According to the fund’s investment strategy, debt mutual funds invests in debt instruments such as corporate debt, commercial papers, certificate of deposit, governments securities etc. of varying maturities. To suit the investor’s needs, there are different types of mutual funds.

As per categorization and rationalization of mutual fund schemes prescribed by SEBI, following are the types of debt mutual funds:

Type of Debt Fund |

Investment Horizon (Duration) |

Investment In |

Returns

Expectation |

Points to Note |

Overnight Fund |

1 Day |

Call Money Market |

3-5% |

Safest & most Liquid, No Exit Load. Should be compared to Savings Banks returns. |

Liquid! Money Market Funds |

1-90 days |

Treasury bills (short term Govt. securities) |

4-6% |

Highly Liquid, Negligible Exit Load. Should be compared to Savings Banks account returns. |

Ultra-Short Duration Funds |

3-6 months |

Treasury Bills, Commercial Papers |

5-7.5% |

Also, known as Liquid

Plus Funds, No Exit

Load |

Low Duration Fund |

6-12 months |

Treasury Bills, Commercial

Papers & Commercial

Deposits |

5-7.5% |

Mostly No Exit Load |

Money Market Fund |

0 – 12 Months |

Any Money Market Instrument — CP, CD, T-Bill, CBLO etc. |

5-7.5% |

Mostly No Exit Load |

Short Duration Funds |

1 Year —3 Years |

Corporate Bonds & Debentures |

6-8.0% |

Lower risk, may have small (0.25-0.5%) exit load for max 6 months |

Medium Duration Funds |

3 years —4 Years |

Corporate Bonds, Debentures and Govt. Securities |

5-8.0% |

Medium Risk, should be compared to 3yrs Bank FDs |

Medium to Long Duration Fund |

4 Years —7 Years |

Corporate Bonds, Debentures and Govt. Securities |

7.0-8.5% |

Medium to High Risk, should be compared to 5 yrs. Bank FDs |

Long Duration Funds |

7+ Years |

Corporate Bonds, Debentures and Govt. Securities |

7.0-8.5% |

Highest Risk Debt Funds. |

Dynamic Bond Funds |

Not fixed. Depends on Fund Manager’s view of interest rate changes |

All Debt instruments |

7-9% |

Medium-High Risk, can shift between maturities aggressively |

Corporate Bond Fund |

Not fixed. Mostly similar to Short /

Medium Duration |

Highest Rated Corporate Bonds—Min 80% Asset |

7.0—8.5% |

Medium Interest Rate Risk |

Credit Risk Funds |

Similar to Short! Medium Duration |

Low Rated and high yield Corporate Bonds — Minimum 65% Assets |

0-9% |

Low-Medium Interest

Rate risk but High

Credit Risk |

Banking & PSU Funds |

Similar to Short? Medium Duration |

Debt instruments of banks, PSUs, Public Financial nstitutions - 80% of total assets |

7.5—9% |

Similar profile as Corporate Bond Funds but with even better credit rating |

Gilt Funds |

Mostly> 3 years |

Govt. securities — Minimum 80% |

6-9% |

High Interest Rate Risk due to large maturities, |

Gilt Fund with 10 year constant duration |

10 Years |

Govt. securities — Minimum 80% |

6-9% |

High Interest Rate Risk due to large maturities,

zero credit risk as Govt. will never default |

Floater Funds |

Mostly similar to Short / Medium Duration |

Floating Rate Instruments — Minimum 65% |

7-8% |

Floating Rate Instruments are those whose interest rate changes with the market condition |

Overnight are safest debt funds as they invest in debt papers of only 1 day. They typically invest in Call Money Market. Call money market is majorly an inter-bank market where banks borrow and give loan for just 1 day majorly to meet their CRR and SLR requirements. These funds can be used as substitute of Savings Bank balance as the money here is very liquid with almost negligible Interest Rate and Credit Risk. There are 30+ overnight funds to choose from and here are few examples –

>> SBI Overnight Fund

>> L&T Cash Fund

>> UTI Overnight Fund

>> ICICI Prudential Overnight Fund

>> Aditya Birla Sun Life Overnight Fund

>> HDFC Overnight Fund

>> Nippon India Overnight Fund

>> DSP Overnight Fund

>> Edelweiss Overnight Fund

>> Sundaram Overnight Fund

>> Tata Overnight Fund

>> Franklin India Overnight Fund

>> Union Overnight Fund

>> Baroda Overnight Fund

>> Canara Robeco Overnight Fund

>> BNP Paribas Overnight Fund

>> IDFC Overnight Fund

>> Axis Overnight Fund

>> HSBC Overnight Fund

>> Indiabulls Overnight Fund

>> ITT Overnight Fund

>> Kotak Overnight Fund

>> LIC MF Overnight Fund

>> Mahindra Overnight Fund

>> Mirae Asset Overnight Fund

Liquid funds are open ended debt mutual funds that primarily invest in short term money market instruments with maturity upto 91 days. Liquid mutual funds invest in money market instruments such as Certificate of Deposits (CDs), Commercial Papers, Term Deposits, Call Money, Treasury Bills, etc. These funds are ideal for investment in short term goals or can also be used for Emergency Fund. It is important to note that each debt paper bought by Liquid fund has to be of duration less than 90 days. So, it is not the average duration which needs to be less than 90 days in Liquid Fund but duration of each security. This makes Liquid Fund much lower risk compared to Ultra Short term and other categories. This rule is only valid for Liquid Funds and for rest, they need to just keep average duration lower than prescribed for the category. There are 35+ liquid funds to choose from and here are few examples — Parag Parikh Liquid Fund, Baroda Liquid Fund etc.

a) Higher Liquidity

b) Very Low Risk - Lower Interest rate & Credit risk

c) No lock in period

d) Negligible exit load \

e) Long Term Tax advantage over FDs

f) Low Expense Ratio — Avg Direct Expense Ratio is around 0.15 and Regular is around 0.25.

g) Currently Liquid Funds of many fund house offer instant redemption facility. Under this facility, you can get upto Rs 50,000 per day instantly in your savings account (within minutes, even though it is a holiday on that day).

Let’s have a look at some of the liquid fund:

>> Invesco India Liquid Fund

>> BOI AXA Liquid Fund - Retail

>> Quantum Liquid Fund

>> IIFL Liquid Fund

>> BNP Paribas Liquid Fund

>> Baroda Liquid Fund - Plan A

>> Mirae Asset Cash Management Fund

>> DSP Liquidity Fund

>> Kotak Liquid

>> Canara Robeco Liquid

>> IDFC Cash Fund

>> PGIM India Insta Cash Fund

>> Nippon India Liquid Fund

>> Axis Liquid Fund

>> UTI Liquid Cash Plan

>> ICICI Prudential Liquid Fund

>> Tata Liquid Fund

>> L&T Liquid Fund

>> HDFC Liquid Fund

>> LIC MF Liquid Fund

>> SBI Liquid Fund

>> Essel Liquid Fund

>> Mahindra Liquid Fund

>> HSBC Cash Fund

>> IDBI Liquid Fund

>> Indiabulls Liquid Fund - Existing Plan

>> Union Liquid Fund

>> Aditya Birla Sun Life Liquid Fund

>> Sundaram Money Fund

>> JM Liquid Fund

>> Principal Cash Management Fund

>> Torus Liquid Fund

>> Quant Liquid Plan

>> Parag Parikh Liquid Fund

>> Motilal Oswal Liquid Fund

>> ITT Liquid Fund

>> YES Liquid Fund

Factors |

Savings Account |

Liquid Category Funds |

Product |

Savings account is a deposit account offered by a bank or post office, which provides security of the principal amount and pays interest on it. |

It is a debt mutual fund, which invests into fixed income instruments of very short term maturities (a day to 90 days) like commercial papers, treasury bills, certificate of deposits, etc. |

Risk |

Almost No Risk |

Very Low as these instruments are either Sovereign Rated Government treasury bills or high credit rated Certificate of Deposits and Commercial Papers

Also, they are not traded in the market and are kept till maturity. So, there is no short-term interest rate risk as well. |

Returns |

Fixed interest rate.

Currently between 2-3% p.a. Some banks may offer slightly higher rates but ask for higher amount of de posits. RBL Bank & Bandhan Bank gives 6% if balance in account is more than Rs. 1 Lakh. |

In the last year, on average liquid funds have returns range of 3-4%. |

Taxes |

If the interest earned in a year exceeds 1 01000, the interest is added to your gross income and taxed as per tax slab. |

Taxes on returns of these funds are same as other debt funds, as discussed in Question

|

Liquidity |

You can take out your cash anytime through ATM |

Once you redeem your investments, it takes minimum 1 working day for the funds to reach your registered bank account. Nowadays, new instant redemption facility is also given by most of fund houses on

their liquid funds, through which you can get your money redeemed instantly as well |

Recommendation of Use |

Storage of cash required for monthly expense |

Your emergency fund could be stored here.

In case of sudden inflows, you could put your inflows in liquid funds till you decide where to invest it. |

Example |

SBI is currently giving 2.9% on Savings Bank Balance. HDFC Bank & ICICI Bank are giving 3%. |

SBI Liquid Fund (Direct) (As on Apr 1, 2021)

Expense: 0.20%

Last one year return: 3.5%

Type: Open-Ended Fund

Exit Load: 0% |

This is a very important constraint to know before investing. If one wants to invest for minimum 6 months, then arbitrage funds can be considered. Ideally, investment horizon for arbitrage funds should be more than 6 months as there can be high short term volatility. For investment horizon ranging from few days to weeks, liquid funds are good option.

Liquid funds are considered to be much safer than arbitrage funds because they invest in debt instruments. Arbitrage funds are riskier as they invest in their money arbitrage opportunities of Equity Markets and many times enough arbitrage opportunities are not available or market sentiments are very weak and future market runs with discount. Arbitrage funds can give you negative returns too in very short term whereas Liquid Funds rarely do that.

Due to limited arbitrage opportunities and too many funds chasing same opportunities, Liquid fund’s returns have been better than Arbitrage Funds in last few years. Following table shows the returns for various holding periods as on 1st Apr2021.

Holding Period |

Arbitrage Funds |

Liquid Funds |

1 Day |

0.00% |

0.01% |

1 Week |

0.07% |

0.06% |

1 Month |

0.31 % |

0.29% |

3 Months |

0.68% |

0.78% |

1 Year |

2.95% |

3.36% |

3 Years |

4.84% |

5.48% |

5 Years |

5.43% |

6.02% |

10 Years |

6.80% |

7.34% |

Liquid funds provide far better liquidity as compared to arbitrage funds. It takes 3 to 5 days to redeem an arbitrage fund while liquid funds can be uncashed within a day. Liquid funds with insta redemption option can be redeemed within minutes.

On an average, expense ratio of liquid funds (Direct Plan) is 0.15 while that of arbitrage funds (Direct Plan) is about 0.40. Expense ratio of arbitrage funds is high due to number of transactions and cost associated with it. On this factor, Liquid funds score better.

Exit load is the fees charged by the Asset Management Company (AMC) at the time of redemption.

AMCs charge 0.25% to 0.50% for arbitrage funds if redeemed within one month. Mostly it is 0.25%. For Liquid

Funds, Exit load is very low, here are details

Redemption Day |

Exit Load for liquid funds |

After first day |

0.0070% |

After second day |

0.0065% |

After third day |

0.0060% |

After fourth day |

0.0055% |

After fifth day |

0.0050% |

After sixth day |

0.0045% |

After seventh day |

Nil |

There is a major difference in taxation of liquid funds and arbitrage funds. For taxation purpose, arbitrage funds are treated as equity funds and they attract flat 15% tax on the short term capital gains if sold before one year. 10% if sold after 1 year. If the liquid fund investment is held for less than 3 years, then it is taxed as per the tax bracket and if held for more than 3 years it is taxed at 20% with indexation benefit. For investor in highest tax bracket, investment in liquid funds may not be attractive in the short term.

Overall, both liquid funds and arbitrage funds have its own advantages and disadvantages depending on the type of investor. If you are an investor in 30% tax bracket, then only you should consider Arbitrage Funds as an investment.

Ultra-short duration funds are open ended debt schemes which invest in bonds or debt instruments which have a Macaulay duration of 3-6 moths and therefore create a portfolio that has an average residual maturity of less than 6 months. Normally, investors can expect returns of around 5-8% from ultra-short duration funds. Ultra-short duration schemes which take some extra risk also have the potential to offer extra returns. These schemes have low impact from change in interest rate scenarios so doesn’t have high interest rate risk but may have an element of credit risk in them. It is very important that investor understand what kind of Credit risk fund manager is taking to get extra alpha in returns in this category. Unlike Liquid Funds, where funds are not allowed to buy low credit risk paper, no such restriction is applicable in this category. Example, now closed scheme Franklin Ultra Short Bond Fund took high credit risk for getting extra returns. This allowed this fund to give much better returns in the past but covid tested its credit risk and therefore had to be closed down. On other hand, fund like Canara Robeco Ultra Short Term Fund take very low credit risk and therefore mostly the returns have been below category average but is safer compared to others in the category.

These funds generally invest in treasury bills short term commercial papers and certificate of deposit that is CP and CDs of maturity value up to 180 days. These fund also have very minimum amount of risk associated with them.

Ultra short duration funds have the capability of providing returns ranging from 4% to 7%.

Top Performing Ultra Short Term Mutual Funds

>> PGIM India Ultra Short Term Fund

>> Aditya Birla Sun Life Savings Fund

>> ICICI Prudential Ultra Short Term Fund

>> IDFC Ultra Short Term Fund

>> SBI Magnum Ultra Short Duration Fund

>> Kotak Savings Fund

>> HDFC Ultra Short Term Fund

>> Invesco India Ultra Short Term Fund

>> L&T Ultra Short Term Fund

>> Axis Ultra Short Term Fund

>> Baroda Ultra Short Duration Fund

>> Quant Money Market Fund

>> BOI AXA Ultra Short Duration Fund

>> IDBI Ultra Short Term Fund

Average Performing Ultra Short-Term Mutual Funds

>> Principal Ultra Short Term Fund

>> Canara Robeco Ultra Short Term Fund

>> Essel Ultra Short Term Fund

>> DSP Ultra Short Fund

Worst Performing Ultra Short-Term Mutual Funds

>> UTI Ultra Short Term Fund

>> Nippon India Ultra Short Duration Fund

>> JM Ultra Short Duration Fund

>> Motilal Oswal Ultra Short Term Fund

>> Mahindra Ultra Short Term Yojana

>> YES Ultra Short Term Fund

>> Sundaram Ultra Short Term Fund

>> Tata Ultra Short Term Fund

>> Indiabulls Ultra Short Term Fund

Low duration funds invest in short term debt securities to create a portfolio whose average duration is between 6-12 months. These funds have higher risk as compared to liquid funds & Ultra Short Term Fund because they invest in assets of longer maturity and can take credit risk as well. Investors looking to park their money for 6-18 months can park their money in these funds.

These schemes have comparatively lower impact from change in interest rate scenarios as duration is less than 1 year so doesn’t have high interest rate risk but may have an element of credit risk in them. It is very important that investor understand what kind of Credit risk fund manager is taking to get extra alpha in returns in this category. Example, HDFC Low Duration takes little extra risk on both Interest Rate & Credit risk by having Duration on higher end of 6-12 months and comparatively higher AA rated papers than category average and hence has given good returns too whereas UTI Treasury Advantage Fund takes much lower risk by keeping duration on lower end of 6-12 Duration limit and no AA or below papers. Due to this, the fund’s returns have also been lower than category. So, you have to be very careful while fund selection.

Low duration funds have the capability of providing returns ranging from 4% to 7.5%.

Top Performing Low Duration Mutual Funds

>> Invesco India Treasury Advantage Fund

>> Axis Treasury Advantage Fund

>> DSP Low Duration Fund

>> ICICI Prudential Savings Fund

>> IDFC Low Duration Fund

>> SBI Magnum Low Duration Fund

>> Aditya Birla Sun Life Low Duration Fund

>> Kotak Low Duration Fund

>> Canara Robeco Savings Fund

>> HDFC Low Duration Fund

>> Mahindra Low Duration Bachat Yojana

Average Performing Low Duration Mutual Funds

>> BNP Paribas Low Duration Fund

>> Nippon India Low Duration Fund

>> Mirae Asset Savings Fund

>> Franklin India Low Duration Fund

>> L & T Low Duration Fund

Worst Performing Low Duration Mutual Funds

>> LIC MF Savings Fund

>> Tata Treasury Advantage Fund

>> Sundaram Low Duration Fund

>> HSBC Low Duration Fund

>> Edelweiss Low Duration

>> PGIM India Low Duration Fund

>> Principal Low Duration Fund

>> JM Low Duration Fund

>> Baroda Treasury Advantage Fund

Money market funds invest in money market instruments with maturity of up to 1 year. These instruments are certificate of deposits, commercial papers, treasury bills etc. We have discussed in detail about them in Section II. Funds in this category has flexibility to have modified duration of 1 month to 12 months, so you will have fund with varied Modified Duration & Average Maturity range in this category. Example – DSP Savings Fund has Average Maturity of only 13 days as of Mar 2021 whereas Tata Money Market Fund has average maturity of about 10 months. Both belong to same category – Money Market Funds. So, when you are investing do understand the kind of fund you want to invest.

If your investment horizon is around 1 year, this is a good category to invest. It gives fund manager little extra flexibility to play on interest rate cycle and being a Money Market funds, mostly invest in safer debt papers and have very low credit risk. Also, mostly, these funds do not have any Exit load so your investments are very liquid too.

These funds are also capable of providing Returns ranging from 4% to 7.5% based on the market situation.

Let’s have a look at some of the money market fund

>> L & T Money Market Fund

>> Franklin India Savings Fund

>> Nippon India Money Market

>> Invesco India Money Market Fund

>> JM Money Market Fund

>> Kotak Money Market

>> Aditya Birla Sun Life Money Manager Fund

>> UTI Money Market Fund

>> ICICI Prudential Money Market Fund

>> DSP Savings Fund

>> HDFC Money Market Fund

>> SBI Savings Fund

>> IDFC Money Manager Fund

>> Tata Money Market Fund

>> Sundaram Money Market Fund

>> Indiabulls Savings Fund

>> Axis Money Market Fund

>> Baroda Money Market Fund

>> Axis Money Market Fund

>> Baroda Money Market Fund

Short duration funds maintain the average duration of portfolio between 1-3 years. They invest in a wide gamut of instruments such as government securities, corporate bonds, derivatives, securitized debt, bonds issued by PSUs and financial institutions. In addition to these they also invest in money market instruments such as commercial papers, T-bills, Certificate of deposits, etc., to maintain sufficient liquidity.

From Short Duration Funds onwards, the risk in Debt Funds starts increasing – both Credit & Interest Rate Risk. As the duration of the funds increases both Credit & Interest rate risk increases too. Credit risk taken by funds in this category is mostly low but there are exceptions like Franklin India Short Term Income Plan which took much higher credit risk but then had to close down the scheme due to liquidity issue during Covid..

With that extra risk, these funds can also provide better returns esp. in falling interest rate scenarios. A good category to invest in for medium to high risk taking debt investors. While choosing the fund in this category, do check the range of Modified Duration in which your fund operates and does it match with your horizon and also the credit risk the fund takes.

Example – As on Mar 2021, BOI AXA Short Term Income Fund has Modified Duration is close to 1 year whereas Principal Short Term debt fund has Modified Duration of close to 2.5 years. Here, BOII AXA’s fund takes much lower interest rate risk compared to Principal’s fund (of course this can change in future).

Top Performing Short Duration Fund

>> IDFC Bond Fund - Short Term

>> Axis Short Term Fund

>> HDFC Short Term Debt Fund

>> Kotak Bond Short Term Plan

>> ICICI Prudential Short Term Fund

>> SBI Short Term Debt Fund

>> Nippon India Short Term Fund

>> L&T Short Term Bond Fund

>> Mirae Asset Short Term Fund

>> Invesco India Short Term Fund

>> DSP Short Term Fund

>> Tata Short Term Bond Fund

>> Aditya Birla Sun Life Short Term Fund

>> Baroda Short Term Bond Fund — Plan A

>> Canara Robeco Short Duration Fund

Average Performing Short Duration Fund

>> BNP Paribas Short Term Fund

>> Franklin India Short Term Income Plan

>> Indiabulls Short Term Fund

Worst Performing Short Duration Mutual Fund

>> IDBI Short Term Bond Fund

>> PGIM India Short Maturity Fund

>> HSBC Short Duration Fund

>> Edelweiss Short Term Fund

>> Principal Short Term Debt Fund

>> JM Short Term Fund

>> Sundaram Short Term Debt Fund

>> BOI AXA Short Term Income Fund

>> LIC MF Short Term Debt Fund

All these funds basically differ on the basis of Macaulay Duration. Macaulay duration is the weighted average maturity of bonds in a portfolio, factoring in all the cash flows. Ultra-short duration schemes are open--ended debt schemes investing in instruments with Macaulay duration between three months and six months. Investors can park their money for a few months to a year in them. Ultra-short duration funds are least impacted by the interest rate movement in the system. So, lowest risk category out of these.

Low Duration Funds invest in instruments with Macaulay Duration of the fund is between six and twelve months. They invest in money market instruments and debt securities. Investors who have an investment horizon of 6-12 months and lower risk tolerance can benefit from investing in low duration funds.

Short term funds are debt funds that lend to companies for a period of 1 to 3 years. These funds mostly take exposure only in quality companies that have proven record of repaying their loans on time as well as have sufficient cash flows from their business operations to justify the borrowing. But out of these three – this is the highest risk category, both in terms of interest rate and credit risk too.

Medium duration funds maintain Macaulay duration of portfolio in between 3-4 years. So, since higher Modified Duration, it means higher interest rate risk. The range of the duration given by SEBI is pretty low and therefore, interest rate wise, all the funds in this category have similar interest rate risk.

Currently (at the time of writing), there is one Index Fund too in this category - BHARAT Bond FOF - April 2025. These index funds have fixed maturity date and therefore their category keeps on changing as their maturity date changes. More details about them in Q54 These funds mostly take low credit risk but there is no restriction on credit risk they can take. So, while selecting the fund in this category, do check the type of debt securities these fund invest in and their credit rating.

Example –

As on March 2021, Credit risk taken by Aditya Birla SL Medium Term Fund is much more with almost 18% securities in A or below rated papers than fund like SBI Magnum Medium Term Fund with only 2% securities in A or below rated papers. Though Modified Duration of both is similar. So, while you invest in this category, you should definitely check the Credit risk taken by the funds and then invest if it suits your risk profile or not.

Also, in addition to risk and returns, the expense ratio of fund should be checked. It is basically fee charged by fund to manage the portfolio. The lower the expense ratio, the higher will be the net returns to the investor.

These funds are also capable of providing good Returns ranging from 5 % to 8.5%.

Top Performing Medium Duration Mutual Fund

>> IDFC Bond Fund - Medium Term Plan

>> SBI Magnum Medium Duration Fund

>> HDFC Medium Term Debt Fund

>> Sundaram Medium Term Bond Fund

>> ICICI Prudential Medium Term Bond Fund

>> Kotak Medium Term Fund

>> L&T Resurgent India Bond Fund

>> Axis Strategic Bond Fund

Average Performing Medium Duration Fund

>> UTI - Medium Term Fund

>> Franklin India Income Opportunities Fund

>> Indiabulls Income Fund

Worst Performing Medium Duration Fund

>> DSP Bond Fund

>> BNP Paribas Medium Term Fund

>> Aditya Birla Sun Life Medium Term Plan

>> Tata Medium Term Fund

>> Nippon India Strategic Debt Fund

Long duration funds are funds which have invested in instruments having a Macaulay duration of 7 years or more. These funds inherently carry high risk than other debt funds, since they are exposed to an entire economic cycle. They are extremely sensitive to interest rate changes and so their returns are hit badly when market interest rates go up. Debt Fund Investors who want to park their funds for a long duration and are ready to bear high risk can go for these funds.

Currently (at the time of writing), there are two Index Funds too in this category - BHARAT Bond FOF - April 2030 and BHARAT Bond FOF - April 2032. These index funds have fixed maturity date and therefore their category keeps on changing as their maturity date changes. More details about them in Q54

Apart from these index funds, this is a very small category with only 2 more funds and not so popular as most of the very long term investors prefer Gilt category more than Long Duration category due to low Credit risk.

And the returns of long duration for Orange range of 5% to 8.5%.

Let’s look at long duration debt fund

>> ICICI Prudential Long Term Bond Fund

>> Nippon India Nivesh Lakshya Fund

Medium to Long Duration Fund is an open ended mutual fund scheme. These debt mutual fund schemes invest in debt and money market instruments with Macaulay duration between 4 to 7 years . The maturity period of the investment portfolio is higher than that of short duration and medium duration debt funds and therefore clearly has higher interest rate risk and higher volatility than those two categories. This long lending horizon makes them extremely vulnerable to changes in interest rates due to the reversal of economic or business cycle. Also, credit risk profile of different funds in the category can also differ like we discussed in Medium Term Category.

Example –

As on March 2021, Credit risk taken by UTI Bond Fund is much more with 13% securities in A or below rated papers including 2 defaulted papers too whereas Tata Income Fund on other hand has zero% allocation in A or below papers.

This is not a popular category and overall AUM in the funds is less than 10k Cr in Mar 2021 with about 14 funds in the category.

Top Performing Medium to Long Duration Mutual Fund

>> Nippon India Income Fund

>> ICICI Prudential Bond Fund

>> Canara Robeco Income Fund

>> SBI Magnum Income Fund

>> HSBC Debt Fund

>> IDFC Bond Fund - Income Plan

>> Aditya Birla Sun Life Income Fund

>> Kotak Bond - Regular Plan

>> LIC MF Bond Fund

Average Performing Medium to Long Duration Mutual Fund

>> Tata Income Fund - Regular Plan

>> HDFC Income Fund

Worst Performing Medium to Long Duration Mutual Fund

>> UTI Bond Fund

>> JM Income Fund

Banking & PSU funds are open ended schemes which predominantly invest in debt instruments of private and public sector banks as well as PSUs and public financial institutions. There is no duration specific restrictions in this category. You will find fund’s with very diverse Modified duration in this category and hence very different interest rate risk. Example – As on Mar 2021, Sundaram Banking & PSU Fund has Modified Duration of only 4 months whereas Edelweiss Banking & PSU Fund has Modified Duration of 5.8 Years!

Fund Manager can take call on the interest rate cycle and can change the Average Maturity of the fund as per their view too. So, you need to be very careful while choosing this fund from interest rate perspective. So, you will be exposed to Fund Manager specific interest rate view too. The idea of this category was to invest in only banks related debt papers of debt papers issued by PSUs which are usually backed by sovereign guarantee. Therefore, this category is considered a safe category from credit risk perspective. But recently with AT1 bonds write down of Yes Bank and also SEBI’s new AT1 bonds norm ,few of these funds took some credit beating too.

Overall, this is a very popular category (more than Rs 1 Lakh Cr AUM as of Mar 2021) due to mostly low Credit risk and good range of Average maturity options to invest in.

And therefore the Returns in banking and PSU funds is in range of 6.5% To 8.5%.

Top Performing Banking and PSU Mutual Fund

>> Axis Banking & PSU Debt Fund

>> IDFC Banking & PSU Debt Fund

>> Edelweiss Banking and PSU Debt Fund

>> Franklin India Banking & PSU Debt Fund

>> Kotak Banking and PSU Debt Fund

Average Performing Banking and PSU Fund

>> LIC MF Banking & PSU Debt

>> Nippon India Banking & PSU Debt Fund

>> SBI Banking and PSU Fund

>> HDFC Banking & PSU Debt Fund

>> PGIM India Banking & PSU Debt Fund

>> Aditya Birla Sun Life Banking & PSU Debt Fund

>> DSP Banking & PSU Debt Fund

>> Invesco India Banking & PSU Debt Fund

>> L&T Banking and PSU Debt Fund

>> ICICI Prudential Banking & PSU Debt Fund

Worst Performing Banking and PSU Fund

>> UTI-Banking & PSU Debt Fund

Like Banking & PSU Funds, this category also doesn’t have any restriction specific to Modified Duration and fund manager has flexibility to take any type interest rate calls. Only restriction in this category is that fund manager has to buy mm 80% Corporate Bonds (not G-secs) and that too AAA or A1 + rated papers only. So, similar to Banking & PSU Funds, these funds also have low credit risk due to restrictions on only highly rated papers. But remember, Credit ratings given by rating agencies doesn’t come with any guarantees, in the past few top rated debt papers have become junk in matter of days example IL&FS.

Since Credit risk of this whole category is mostly very low, while selecting the right fund, you should be careful about the interest rate risk the fund is taking and it varies a lot like in Banking & PSU category.

Example —

As on Mar2021, DSP Corporate Bond Fund Modified Duration is near 1 year which shows low interest rate volatility whereas L&T Triple Ace Bond Fund in the same category has modified duration of 5.4 years which shows high sensitivity to interest rate changes.

Overall, this is a very popular category (more than Rs 1.5 Lakh CrAUM as of Mar 2021)due to mostly low Credit risk and good range of Average maturity options to invest in.

Corporate Bond funds can provide returns ranging from 6% to 8.5% depending on the market condition.

Top Performing Corporate Bond Mutual Fund

>> DSP Corporate Bond Fund

>> L&T Triple Ace Bond Fund

>> UTI Corporate Bond Fund

>> Sundaram Corporate Bond Fund

>> Invesco India Corporate Bond Fund

>> HDFC Corporate Bond Fund

>> Franklin India Corporate Debt Fund — Plan A

>> Kotak Corporate Bond Fund

>> Aditya Birla Sun Life Corporate Bond Fund

>> Canara Robeco Corporate Bond Fund

Average Performing Corporate Bond Mutual Fund

>> PGIM India Premier Bond Fund

>> IDFC Corporate Bond Fund

>> Nippon India Prime Debt Fund

Worst Performing Corporate Bond Mutual Fund

>> Axis Corporate Debt Fund

>> Union Corporate Bond Fund

>> BNP Paribas Corporate Bond Fund

>> Edelweiss Corporate Bond Fund

>> Tata Corporate Bond Fund

Credit risk funds invest minimum 65% of its total corpus in not so highly rated bonds i.e., bonds having rating AA or below that. The reason why it is called credit risk fund is that it takes high credit risk by investing in less rated papers. But higher the risk, higher can be the return. Like Corporate Bond and Banking & PSU funds, this category doesn’t have any restriction on Modified Duration, so each fund can keep the Average Maturity & Modified Duration of the fund as per their interest rate view.

These funds follow accrual strategy to provide better returns. Accrual strategy is nothing but investing in bonds with lower ratings with a hope that the ratings will improve in the future. This category was popular till 2018 as it gave very good returns as default rate was low in bonds and extra risk was getting paid with extra returns. But since 2018, with series of companies defaulting on their payments like Amtek Auto, Zee, DHFL and many more small companies due to stricter NPA regime by GoI, this category took max hits on the returns. Among all debt categories, this category gave worst returns in 2019 and 2020, many funds gave negative returns too. This category is clearly the highest risk category for Debt Fund investors.

With bad experience in 2019 & 2020, many of the funds have reduced their credit risk profile even this category. Ideally, it is a category which retail investors should avoid, if you want to invest, do check the credit risk and interest rate risk these funds take. Example, As on Mar 2021, Nippon Credit Risk fund has about 50% of investments in unrated bonds (which can be very high risk) whereas IDFC Credit Risk Fund has only 5% in A or below rated papers (including unrated).

Top Performing Credit Risk Mutual Fund

>> IDFC Credit Risk Fund

>> ICICI Prudential Credit Risk Fund

>> Kotak Credit Risk Fund

>> HDFC Credit Risk Debt Fund

Average Performing Credit Risk Mutual Fund

>> Mahindra Credit Risk Yojana

>> SBI Credit Risk Fund

>> Franklin India Credit Risk Fund

>> Axis Credit Risk Fund

Worst Performing Credit Risk Mutual Fund

>> PGIM India Credit Risk Fund

>> Baroda Credit Risk Fund — Plan A

>> L&T Credit Risk Fund

>> Aditya Birla Sun Life Credit Risk Fund

>> Nippon India Credit Risk

>> Principal Credit Risk Fund

>> Principal Credit Risk Fund

>> DSP Credit Risk Fund

>> Invesco India Credit Risk Fund

>> UTI Credit Risk Fund

>> IDBI Credit Risk Fund

>> Sundaram Short Term Credit Risk Fund

>> BOI AXA Credit Risk

Gilt funds are a type of mutual funds which invest exclusively in government securities. When Government of India requires any funds, it borrows from RBI. RBI, on behalf of GoI raises funds by issuing government securities, in which Gilt fund manager invests. These funds invest 80% of its total assets in government securities of varying maturity. Gilt funds have higher liquidity as the secondary market of Government securities is active and have good volumes. Most of the gilt funds do not charge any exit load on redemption. Since gilt funds invest only in government securities, their credit risk is negligible. It is not compulsory to buy only Central Government Securities but they can buy the State Government Securities as well.

There are no restrictions of Duration in this category but funds majorly invest in long term debt only and not much in Treasury Bills (Short Term Debt) of GoI. These funds mostly have high Interest rate risk as their Modified duration (MD) is high. Please check their MD before buying these funds and check if it matches your investment horizon.

Example – As on March 2021, LIC MF Government Securities Fund has MD of 2.5 years whereas on other hand, Edelweiss Government Securities Fund has MD of 8.2 which shows much higher interest rate risk than LIC’s funds.

The returns can be in the range of 6% to 8%.

Top Performing Gilt Mutual Fund

>> Nippon India Gilt Securities Fund

>> IDFC G Sec Fund — Investment Plan

>> UTI Gilt Fund

>> Edelweiss Government Securities Fund

>> Aditya Birla Sun Life Government

>> Securities Fund

>> SBI Magnum Gilt Fund

>> DSP Govt Sec Fund

>> PGIM India Gilt Fund

>> LIC MF G-Sec Fund

>> Axis Gilt Fund

>> ICICI Prudential Gilt Fund

Average Performing Gilt Fund

>> Canara Robeco Gilt Fund

>> Tata Gilt Securities Fund — Appreciation Gilt Fund

>> Kotak Gilt — Investment — PF and Trust

>> Kotak Gilt — Investment

>> Invesco India Gilt Fund

Worst Performing Gilt Fund

>> Baroda Gilt Fund - Plan A

>> L & T Gilt

>> HDFC Gilt Fund

>> Franklin India Government Securities Fund

>> IDBI Gilt Fund

Gilt Funds with 10 Year Constant Duration are Debt Funds investing a minimum of 80 percent of their assets in government securities issued by the Reserve Bank of India (RBI) with Macaulay Duration of the portfolio equal to 10 years. Main difference between this category and Gilt Funds category is that here SEBI has restricted the Duration of the fund too unlike in Gilt funds where funds can invest in Govt securities of any duration they like. So, in this category, all funds have very low credit risk and similar interest rate risk (which is very high) too. It is a relatively very small category with only 4 funds as on Mar 2021 and total AUM of less than Rs. 2000 Cr.

Top Performing Gilt Fund with 10 Year Constant Duration Mutual Fund

>> IDFC G Sec Fund — Constant Maturity Plan

>> ICICI Prudential Constant Maturity Gilt Fund

>> SBI Magnum Constant Maturity Fund

Average Performing Gilt Fund with 10 Year Constant Duration

>> DSP 10Y G-Sec Fund

Dynamic bond funds are debt funds that invest in bonds across maturity. Maturity is adjusted based on market conditions to improve returns for the investors. These funds are constructed in a way that allows fund managers to use interest rates movements in the economy as an opportunity to generate higher returns. This is done by increasing or reducing the lending duration depending on whether the interest rates are heading down or up.

These are suitable for investors who want to invest money for longer duration, for at least 3-5-year investment horizon. Tend to generate higher returns than funds returns but takes a higher risk too. Bond funds are impacted by interest rates in the market. When the rates go down, long duration bond funds are rewarded the most. However, in a higher interest rate scenario the long duration funds lose out badly. Dynamic bond funds are thus considered a good way of tiding over such volatility in the bond market because of their flexibility to switch to short term securities.

The fund manager’s role in these schemes is very crucial. The fund manager’s view of interest rate can lead to good returns in these schemes, but if the call goes wrong, investors can lose money. So, here the fund manager risk is highest among all as from SEBI’s regulation perspective, there is no restriction on Duration as well as on Credit Risk profile.

Fund Manager selection becomes very important in this category as wrong fund manager calls can give even negative returns to investors like ABSL Dynamic Bond Fund was very popular fund but gave negative returns in 2019 due to some wrong interest rate and credit calls. Interest Rate calls of the fund manager can be very different, as of March 2021, Nippon India Dynamic Bond fund is carrying bonds with Modified Duration of about 6.5 Years whereas Canara Robeco Dynamic Bond Fund is carrying bonds with Modified Duration of just 1.5 years. So very wide difference.

And the returns of dynamic Bond fund is in range of 5%to9%.

Top Performing Dynamic Bond Mutual Fund

>> SBI Dynamic Bond Fund

>> Edelweiss Dynamic Bond Fund — Retail Plan

>> Kotak Dynamic Bond Fund

>> Mirae Asset Dynamic Bond Fund

>> Axis Dynamic Bond Fund

>> PGIM India Dynamic Bond Fund

>> IDFC Dynamic Bond Fund

>> HSBC Flexi Debt Fund

>> Union Dynamic Bond Fund

>> ICICI Prudential All Seasons Bond Fund

>> Indiabulls Dynamic Bond Fund

>> Quantum Dynamic Bond Fund

>> L&T Flexi Bond Fund

Average Performing Dynamic Bond Mutual Fund

>> Nippon India Dynamic Bond Fund

>> Canara Robeco Dynamic Bond Fund

>> IIFL Dynamic Bond Fund

>> BNP Paribas Flexi Debt Fund

>> Franklin India Dynamic Accrual Fund

>> Tata Dynamic Bond Fund

Worst Performing Dynamic Bond Mutual Fund

>> JM Dynamic Debt Fund

>> Quant Dynamic Bond

>> IDBI Dynamic Bond Fund

>> HDFC Dynamic Debt Fund

>> Aditya Birla Sun Life Dynamic Bond Fund

>> Principal Dynamic Bond Fund

>> UTI-Dynamic Bond Fund

>> Baroda Dynamic Bond Fund - Plan A

Debt funds that invest 65% of their money in Floating-rate bonds are called Floater funds. The interest rates on these bonds are market linked. Therefore, bond’s interest rate changes with changing interest rate scenario in the debt market.

These funds typically do well when interest rates are set to rise since the floating rate bonds reset their yields as per the prevailing interest rates and with increasing yields, the investors will get benefit. But this is not as simple as it appears because there aren’t many issuers of floating rate bonds (esp. in low interest rate scenarios). Thus, these funds employ a derivative strategy to comply with the minimum 65% investment in floating rate bonds by using a combination of fixed rate bonds and Interest Rate Swaps.

In an interview to Morningstar, Anju Chhajer, Senior Fund Manager, Nippon India Mutual Fund, who manages Nippon India Floating Rate Fund explains the strategy she adopts in this fund. “There are two strategies used in this fund. Firstly, we buy fixed rate bonds, when there is a lack of availability of floating bonds, and convert them into floating rate bonds through Overnight Index Swaps or, OIS. The combination of fixed bonds and OIS also adds liquidity to the portfolio as both instruments are liquid. A floating rate bond does not mean zero interest rate risk. In the second strategy, we buy floating rate bonds. The OIS curve and bond curve do not move parallel always. Bond yields have dropped and OIS curve has not moved down parallel. Hence, we have made money in both segments of the market. We also benefited from higher carry. These funds aim to make money in falling interest rate scenario through the spread. The three-year OIS curve has been in a range in the last 6 months. Since there aren’t enough floating rate bonds in the market. We have to buy at the right spread.”

One of the biggest advantages of this fund is its lowest degree of sensitivity to changes in interest rates and hence have lower interest rate risk compared to longer duration funds category.

The average maturity of this category is around 2-2.5 years thus in this context investors should compare it with the short duration category. Investors can also expect floater funds to be less volatile vis-à-vis the short duration category. However, floating funds are not credit risk proof but mostly take very low credit risk. Expense ratio in the category varies a lot ranging from 0.2 to 0.7. So, do take care of this aspect before investing. Relatively a small category with only 10 funds in the portfolio.

Top Performing Floater Fund

>> Aditya Birla Sun Life Floating Rate Fund

>> Nippon India Floating Rate Fund

>> HDFC Floating Rate Debt Fund

>> ICICI Prudential Floating Interest Fund

>> UTI — Floater Fund — Regular Plan

>> Franklin India Floating Rate Fund

Capital Protection Funds are Closed ended Debt oriented funds. The objective of capital protection funds is to preserve the capital of the investors. Majority of the investments are made in AAA-rated bonds which have very less chance of defaulting. Therefore, they minimise the risk of capital loss.

Capital protection funds typically invest a major share, about 80% of the total investment amount into highly secure debt instruments like AAA rated bonds. The remaining 20% of the amount is invested in riskier avenues like equity. The design of the fund thus protects the principal, regardless of how the equity market fares during economic downturns, the principal amount is protected.

The maturity of the debt portfolio and the lock-in period of the funds are aligned, which further protects it from volatile interest rate movements. The chances of interest rate fluctuation related market-to-market losses are also averted as these debt instruments are held till the time of maturity. These are close-ended funds with a term usually between 1, 3 and 5 years, offering a conservative investment option.

These funds provide superior downside risk protection during a market downturn but offer limited upside during market upturns. They are suitable for conservative investors with a low-risk appetite. These funds provide even the most conservative investors an opportunity to invest a small part of their portfolio in equity, thereby giving them the scope to participate in equity market upturns. SBI, UTI, Nippon & ICICI AMCs regularly launch these Capital Protection Funds though overall category is small with less than Rs 10k Cr AUM in the category as of March 2021.

Capital protection funds are very similar to Conservative hybrid funds in investment and objective aspect. The main point of difference between the two is that Capital protection funds are close-ended funds whereas, Conservative hybrid funds are open-ended funds. Investment in Capital Protection Funds can be done only in NFO period. Conservative hybrid funds are available for subscription and repurchase on a continuous basis. There is no fixed maturity period. Investors have the option to buy and sell units at NAV which is declared on a daily basis. Both the categories are treated as Debt funds for income tax purpose as equity investment is less than 65% in both.

Fixed Maturity Plans (FMPs) are close-ended debt mutual funds that mature after completion of a pre-determined time period. Investments in an FMP can only be made during the new fund offer (NFO) period. Subsequent to completion of the NFO period, no new investments can be made into an FMP scheme. Fixed maturity plan investments can be redeemed only after the scheme has matured and no premature redemption of units are allowed during the interim.

The following are the key features of these schemes:

>> They have a fixed tenure:

Investments are essentially locked-in till maturity, which is usually more than 3 years from the date of unit allocation. .

>> They potentially have Low Interest Rate Sensitivity:

Since a majority of the investments made by these schemes are held till maturity hence FMPs tend to feature low levels of interest rate sensitivity.

>> They have Low Credit Risk:

A majority of investments made by FMPs are made into high quality debt and money market instruments that feature potentially low levels of credit risk for investors. Still, there have been some credit defaults in FMPs too, so do check the type of credit risk fund is taking by checking their rating and type of debt papers.

>> Indexation Benefits on Returns:

A majority of new FMPs feature a maturity period of 3 years or more. This ensures that long term capital gains taxation rules including indexation benefits are applicable to capital gains from these non-equity investments. Indexation provides investors the benefit of factoring in inflation, which reduces overall tax liability on gains.

>> Low Liquidity:

Since redemption of scheme units cannot be made prior to maturity of the FMP schemes, these funds have potentially low levels of liquidity.

>> Locked-In Rates:

While locked-in rates are an excellent choice during a falling interest rates regime, the same can become a problem during a period of rising interest rates. When market rates move upwards, locked-in rates can lead to missed opportunities with respect to potentially higher returns coupled with possibly lower risk levels.

>> Returns Not Guaranteed:

Fixed Maturity Plans provide investors with the benefit of locked-in returns from instruments held till maturity and high quality investments minimize the credit risk for investors. That said, low potential risk does not mean zero risk for the investors and returns from FMPs are still market-linked. As a result, returns from FMPs are not guaranteed unlike other fixed return instruments such as fixed deposits.

Fixed maturity plans may be considered similar to fixed deposits. While these investments are similar in terms of the fact that they have fixed investment tenure, the following are some key differences between fixed maturity plans and fixed deposits.

FDs assures fixed returns and hence offer more security but FMPs interest rates are not guaranteed like FDs

In FDs, the interest income is added to the investor's income and is taxable at the applicable tax slab, also known as marginal rate of tax. Fixed maturity plans, in most cases, have a maturity plan of 3 years. Hence, these plans are taxed as Debt funds for the long term and Long-Term Capital Gains of 20% with indexation is applied.

FDs offer a premature withdrawal facility therefore; they have more liquidity. FMPs are generally meant for investors who do not mind keeping their money locked-in for at least a period of three years, therefore, have less liquidity. Even though FMPs are listed on exchange for secondary trading but there is hardly any liquidity there.

Since returns on FDs are fixed, they generally make an investor feel more secure than FMPs. FMPs are exposed to credit risk as well as reinvestment risk. Credit risk is the possibility of default in one or more of their underlying papers. Reinvestment risk is the possibility that the maturity proceeds will be reinvested at lower rates in future.

20. Debt ETFs (Debt Exchange Traded Funds)

The Bharat Bond ETF is India’s first corporate debt ETF. Companies approach the firm managing the bond ETF with their borrowing requirements. The bond ETF raises funds from investors and hands them over to the underlying companies for a fixed tenure. Once the tenure is over, these companies return the amounts back to the ETF, which then passes it on to the investors. The units of both the ETFs will be listed on the stock exchanges where they can be traded. Bharat Bond ETFs currently only have PSU bonds only and we are sure more such ETFs will be launched in near future with wider corporate bonds.

The corporate bond market, where NCDs and other debt instruments are issued by companies, remains fairly illiquid. That is, there aren’t enough buyers and sellers of these securities in the secondary market and therefore price discovery for such bonds become complicated. Now, with Debt ETFs corporates will collectively issue fresh securities. The ETF also can pick up already-issued and existing securities of the same companies with the same maturity and converts them into an investment basket. As the ETF units are bought and sold (similar to Equity ETFs), the underlying securities too get traded (through the market makers that the fund house appoints) and thereby become more liquid.

Specifically, to Bharat Bond ETF, The ETF does not carry credit risk. It invests in only AAA-rated State-owned firms.

Case of Rating downgrade or default –

The bond ETF needs to be agile if an underlying company defaults on its interest or principal payments, or even if its credit rating falls. If a company gets downgraded, but still remains an investment-grade paper, the indices will remove the security at the subsequent rebalancing date. The ETF will also simultaneously exit the security. But between the downgrade and the exit, the security’s price can drastically go down and impact the scheme’s net asset value.

If the underlying security defaults, then there’s a bigger problem. ETF will remove a defaulting security, but at a price that is found reasonable. This can cause a setback to the fund, though a in case of Bharat Bond ETF, state-owned AAA-rated defaulting is a rare occurrence. Bharat Bond ETF has a provision for a segregated portfolio, like most other open-ended debt funds.

Should you invest?

The USP of such launches is that if held to maturity, these funds mimic fixed deposits (FDs). They pay a predictable (though not guaranteed) rate of return and do so with more tax efficiency than FDs. The return, roughly speaking, is the yield of the fund minus its expense ratio.

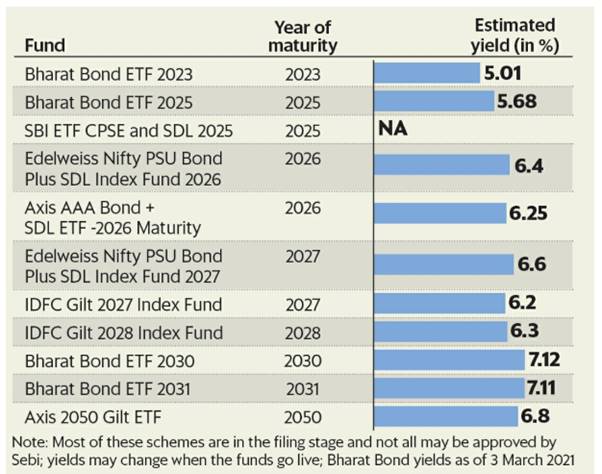

Many Debt Index Funds & ETFs are live & in pipeline after the success of Bharat Bond ETF as of March 2021. Here is the list collated by Livemint –

[Debt Exchange Traded Funds]

|