast eight out of the last three recessions.”

“The people looking for a crystal ball are no dummies. The list of Nobel Laureates who lost money trying to find a mathematical solution is quite long. John Nash, Robert Merton, and Myron Scholes are three who come to mind. Nash tried to develop market-timing systems using mathematical models based on game theory, for which he won the Nobel Prize. He did not succeed. Merton and Scholes were the architects of intrinsic formulas that mathematically predicted the risk and return in hundreds of markets. Those models eventually led to the 1998 collapse of Long-Term Capital Management (LTCM). The failure of LTCM was so potentially devastating to the global economy that the Federal Reserve had to orchestrate a bailout by several Wall Street firms. So, is there a crystal ball that can predict the market? If Nobel Laureates cannot find one that works, then there is no point for us to try.ML

Most Indians would have played the game of “saaklee” in their childhood. It starts as a one versus the rest. The rest try their best to run away from the one. Whoever, the one person is able to touch from the rest joins the person. Thereafter, it is two versus the rest. The two need to hold hands and run after the rest. The next person who is touched by the other two has to join them. Then, it becomes three versus the rest, with the three holding hands and running after the rest. The game is over when the last person is touched by the others holding hands as a team.

Initially, when one person, say A, is running after the rest, it is tempting to touch the person who is easiest to catch up with, say Z. Thereafter, when A and Z have to run together after the rest, A will be hampered by the speed of Z. Thus, A will take a long time to complete the game of catching all the others. Logically, A should not be tempted into catching the

slowest person, who is a ready prey. Instead, she should try to catch the fastest person among the rest. Thereafter, at each stage, if the fastest person among the rest is targeted, the objective of catching all the others will be achieved much faster.

On the same lines, investors should target the better schemes, in order to achieve their goals faster. This calls for comparing between schemes. Risk profile, asset allocation and relative risk levels in different investments were discussed earlier in this Page. Based on these, a financial planner would advise the investor on distribution of investment across different schemes. In effect, the financial planner would recommend a model portfolio most appropriate for the investor.

“The key to selection of mutual funds is not to focus on future return which an investor cannot control — but on risk, cost and time, all of which the investor can control,” points out Bogle perceptively.

Bogle again: “Don’t select funds as if they were simply individual common stocks, to be discarded and replaced as they face the inevitable ebb and flow of performance. Select a fund with the same thoughtful consideration you would give to appointing a trustee for your assets and establish a lifetime relationship.”

5. Exit from Schemes of Mutual Fund

Hall hit the nail on the head: “The old idea that you could just invest your money in mutual fund, do a Sleeping Beauty imitation, and then wake up rich is more myth than reality. . . . And when a change needs to be made, do so decisively. After all, selling a mutual fund is not like getting a divorce.”

Exit from a mutual fund scheme is warranted in the following situations:

>> You need to re-balance your portfolio: In such a case, exit the scheme that is the worst performing in the asset category where you are over-weight.

>> You have exceeded your targeted return: Don’t get greedy about your return from the scheme. Exit gradually, instead of selling all the investments at the same time.

>> The scheme has been consistently under-performing the market or its peer group of schemes.

>> There are strong and reliable indications that the operations of the mutual fund are being handled unethically or imprudently or unprofessionally.

>> Changes in the scheme structure or the people behind the operation make you uncomfortable.

Let’s listen to the experts on this:

“As the investment consultant Charles Ellis puts it, ‘If you’re not prepared to stay married, you shouldn’t get married.’ Fund investing is no different. If you’re not prepared to stick with a fund through at least three lean years, you shouldn’t buy it in the first place. Patience is the fund investor’s single most powerful”

Cunningham has this to say: “Peter Lynch regards the prevalent practice of rebalancing as backward, saying it is like gardening by watering the weeds and pulling the flowers. The beneficiaries of this backward gardening are not the investors or traders who do the rebalancing, but their advisers — who generate fees from trading — and the US federal and local treasuries — which get tax payments. Buffett put it best in asking whether it would have made sense for the Chicago Bulls to trade Michael Jordan on the grounds that he had become too important and valuable to the team.” |