|

>> The AMC, like any company, has a profit and loss account and a balance sheet.

>> The money that the sponsor invests in the AMC would go towards its share capital (or share premium). The prescribed minimum net worth (share capital plus reserves) is 50 crore. This helps in meeting the infrastructure costs such as premises, furniture, software etc. relating to asset management and also various expenses until the operation breaks even.

>> Income for the AMC would be in the form of management fees earned from the schemes.

>> Expense would be in rent, infrastructure, systems development, salary cost of staff, corporate advertisements, issue expenses, etc. Further, to make a scheme attractive, the AMC may choose to bear certain expenses that it is otherwise permitted to charge to the scheme.

Recently, some AMCs adopted a practice of paying a high upfront commission to distributors of closed-end schemes. This meant an initial cash outgo for the AMC that would be recovered from the scheme during the tenor of the scheme through management fees.

>> When the recurring expenses of a scheme are more than the prescribed ceilings, the excess has to be borne by the AMC (or trustees or the sponsor).

>> If expenses are more than income, then the capital of the AMC gets eaten up. SEBI prescribes that the 50 crore minimum net worth is to be maintained at all times. The Trustees are obliged to review the net worth of the AMC quarterly, and ensure that any shortfall is made up.

>> It is mandatory for AMCs to make their financial statements available on their website. Unit holders may, if they so desire, request for the annual report of the AMC.

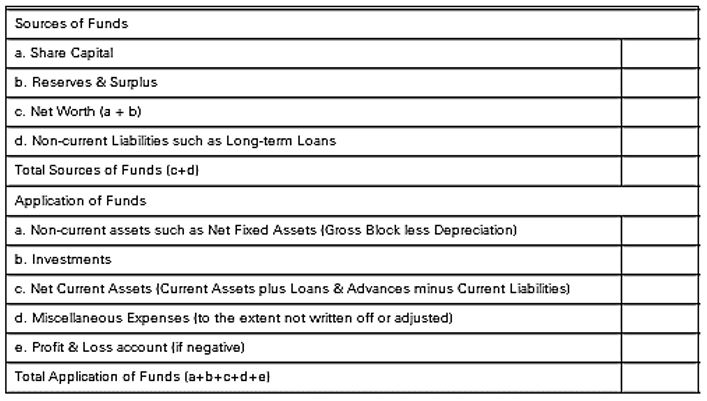

>> The balance sheet of AMCs, like that of any company, comprises the following heads of accounts:

[Balance Sheet of Asset Management Company-AMC]

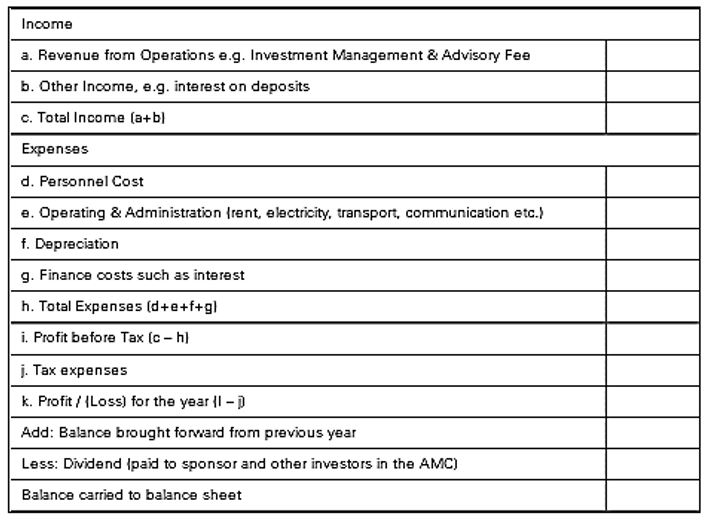

>> The Profit and Loss account of AMCs generally includes :

[Profit Loss of Asset Management Company-AMC]

>> The revenue account and balance sheet of the schemes are independent of the profit and loss account and balance sheet of the AMC. Each scheme would have its own revenue account and balance sheet.

>> During the NFO, when units are issued at face value, the money brought in by investors would become part of the scheme’s unit capital (on the liability side of the balance sheet) and bank account (on the asset side of the balance sheet).

>> Post-NFO, the money invested by investors in the schemes would go into the balance sheet of the scheme, split into unit capital, unit premium reserve and equalization reserve, to the extent of the NAV.

>> The load collected from investors would be shown in the scheme accounts, and accrue to the benefit of unit holders.

>> Income for the scheme would be in the form of interest, dividend and any capital gains realized.

>> Expenses for the scheme would be in the nature of trusteeship fees, agent’s commission, audit fees, registrar and transfer agent fees, management fees, etc. apart from any capital losses incurred.

>> The income, net of expenses and losses on investments sold, would be the profit or loss for the period.

>> The net appreciation or depreciation in investments held as at the end of the period would be added to the profit or loss for the period. This is a “below the line” adjustment. The balance would be carried to the balance sheet as reserves, subject to any dividend payout and additional tax thereon.

>> The appreciation or depreciation, as the case may be, in investments is calculated on the basis of valuation policies mandated by SEBI.

>> Often there are multiple options under a scheme, say, dividend option and growth option. The investment, income and expenses may be maintained for the entire scheme, and the profits or losses may then be apportioned between the options based on net assets to determine the NAV of each option.

>> The balance sheet of schemes comprises the following heads of accounts:

[Balance Sheet of Scheme under MF]

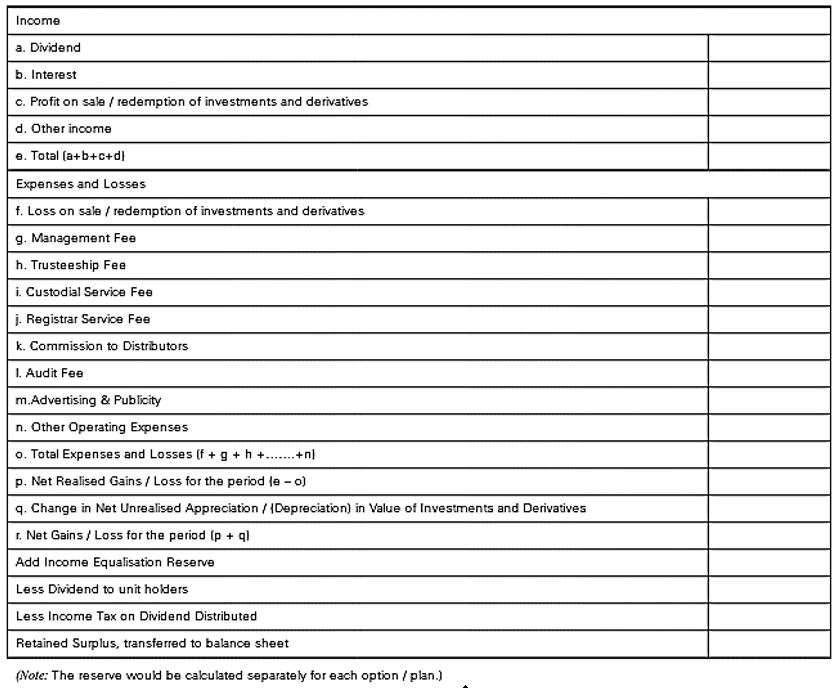

>> The revenue account of schemes comprises the following heads of accounts :

[Revenue Account of Scheme under MF]

>> Mutual funds are required to update the NAV and sale / re-purchase prices (other than for fund of funds) on the AMFI website (www.amfiindia.com) by 9 p.m every day.

>> Fund of fund schemes have time till 10 am on the following business day to upload the NAV and sale / re-purchase prices on the AMFI website.

>> NAVs have to be published daily in at least two daily newspapers. Fund of funds need to mention with an asterisk that the NAV information has a lag of one day / actual number of days of lag.

>> Total Expense Ratio of each scheme needs to be disclosed daily in downloadable spreadsheet format.

Scheme portfolio [including International Securities Identification Number (ISIN)] needs to be disclosed every month on the mutual fund website, in a user-friendly and downloadable format (preferably in a spreadsheet). The portfolio, as on the last day of each month, has to be disclosed on or before the 10th working day of the succeeding month. For example, portfolio as of 31 August 2018 has to be disclosed by 10 September 2018.

>> Within one month of the close of each half-year, i.e. 31st March and 30th September, mutual funds (i.e. the schemes) are required to publish their unaudited financial results as per the prescribed format along with other mandated disclosures, such as:

- Effect of changes in any accounting policies;

- Investments made in associate companies, payments to associate companies, etc.;

- Investments made in companies that have invested more than 5 per cent of the NAV;

- Large holdings (over 25 per cent of the corpus of the scheme), including information about the number of investors and total holdings by them in percentage terms. This also needs to be disclosed in allotment letters after initial public offerings, and in the annual results;

- Any bonus declared during the half-year in respect of the scheme;

- Borrowings above 10 per cent of the NAV;

- Exposure to derivatives above 10 per cent of the NAV;

- Deferred revenue expenditure; and

- Brokerage and commission paid to associates / related parties I group companies of sponsor / asset management company.

The half-yearly unaudited financial results have to be published in one national English daily newspaper and in a newspaper in the language of the region where the head office of the fund is situated.

Within 7 days of their publication, copies of the advertisement need to be filed with SEBI.

Similarly, within one month from the close of each half-year, namely 31St March and 30th September, mutual funds are required to publish their scheme portfolio in the prescribed format in one national English daily newspaper and in a newspaper in the language of the region where the head office of the fund is situated. The portfolio disclosure shall include:

Equity-oriented schemes — Portfolio turnover, name of industry against each security.

Debt-oriented schemes — Average maturity of portfolio.

Prescribed details of derivatives. Margin amounts paid are to be separately disclosed under cash and bank balances.

Instead of publishing the portfolio, the mutual fund can send the portfolio statement to unit holders within one month of the close of each half-year.

Besides, the portfolio statement is to be put up on the mutual fund web site in a user-friendly and downloadable format (preferably in a spreadsheet), and also filed with SEBI.

Abridged scheme-wise annual report has to be mailed to all unit holders not later than six months from the date of closure of the relevant accounting year. Also, the full and unabridged annual report has to be available for inspection at the head office of the fund and a copy made available to the unit holders on request on payment of nominal fees, if any.

In order to bring cost effectiveness in printing and despatch, and as part of a green initiative, mutual funds are now allowed to send the annual reports or abridged summary by e-mail instead of in a physical format, wherever the address is available. Mutual funds need to continue sending physical copy if they do not have a unit holder’s e-mail ID. They can however write to the investors asking for their e-mail ID. Investors have the right to ask for the physical copy.

The number of investors holding over 25 % of the NAV in a scheme and their total holdings in percentage terms need to be disclosed along with the annual results.

Brokerage and commission paid to associates / related parties / group companies of sponsor / asset management company need to be disclosed in the abridged scheme-wise annual report and the Statement of Additional Information.

The requirement of publishing the scheme-wise annual report or abridged annual report has been scrapped. However, it has to be featured in the AMC’s website. The AMC’s website has also, in turn, to be linked to AMFI’s website.

Mutual funds have to disclose on their websites, on the AMFI website, as well as in their annual reports, details of investor complaints received by them from all sources. The said details should be vetted and signed off by the trustees of the concerned mutual fund. The report is to be uploaded within 2 months of the end of the financial year.

The annual report of the AMC should be displayed on the website of the mutual funds. It should also be mentioned in the annual report of the mutual fund schemes that the unit holders, if they so desire, may request for a copy of the annual report of the AMC. |