In the investment world, the offer document is like the horoscope. It gives historical information. The offer document also mentions the AMC’s views on the investment prospects, and its suitability to investors. The financial adviser, like the astrologer, is expected to assess the match — in this case, between the proposed investor and the investment product. But neither the AMC nor the financial adviser is permitted to promise a return. The proposed investor needs to take an independent view on the investment.

An astrologer, in the normal course, has nothing to gain by giving a biased view on the match. Yet, an unethical astrologer can be influenced into suggesting that the horoscopes match, even when they do not. This is perhaps the reason why some families do not go blindly by the views of an unknown astrologer, especially if the astrologer is introduced by the other party to the proposed marriage.

Cut back to the financial world. The investor needs to be cautious, especially when dealing with a party with whom she is not adequately experienced. The party trying to convince her to invest could be operating with a significant conflict of interest. A sale based on mis-statement can give monetary gain to the party, while the investor would be at a loss. Investors who do not have the requisite knowledge should therefore seek the advice of someone they trust. SEBI has prescribed detailed guidelines to protect the investor.

The Offer Document is a key document that provides essential information about the scheme to help investors make informed decisions about whether to purchase the units being offered.

The Offer Document has two parts:

- Scheme Information Document (SID)

This has all the information relating to the scheme/s of the mutual fund.

- Statement of Additional Information (SAl)

This has all the statutory information about the mutual fund, and other information that is common across schemes. Legally, it is a part of SID, although physically it is a different document.

Keeping in mind the profile of prospective investors, the regulations provide that information in the Offer Document has to be presented in “simple language and in a clear, concise and easily understandable manner”.

SID and SAI are to be prepared as per the prescribed format. The contents need to follow the same sequence as prescribed.

Besides, SEBI has also laid down certain “standard observations” that need to be incorporated in the Offer Document. While filing the Scheme Information Document (SID) for launching a new scheme / revising and filing existing SAl and SID with SEBI, the mutual funds should highlight and clearly mention the page numbers of the SAl and SID on which each observation has been incorporated.

Mutual funds also need to label their mutual fund scheme as follows:

>> Nature of the scheme: Whether to create wealth or provide regular income in an indicative time horizon (short I medium I long term).

>> A brief about the investment objective (in a single line sentence) followed by kind of product in which investor is investing (equity / debt).

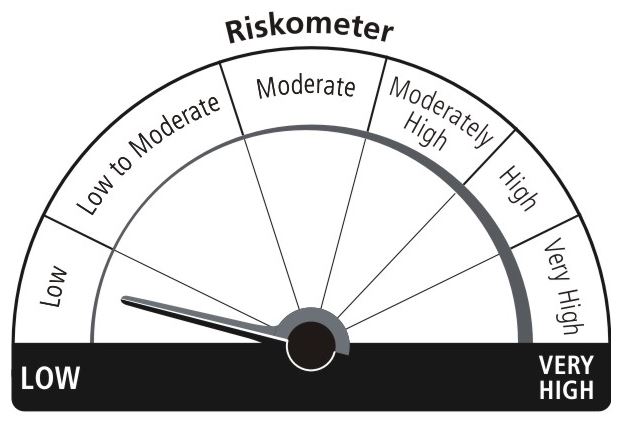

>> Level of risk, depicted by a risk-o-meter. On next page the box that is applicable for liquid schemes is illustrative.

>> Similarly, depending on the nature of risk in the scheme, the position of the arrow inside the meter, and the description below the meter varies.

>> A disclaimer that investors should consult their financial advisers if they are not clear about the suitability of the product.

The product label is to be disclosed in —

>> Front page of application forms, Key Information Memorandum (KIM) and Scheme Information Documents (SIDs).

>> Common application form — along with the information about the scheme.

>> Scheme advertisements placed in manner so as to be prominently visible to investors.

[Riskometer]

This product is suitable for investors who are seeking ?

> Regular Fixed Income for Short Term

> Investment in Debt / Money Market Instruments / Government Securities.

“Investors should consult their financial advisors if in doubt about whether the product is suitable for them”

A mutual fund is free to add in the Offer Documents, any other disclosure, which in the opinion of the trustees of the mutual fund (Trustees) or the Asset Management Company (AMC) is material for the investor. However, the information should not be presented in an “incomplete, inaccurate or misleading manner”. Further, inclusion of such information should not, by virtue of its nature, or manner of presentation, obscure or impede understanding of any information that is required to be included.

Application forms for schemes of mutual funds have to be accompanied by the Key Information Memorandum (KIM), the format for which is outlined by SEBI. This memorandum has to be “printed at least in 7 point font size with proper spacing for easy readability”.

KIM is a concise version of the SID that is more easily available at the offices of various intermediaries who sell the units. The investor, however, has the right to insist on the detailed SID.

Draft SID, filed with SEBI, is made available on SEBI’s website at http://www.sebi.gov.in for 21 working days to enable the public to comment on the adequacy of disclosures.

A point to be noted is that SEBI does not approve or disapprove offer documents. The mutual fund has to file the SID and KIM for the proposed scheme with SEBI. A 21-working day window is provided for SEBI to give its comments.

The AMC has to file its replies to the modifications suggested by SEBI within 6 months of the letter. The scheme has to be launched within 6 months from the date of issuance of final observations by SEBI. If either of these periods lapses, then the AMC will need to re-file the SID and pay the relevant filing fees, in order to proceed with the issue.

Final SID (after incorporating SEBI’s comments) must reach SEBI before it is issued for circulation. Soft copy of the final SID in pdf format along with a printed copy should be filed with SEBI two working days prior to the launch of the scheme.

The AMC also needs to submit an undertaking to SEBI while filing the soft copy that information contained in the soft copy of SID to be uploaded on SEBI website is current and relevant, and matches exactly with the contents of the hard copy, and that the AMC is fully responsible for the contents of the soft copy of SID. The soft copy of SID should also be uploaded on AMFI website two working days prior to launch of the scheme.

In the certificate submitted by trustees with regard to a new scheme proposed to be offered by the AMC, the trustees are required to certify as follows:

“The Trustees have ensured that the (name of the scheme I Fund) approved by them is a new product offered by (name of the Mutual Fund) and is not a minor modification of any existing scheme / fund / product.”

This certification has to be disclosed in the SID along with the date of approval of the scheme by the trustees.

This certification is not applicable to close ended schemes except for those close ended schemes which have the option of conversion into open ended schemes on maturity.

All information in the offer document has to be updated 30 days before the launch of a scheme.

“Investment Objective” is an important section that is part of the SID and KIM. According to Alvin Hall “In reality, the distinction among objectives of some of the equity funds is not clear-cut. The actual stocks that constitute a specific mutual fund portfolio depend on the analysis and perspective of the fund’s manager. Hence, a generic investment objective (e.g., growth, income) can be interpreted and executed differently by different managers. One company’s aggressive growth fund may look like another company’s specialty fund, which may look like another company’s world fund. It is important to read the fund’s prospectus and review the list of its top holdings before making an investment decision”. |