As per the SEBI mandate, debt funds invest in multiple bonds or deposits issued by Government, Private or PSU companies depending on the riskiness and investment horizon. The source of return for these funds is majorly interest income and price appreciation (in case sold before the maturity). Similar to shares, bonds are also tradable in the secondary market to help in their price discovery. Price of bond is sensitive to interest rate movements in the market.

Debt funds are gaining popularity among investors as an alternative to Fixed Income investments. But before making any investment in debt mutual funds, there are certain parameters which should be considered –

> Average Maturity,

> Modified Duration,

> YTM, Credit Ratings,

> Segregated portfolios & Expense Ratios.

Debt funds invest in multiple fixed income or debt securities and each security in the portfolio may have a different maturity. A bond’s maturity date indicates the specific future date on which an investor gets his principal back i.e., the borrowed amount is repaid in full and bond cease to exist. Average Maturity is the weighted average of all the current maturities of the debt securities held in the fund. The weights are the percentage holding of each security in the portfolio. For e.g., a debt fund having an average maturity of 5 years constitutes debt securities held by the fund that, on an average, will mature in 5 years, though individual securities may have maturity different than 5 years.

Before investing in debt funds, it is advisable to have a look at the average maturity of the fund. The average maturity of the debt fund can be easily calculated with the help of maturity period of each security and the amount invested therein.

Let us consider the following example to understand in detail:

[Average Maturity in Debt Fund]

Consider a case where a debt fund holds three bonds each having maturity of 2 years, 3-years and 5-years respectively. The amount invested in 2-year bond is Rs. 30,000, in 3-year bond is Rs 10,000 and in 5-year bond is Rs 20,000. First, multiply the invested amount with the corresponding maturity period. The product of maturity and amount invested is given in the last column. Then, divide the total product (Maturity* Amount Invested) by the total amount invested to arrive at the average maturity of the debt fund i.e., 3.17 years in this example. So, the example shows that the average age of the debt fund is 3.17 years although individual bonds have a maturity which is different from 3.17 years.

The Average maturity of a fund tells you weighted average maturity of that fund which in turn represents interest rate sensitivity. Mutual funds with several long-maturity papers in its portfolio are more sensitive to NAV fluctuations. However, we believe modified duration is better indicator of interest rate sensitivity (refer Q58 on Modified Duration).

Remember, average maturity does not indicate the life of a debt fund. An open-end fund never matures. Illustratively, if you invest in a bond fund having an average maturity of six years, you don't have to hold the fund for six years, you can sell it the next day or after 20 years. Basically, what it means is that the maturity of a fund's bond holding is six years.

Average maturity of a fund portfolio undergoes a change with the passage of time. As a debt security approaches its maturity date, the length of time to maturity becomes shorter. Thus, even if a fund buys and holds a debt portfolio, the average maturity of a fund keeps on decreasing till the security held reaches its maturity date. Also, if a fund sells one security and buys a fresh one, it is obvious that its average maturity will change too since each security has its own maturity period.

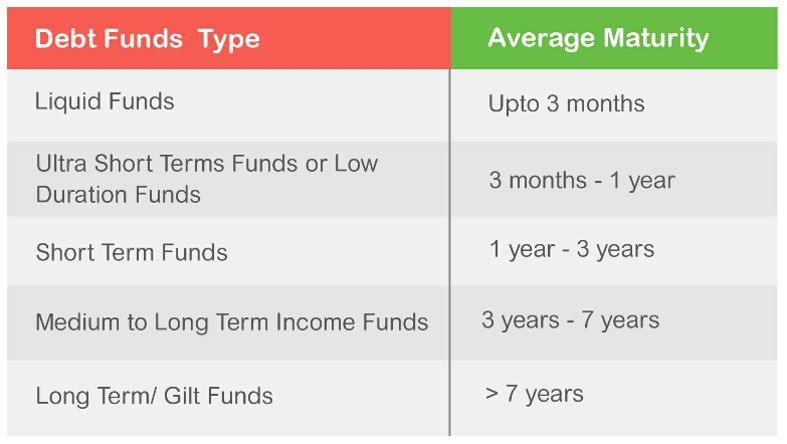

Debt Funds are classified based on maturity. A Debt Fund of any particular category makes sure that it keeps on changing the Debt portfolio to keep the Avg Maturity in this range always

[Average Maturity Range in Debt Fund]

– Note that, longer the average maturity, the higher is the interest risk associated with a debt fund. So, while shortlisting debt funds, you need to consider your investment horizon as the starting point and align it with the average maturity of the fund to ensure that it is in line with your time horizon. Even the credit risk is higher in higher Average maturity funds because more the maturity period, higher the chances of changes in credit rating in that time period.

Modified duration is the sensitivity of a debt fund to changes in interest rates. Higher modified duration means the fund is more sensitive to interest rate change.

The fact that two bonds have the same term to maturity does not mean that they have the same interest-rate risk. A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon bond with ten years to maturity makes substantial cash payments before the maturity date. Since the coupon bond makes payments earlier than the zero-coupon bond, we might guess that the coupon bond’s effective maturity that measures interest-rate risk is shorter than of zero-coupon bond. Indeed, that is exactly what it is and therefore concept of duration was born.

Duration helps an investor understand how sensitive a bond's value is to interest rate changes. There are several different types of duration calculations, but one involves what's known as modified duration and produces the percentage change in bond’s price for a given change in interest rates.

The easiest way to come up with the modified duration for a bond is to start by calculating another type of duration called Macauley duration. This type of duration produces the weighted average time in which the investor will receive cash flows from the bond. So, to calculate Modified Duration, we will first calculate Macauley Duration.

To calculate Macauley duration, you have to figure out the timing of all cash flows from the bond. Most bonds make relatively small interest payments and then make a big principal repayment at maturity.

Once you know how much and when all payments will be made, you have to time-weight their discounted values. To get discounted values, take the present value of each bond payment, discounted by the current yield to maturity (YTM). Keeping each present value separate, multiply the present value by the period in which the payment is made. For instance, with a ten-year bond paying annual interest payments, you'll multiply the present value of the first payment by 1 and the second payment by 2 and so on. Then add those numbers together and divide by the present value of all the bond's payments.

Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield. The concept of modified duration can be applied to interest-rate sensitive instruments with non-fixed cash flows, and can thus be applied to a wider range of instruments than can Macaulay duration. Modified duration is used more often than Macaulay duration.

Example, if Modified Duration of a Fund or Bond is 6%, then it means, with 1% change in interest rate, Bond’s price will change by 6%.

Maturity |

Interest Rate Change |

Bond Price Change |

10 Years |

+1% |

-6% |

10 Years |

-1% |

+6% |

Many times, the dual use of the word "duration", as both the weighted average time until repayment and as the percentage change in price, often causes confusion. Strictly speaking, Macaulay duration is the name given to the weighted average time until cash flows are received, and is measured in years as discussed. Modified duration is the name given to the price sensitivity and is the percentage change in price for a unit change in yield. Both measures are termed "duration" but it is important to keep in mind the conceptual distinctions between them.

Rules of Duration –

When thinking about duration, a few general rules apply. With everything else being equal:

• The duration of any bond that pays a coupon will be less than its maturity, because some amount of coupon payments will be received before the maturity date.

• The lower a bond’s coupon, the longer its duration, because proportionately less payment is received before final maturity. The higher a bond’s coupon, the shorter its duration, because proportionately more payment is received before final maturity.

• Because zero coupon bonds make no coupon payments, a zero coupon bond’s duration will be equal to its maturity.

• The longer a bond’s maturity, the longer its duration, because it takes more time to receive full payment. The shorter a bond’s maturity, the shorter its duration, because it takes less time to receive full payment.

• When interest rates rise, everything else being equal, the duration of a coupon bond falls.

We should know that the duration of a portfolio of securities is the weighted average of the durations of the individual securities, with the weights reflecting the proportion of the portfolio invested in each. For managers of actively-managed funds, duration is a moving target. Some managers will actively shift their portfolios around the benchmark target in response to market developments and others may keep on churning their portfolio to keep the duration in a fixed range. Duration is only meant to describe the interplay between a security’s price and prevailing interest rates, and does not give any indication regarding an issuer’s credit rating.

The YTM of a debt fund portfolio is the rate of return an investor could expect if all the securities in the portfolio are held until maturity. For instance, if a debt fund has a YTM of 10%, it means that if the portfolio remains constant until all the holdings mature, then the return to the investor would be 10%. However, the YTM does not remain constant as the portfolios are actively managed by the fund manager. It broadly indicates to the investor the kind of returns could be expected. But it is not a definite indicator since returns may vary due to change in interest rate scenario or changes in the portfolio.

To understand the term YTM better, we must also understand what is a Coupon Yield and a Current Yield.

i. Coupon Yield:

When a Bond is issued, the issuing entity determines its term of maturity; par value; and the rate of interest it pays, called its coupon rate. These characteristics remain stable over time and are not affected by any changes in the market value of the bond.

The Coupon rate is also called Coupon Yield or Nominal Yield. If ABC company issues a bond with face value of Rs 1,000/- which pays coupon interest at a rate of 8% and matures in 7 years. The coupon yield comes to Rs 80/- a year for 7 years. After 7 years, issuer pays back the principal back to you.

ii. Current Yield:

After 2 years, suppose current price of Rs 1,000 bond has reduced to Rs 800. Regardless of what you paid; you are still entitled to the Rs 80 annual interest. But now, Rs 80 represents a higher percentage yield than the 8% coupon rate. Since you paid only Rs 800 (not Rs 1,000) and still receive Rs 80/- return a year, which makes the actual yield 10%. Because this bond is selling at less than its face value, it is said to be selling at a “discounted rate” and this yield of 10% is the bonds “Current yield”. Obvious question which comes here is how and why does bond’s price changes? We have discussed that in Q13

iii. Yield to Maturity (YTM):

Current yield does not take into account the difference between the current price of the bond at which suppose you purchased it and the principal repayment at maturity. If you paid Rs 800/- for a Rs 1,000/- bond, you would receive Rs 1,000/- i.e., Rs 200/- more than the purchase price at maturity. That Rs 200/- is also considered as yield and must be included in yield calculations to understand the exact benefit. Correct? Now, this Yield which includes this Rs 200 also in calculations is called YTM

So, The YTM is based on the current marked-to-market price of the bond, not the yield at which the security was acquired.

Yield to Maturity is considered a long-term bond yield, but is expressed as an annual rate. In other words, it is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity and if all payments are made as scheduled.

Yield to Maturity (YTM) Calculations –

Calculations of yield to maturity assume that all coupon payments are reinvested at the same rate as the bond’s current yield,

Calculation of YTM is a complex process which takes into account the following key factors:

1. Current Market Price = Rs 800

2. Par Value = Rs 1000

3. Coupon Interest Rate = 8%

4. Time to maturity = 5 years

Despite its complexity the following formula can be used to find out its approximate value:

Calculations.jpg)

C = Coupon / Interest Payment

F = Face Value

P = Price

n = years to Maturity

= [80+(1000-80)/5]/(1000+800)/2

= 120/900

= 13.3% = YTM

Interpretation of YTM:

As in our example, When a bond's market price is below par, called a discount bond, its current yield and YTM are higher than its coupon Yield. However, when a bond sells for more than par, called a premium bond, its current yield and YTM are lower than the coupon rate. Only when a bond sells for its exact par value, all three yields are at same rate.

Yield from the debt fund is the weighted average of the yields on different securities, weighted by the proportion of sum invested in the fund (as a fund invests in bonds of varying maturities and yields).

For example – As of Mar 2021, HDFC Corporate Bond Fund has 181 Bonds in its portfolio with weighted average YTM of 5.44% and Average Maturity of 4.06 years. Which means if this whole portfolio of 181 bonds is kept as is till maturity which is average 4.06 years, then investor will get 5.44% approx.

This weighted average yield gives an indication of the attractiveness of the underlying bonds invested by the fund. However, interest rate risks, possible defaults and reinvestment risks would affect the returns of a debt fund. In addition, fund managers may not hold bonds to maturity. Therefore, investors should not interpret the weighted YTM of a debt fund as a writing on stone for returns of the debt fund and hence even debt funds are subject to bond market risks.

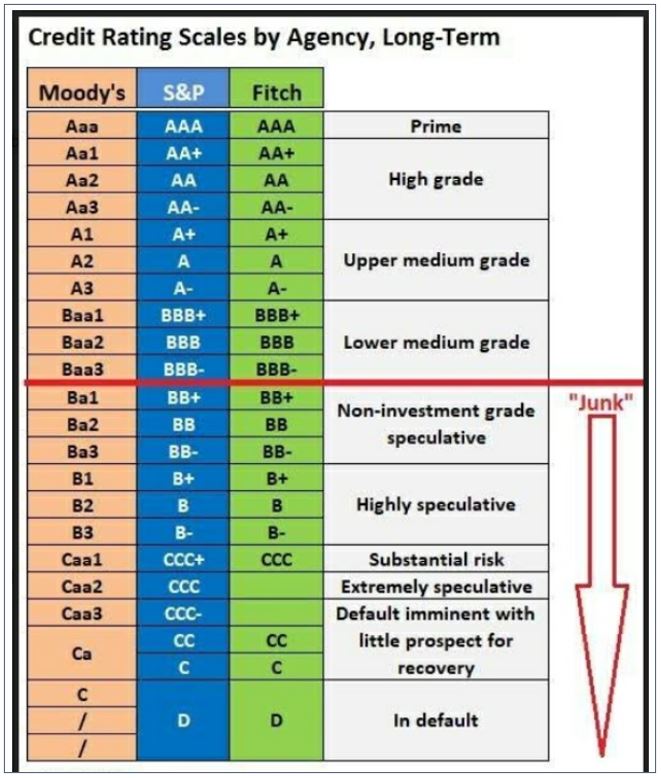

Rating organisations evaluate the credit worthiness of an issuer with respect to debt instruments or its general ability to pay back debt over the specified period of time. The rating is given as an alphanumeric code that represents a graded structure or creditworthiness. Bonds having AAA, AA+, AA, AA-, A+, A, A-, BBB+, BBB and BBB- are investment grade bonds and the bonds having rating below BBB are junk bonds i.e., BB+, BB, BB-, B+, B, B- and C. Bond having a D rating means it has defaulted. These ratings are assigned to long term bonds. Ratings for short term bonds are A1, A2, A3, B and C. Higher the proportion of top rated bonds in the portfolio, higher is the credit quality of the fund.

Though government securities called sovereign bonds (SOV) are not rated by rating agencies, they form a part of credit rating portfolio. Presence of SOV in good amount enhances the credit quality of the portfolio. To compare ratings of two funds within the same category, you can group the ratings of AAA, A1+ and SOV together.

Fund with higher top notch ratings can be considered. Here is the rating scale used by major rating agencies in India for Long term debt which will help you evaluate the fund better –

[Credit Ratings in the Debt Mutual Fund Portfolio]

Armed with knowledge of the rating scales and default probabilities, debt-fund investors can do their own homework on credit quality. But the real challenge arises when rating agencies wake up late, and effect drastic rating downgrades or suspend the ratings of a bond held by your debt fund. Such downgrades immediately lead to big drops in the market prices of such bonds, and, more importantly, impact their liquidity. This is indeed what happened with Amtek Auto, BILT & IL&FS. For, this it is important that investor should see overall risk management practice of fund house, the type of bonds they have taken but no one can be absolutely sure that these things wouldn’t happen in future in their fund unless it is a Gilt Fund.

A structured obligation is a modified way to raise funds from the market. Organisations which use this method create a Special Purpose Vehicle or SPV (usually a Trust) and commit their existing assets or future receivables to it. It then creates special ownership rights called as Pass Through Certificates or PTCs and sells them to prospective investors. These certificates can come in various pools or tranches, some being high credit quality while others taking the lower grade. As a result, they enjoy different return profiles as well. The investors buy into these certificates/instruments based on their risk taking ability thus providing funds to the organisation for its further use. Banks, Financial Institutions, Infrastructure companies use this method a lot to raise money.

For an organisation whose individual credit rating is not good can create an SPV structure and command a better rating. This allows them to either raise more funds than they could as an organisation or at lower interest cost or both. The rating agencies use the SO mark to differentiate these instruments from others.

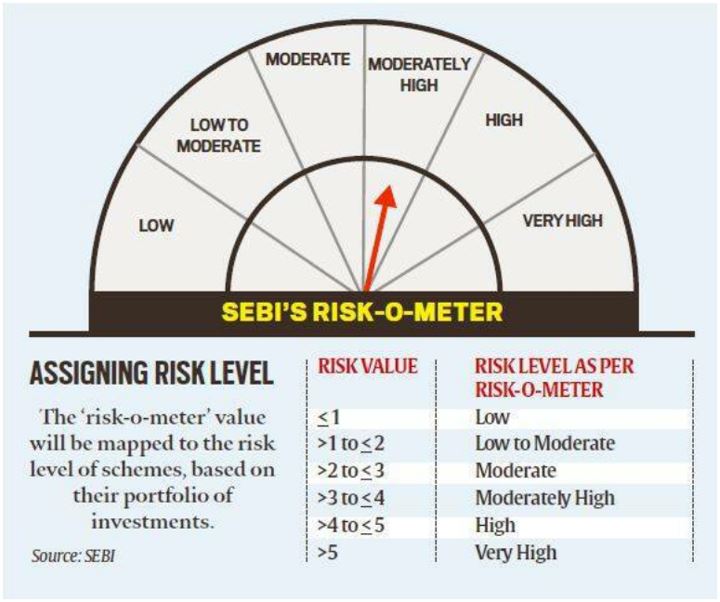

Riskometer is a graphical representation of the risk a mutual fund carries. It resembles the speedometer of a vehicle and displays 5-levels of risk, each with a respective colour.

Fund houses are mandated to disclose the Riskometer, along with the portfolio disclosure, for all their schemes on their respective websites and on AMFI website within 10 days from the close of each month.

[Mutual Fund Riskometer]

The Riskometer methodology of debt funds factors in three parameters – Credit Risk, interest rate risk and liquidity risk to assign risk grades. A risk score is assigned to each of these parameters. For example, a fund investing a higher portion of its assets in low credit rating papers will earn a higher risk score on the credit parameter. Similarly, funds whose underlying investments are more volatile due to interest rate changes and less liquid will attract higher risk scores on those two parameters, respectively. These three risk scores are then aggregated through a simple average to arrive at the fund's overall risk score, which forms the basis of bucketing it into one of the six risk labels (Low, Low to Moderate, Moderate, Moderately High, High and Very High). It is a very useful tool to help understand the risk profile of a debt fund.

IL & FS crisis was one of the most major credit crisis our markets have faced in the recent past. It was a crisis which forced the investors as well as managers & rating agencies too to put their heads down and think about their Risk management processes.

It all started on August 28, 2018, when the Financial Services arm of country’s one of largest financing and infrastructure development group – IL & FS (Infrastructure Leasing and Financial Services) which was rated AAA by credit rating agencies, defaulted on one of its commercial papers. It repaid the same just within two days, no harm here! But, only in next 5 days it defaulted on a loan to SIDBI (Small Industries Development Bank of India) amounting to over Rs. 1,000 Cr. This turned over the heads of Mutual funds. The fund managers started revisiting their portfolio. Soon it was found that many NBFC’s have been borrowing for short term from the markets and lending it to Real Estate builders and buyers for a long term tenure.

The effect soon trickled down to mortgage firms and the major hit was DHFL (Dewan Housing Finance Corp Ltd). An issue which began as a liquidity problem for IL&FS in no time caused solvency problems for DHFL. Within a short period of 15 days, the Long term as well as Short term securities of IL&FS were downgraded from AA+ to BB. Such a swift drop in just a matter of days only created more fear among investors. If any bond is downgraded, it directly affects the prices of the bonds. If the downgrade is a very steep one, it will have an adverse impact on the bond prices.

The next question in your mind will be why so?

We have seen that high rated bonds secure a lower rate of interest. While the lower rated bonds have to acquire debt at a higher rate so as to compensate the lender for the high risk he is taking. So, if any bond is downgraded significantly, there is a change in price which corresponds to the amount necessary to bring the yield of a bond (and therefore its price) in line with other bonds rated at the same level. Similar thing happened in this crisis. Due to such steep downgrade, many mutual funds took a mark-to-market loss on their portfolio.

Nearly, 14 mutual fund schemes had a collective exposure of approximately Rs. 2,000 Crores to IL&FS group companies as on Aug 2018. Many mutual fund schemes witnessed a substantial fall in the NAV according to their respective exposure to the group’s securities.

Provisioning in case of debt defaults. In the year 2018, after NBFC crisis, lot of default started happening. Lot of rating downgrades were done in 2018. Because of these downgrades or these credit events, a lot of debt funds had gone down on their NAV’s particularly. This has never been seen before. Earlier it could be seen that these debt funds (esp. credit risk category) would keep growing slowly and continuously and people were comparing these debt funds with fixed deposits but things changed in 2018 and investors realized the risk associated with Debt Funds.

In case of defaults & major rating downgrades, there is a provisioning called segregated portfolio. The concept of a Segregated Portfolio is promoted by the Securities and Exchange Board of India (SEBI) in December 2018 by a circular and is a procedure that allows mutual funds to separate a certain number of units against downgraded debts and money market instruments held by them. To quote from circular - SEBI has decided "to permit creation of segregated portfolio of unrated debt or money market instruments by mutual fund schemes of an issuer that does not have any outstanding rated debt or money market instruments". This is allowed provided that segregated portfolio of such unrated debt or money market instruments may be created only in case of actual default of either the interest or principal amount.

Segregated portfolios is a mechanism to separate illiquid and hard-to-value assets from other more liquid assets in a portfolio. It prevents the distressed assets from damaging the returns generated from more liquid and better-performing assets.

Example – Nippon India Ultrashort Fund has a segregated portfolio for Altico Capital India Limited.

SEBI added a layer of protection for the investors in mutual funds when it allowed funds to segregate debt instruments that see a downgrade in credit rating into a separate portfolio. The idea of isolating illiquid and hard-to-value assets from a debt investment is to protect the rest of the portfolio and its investors from the consequences of a downgrade or default in one security.

It works in the following way:

If a fund has a NAV of Rs 20, of which Rs 2 was invested in a security of a company which has defaulted or its rating has been downgraded, etc, then the fund house can resort to creating a side pocket containing the bad bonds. In such a case, the NAV of the main fund takes a hit and reduces by the amount side pocketed. A new fund is created out of the amount which has been segregated. This new fund has the same number of units as the main fund.

There's a possibility that this money will be recovered. By segregating the bad bonds, investors' interest stays protected because if the bad debt recovers, investors would be the beneficiary. Further, one can redeem and walk out with the remaining money from the main fund. This side-pocketing provision ensures that the rightful owner remains entitled to the benefits of the recovery in a fund and gets it in the future, subject to realisation.

The total portfolio is the portfolio which is the original one and then is splitted into two portfolios-main portfolios and segregated portfolios. The main portfolio is the portfolio which is separated from the 'total portfolio' with good debts and can be redeemed by the investor at any point of time. The segregated portfolio is that part of the total portfolio which contains the bad, downgraded and illiquid debts. Unitholders in the scheme are allotted units of the side-pocket, in the same ratio as the investment in the parent scheme. Units of the side-pocket are not redeemable, while the units in the main/original scheme portfolio are redeemable as usual. In segregated portfolio no fresh subscriptions are allowed. Investors can redeem these units once the money is recovered from the bad debt by the mutual fund scheme.

Taxation of segregated portfolio Capital gains for both the main and segregated portfolios are taxed on the basis of following:

1. Holding period

2. Cost of acquisition

These are to be determined in the following way:

Budget 2020, applicable from FY 2020-21, clarified that the holding period of the segregated portfolio will be from the original date of acquisition of the main portfolio. That means, the date of segregation does not count. What counts is when you bought the total portfolio, before segregation. For example, had you bought a fund in May 2019 and it underwent segregation in May 2020, your date of acquisition for the main portfolio as well as the segregated portfolio would only be May 2019.

Next is the cost of acquisition. Here, the Income Tax Act says that the proportion by which the split happened (on segregation) would apply for the cost of acquisition as well. Let us suppose a fund that you had bought at a NAV of Rs 10 grew to Rs 100 (at the time of segregation) and was segregated as Rs 90 (main portfolio) and Rs 10 (segregated portfolio). Then the cost of the segregated portfolio will be 10% of Rs 10 NAV cost – which is Re 1 – and the cost of main portfolio would be Rs 9. Once the cost of acquisition is known, the taxation of capital gains – whether short term or long term would apply based on the asset class and time frame.

Franklin Winded Up 6 Debt Funds. Why?

On April 23rd, 2020 fund manager of Franklin Templeton Mutual Fund wound up six debt schemes.

1. Franklin India Ultra Short Bond Fund

2. Franklin India Short Term Income Fund

3. Franklin India Credit Risk Fund

4. Franklin India Low Duration Fund

5. Franklin India Dynamic Accrual Fund

6. Franklin India Income Opportunities Fund

Winding up means these funds will cease to exist after all the holding they have been sold-off, as and when that happens. And till that time it happens, there will be no purchase (including SIP instalments, Switches & STP) or Redemption or SWP instalments will be allowed from these funds.

As per a report from B&K Securities, the corpus of the six exposed FT funds stood at Rs 47,658 crore at the end of August 2018. It was also the time when liquidity crisis in the shadow banking space began to surface after the first default by IL&FS. Since then, these six closed funds from Franklin Templeton lost a total corpus of Rs 16,804 crore till March 2020. As a result, in a span of 19 months, the reduced corpus stood at Rs 30,854, including Rs 2,753 of borrowing to manage redemption pressure. Worst was yet to come as in April, these funds lost a corpus of Rs 4,075 crore in first 20 days of the month and reduced corpus stood at Rs 26,779 crore on April 20, 2020. This means these debt funds were yet to come out of liquidity drought started in the wake of the shadow banking crisis when COVID-19 blew the knockout punch.

If we look at the list of funds mentioned above, it has all kinds of debt funds, including low duration and ultra-low duration. Now, while all AMCs take risks in funds like Credit Risk Funds to generate high returns, it is only Franklin that decided to follow this strategy even in short duration funds (low and ultra-low duration). Franklin Templeton followed the approach of taking credit risk i.e., investing in low-rated bonds across debt funds with an aim to generate high returns.

Low-rated bonds give a higher interest rate because they carry a higher risk of default, i.e., the borrower not paying back the interest or principal amount. So to compensate for this risk that the Fund Manager takes by investing in these bonds, they tend to give a higher interest rate. This risk of default is called credit risk. The main challenge in these funds is low liquidity in secondary market. So most of these funds were kept till maturity. But these funds have been in existence for many years and have delivered some excellent returns, what went wrong? Well, one word, COVID-19.

COVID-19 + Slow Inflows + Redemption Pressure + Low Liquidity of the Debt papers:

A tricky situation While we are all aware of how stock markets had tumbled amid the COVID-19 crisis, there has also been an equal impact on the bond market (where bonds are traded). Now, as a result of a flight to safety caused by this pandemic, the bond market has become illiquid. What that means is that there are not enough buyers for the bonds, especially of low-rated bonds. Even if there are, they are asking for a considerable discount on the price.

On the other hand, these funds per AMC have seen more than normal redemption pressure as most investors are in need of cash or are liquidating from these funds first than any other debt funds of other AMCs. This due to previous issues with the debt funds of Franklin Templeton, like the side pocketing, voluntary markdowns that saw steep fall in returns, etc in 2018-19. What compounded the problem was the inflows in the funds had also slowed down substantially due to the previous issues we just described.

Now, in a normal scenario, a fund will honor these redemption requests by either selling the bonds or borrowing money from banks to pay in case the manager doesn’t want to sell at the price he is getting. These funds also resorted to borrowing money, and over the last 6 months, they have been able to manage redemption demand by selling bonds at the right price.

But an ever-increasing redemption pressure, lack of demand for low-rated bonds, and inflows slowing down meant they would have had to sell these bonds at a discount resulting in a loss for investors who were staying invested in these funds. So, technically, the investors who were redeeming were not just creating losses for themselves, but also forcing the Fund Manager to sell at not-so-right-price indirectly hurting other investors in these Funds.

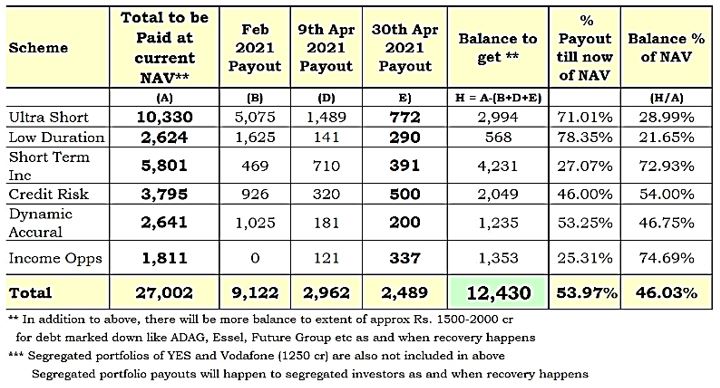

So, best option which Franklin saw in that situation was closing these 6 debt funds completely and give money back whenever they get the money from the debt paper companies. This resulted in many court cases against them and many investor’s years of savings stuck with them and finally Supreme Court allowed them to start distributing the cash they have to the investors. This distribution responsibility was given to SBI Mutual Fund by the Supreme Court. Investors has started getting their money back now and this was the latest situation compiled by Outlook Asia as on 1st May 2021 –

[Franklin Winded Up 6 Debt Funds]

A perpetual bond is a bond with no specified maturity date. These bonds do not repay the original loan amount; instead they only pay a steady stream of high interest rate to the investors forever. Yes, you read it correctly – Forever.

Perpetual bonds empower companies to smoothly raise the capital required to fund their ambitious expansion plans without significantly adding to their exist debt liabilities and diluting equity. AT-1 or Additional Tier-1 Bonds are perpetual bonds issued by banks in compliance with the Basel III regulations. They are a component of the bank’s permanent equity and furnish relatively high interest rates, posing as lucrative investment options for big players like mutual funds, pension funds, etc.

If a bank reaches the brink of bankruptcy and their Common Equity Tier 1 ratio slips below 6.125%, the entire principal value of AT-1 bonds can be written off or simply converted into common equity. Therefore, investors can lose all their money in the blink of an eye.

AT-1 Bonds have no maturity. But to captivate investors, they are issued with call options. It means that if a bank has sufficient capital, it can call back the bonds and repay the investors. Call options are usually offered at the end of 5 or 10 years. These call options are voluntary and the banks may or may not choose to exercise them. Almost all Indian banks have exercised these call options and redeemed their respective AT-1 Bonds. In March 2020, the RBI decided to wipe off Yes Bank’s Additional Tier-1 bonds worth Rs 8,415 crore. As a consequence, several mutual funds debt schemes and pension funds lost thousands of crores. Ultimately, the unit holders of these debt schemes bore the brunt.

With a view to safeguard retail investors from a similar mishap in the future, SEBI in the second week of March 2021 issued a circular reviewing the norms regarding instruments like AT-1 and AT-2 Bonds. These new norms would be applicable from 1st April, 2021.

The new stricter norms are as follows –

1. No Mutual Fund under all its schemes shall own more than 10% of such instruments issued by a single issuer.

2. A Mutual Fund scheme shall not invest –

a. more than 10% of its NAV of the debt portfolio of the scheme in such instruments; and

b. more than 5% of its NAV of the debt portfolio of the scheme in such instruments issued by a single issuer.

3. Further, the maturity of all perpetual bonds shall be treated as 100 years from the date of issuance of the bond for the purpose of valuation.

The last norm about treating the maturity of AT1 bonds as 100 years caused a stir, putting the mutual funds in a state of flux. Let’s understand why.

AT-1 or perpetual bonds are traditionally valued at price-to-call. This means that mutual funds have valued them as if they would be repaid on the call dates. Such dates are typically set at short intervals of, say, 5 to 10 years, and hence their maturity is set accordingly.

Keep in mind – the longer the maturity of an instrument, the higher the interest rate risk because the time taken for investors to receive the full payment increases. Hence, an abrupt change in the maturity assumption of these AT-1 bonds from the earlier 5 or 10 years to 100 years will escalate the interest rate sensitivity (i.e. duration) of these bonds dramatically, making these bonds all the more riskier.

If implemented, this norm could wreak panic in the debt markets and have detrimental ripple effects like

– Rapid redemptions by unit holders could shrink mutual fund’s appetite for AT-1 bonds and eventually lead to increased borrowing costs for banks.

- Smaller banks with weak financials will find it difficult to raise capital via AT-1 bonds.

This could especially prove hazardous for PSU banks, as it will further pressurize the Government to take the onus and inject more equity.

To avoid the above-mentioned consequences from turning into reality. The Ministry of Finance, Association of Mutual Funds India (AMFI) along with various Mutual Funds requested SEBI to withdraw the 100-year maturity rule. And so, SEBI issued a clarification on the valuation of bonds issued under Basel III framework.

Now, the remaining maturity of Basel III Additional Tier-1 (AT-1) bonds will be 10 years until 31 March, 2022. This 10-year period will extend to 20 years and 30 years over the subsequent six-month periods. From April 2023 onwards, the residual maturity of AT-1 bonds will become 100 years from the date of issuance of the bond. |